How to Trade Forex on Exness

Executing Buy and Sell Orders on Exness: A Step-by-Step Guide to Successful Trading

How to Open an Order: Buy and Sell on the Exness Website

Now that you have funded your account, you are ready to trade. You can access the Exness trading platform on your web browser or download it on your desktop or mobile device. The platform offers a user-friendly interface, advanced charting tools, market analysis, indicators and more. You can also use the Exness Trader app to trade on the go.In this article, I will guide you through the easiest way to start trading without downloading anything.

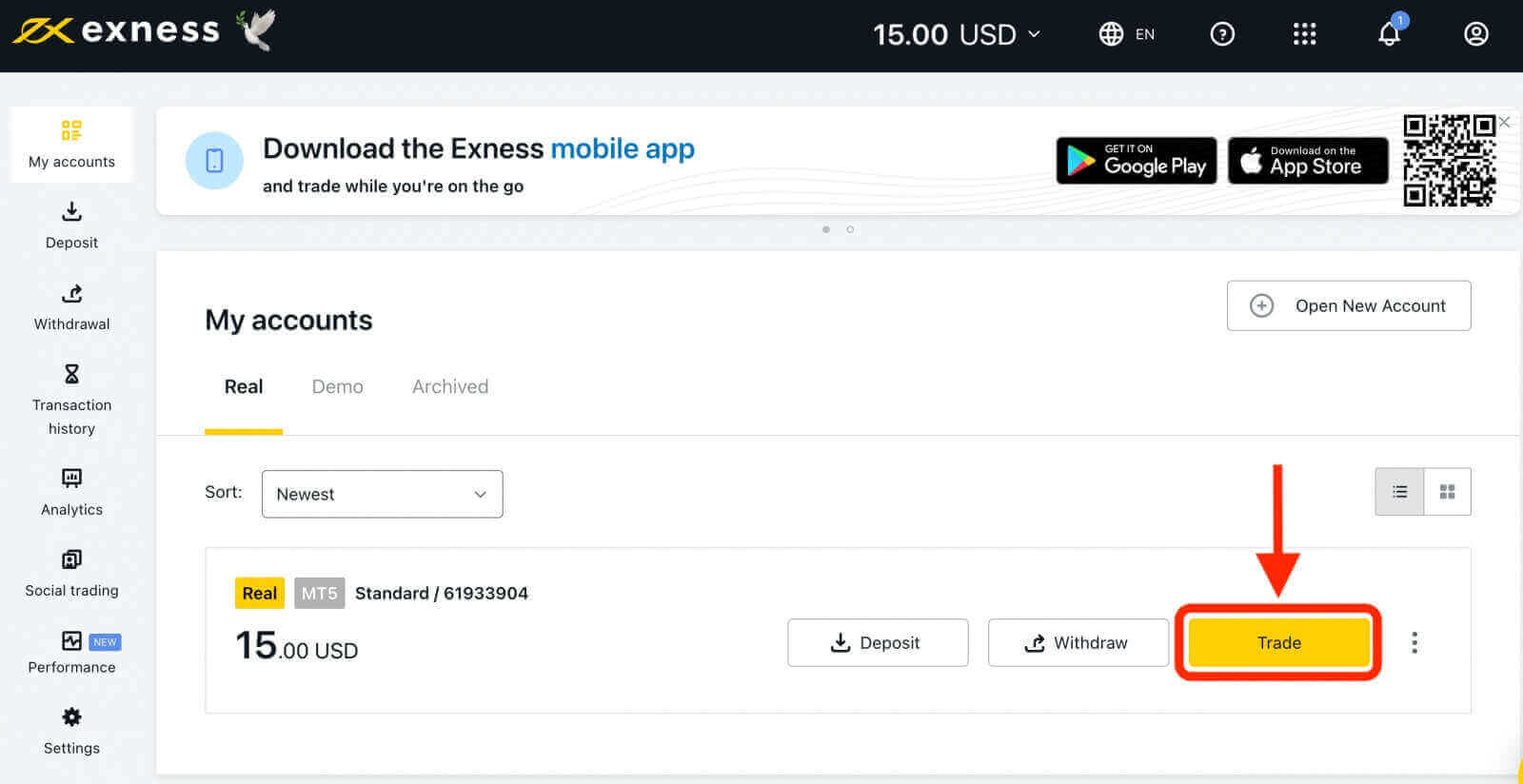

1. Click the "Trade" button.

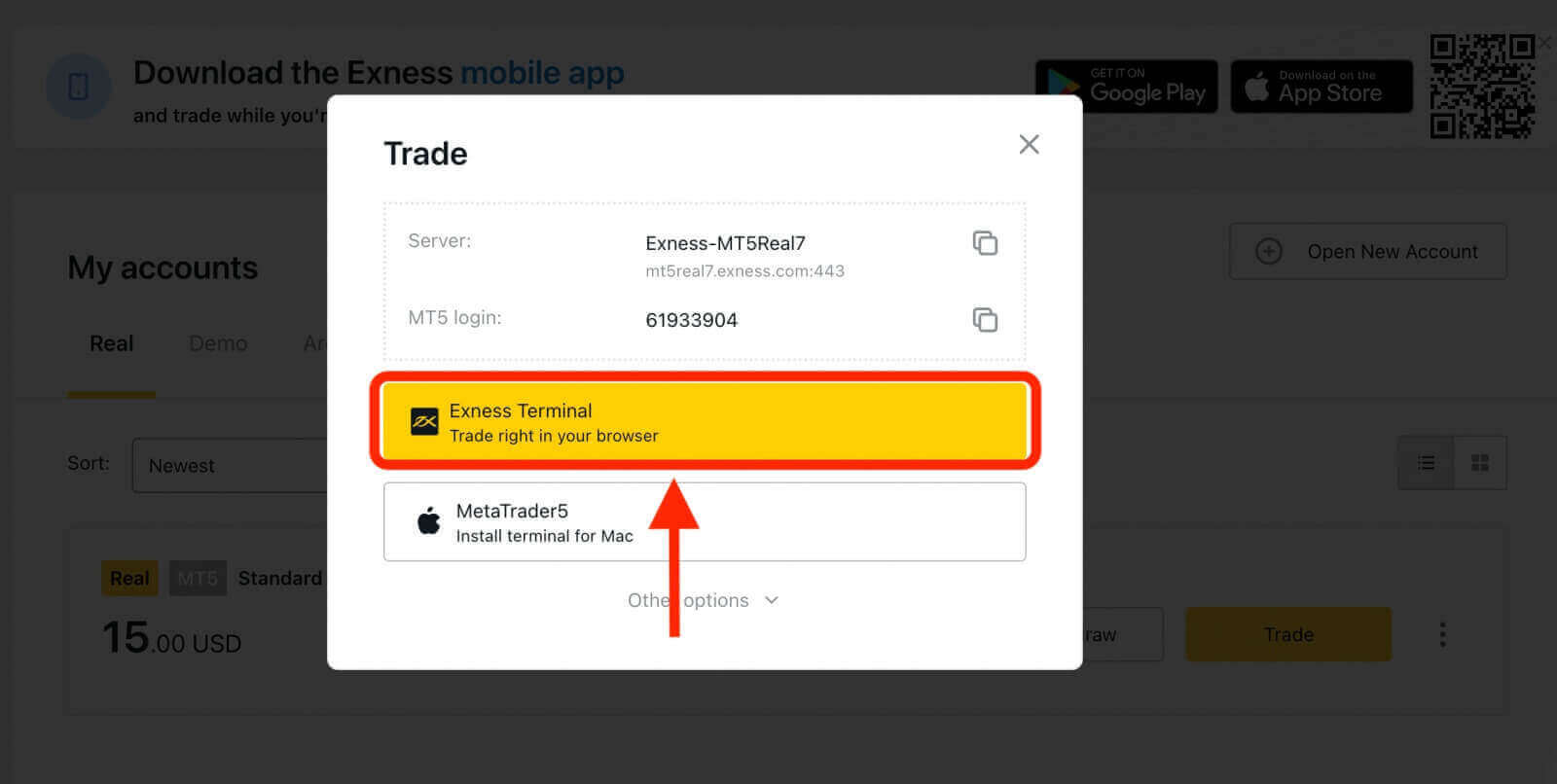

2. Click "Exness Terminal" to Trade right in your browser.

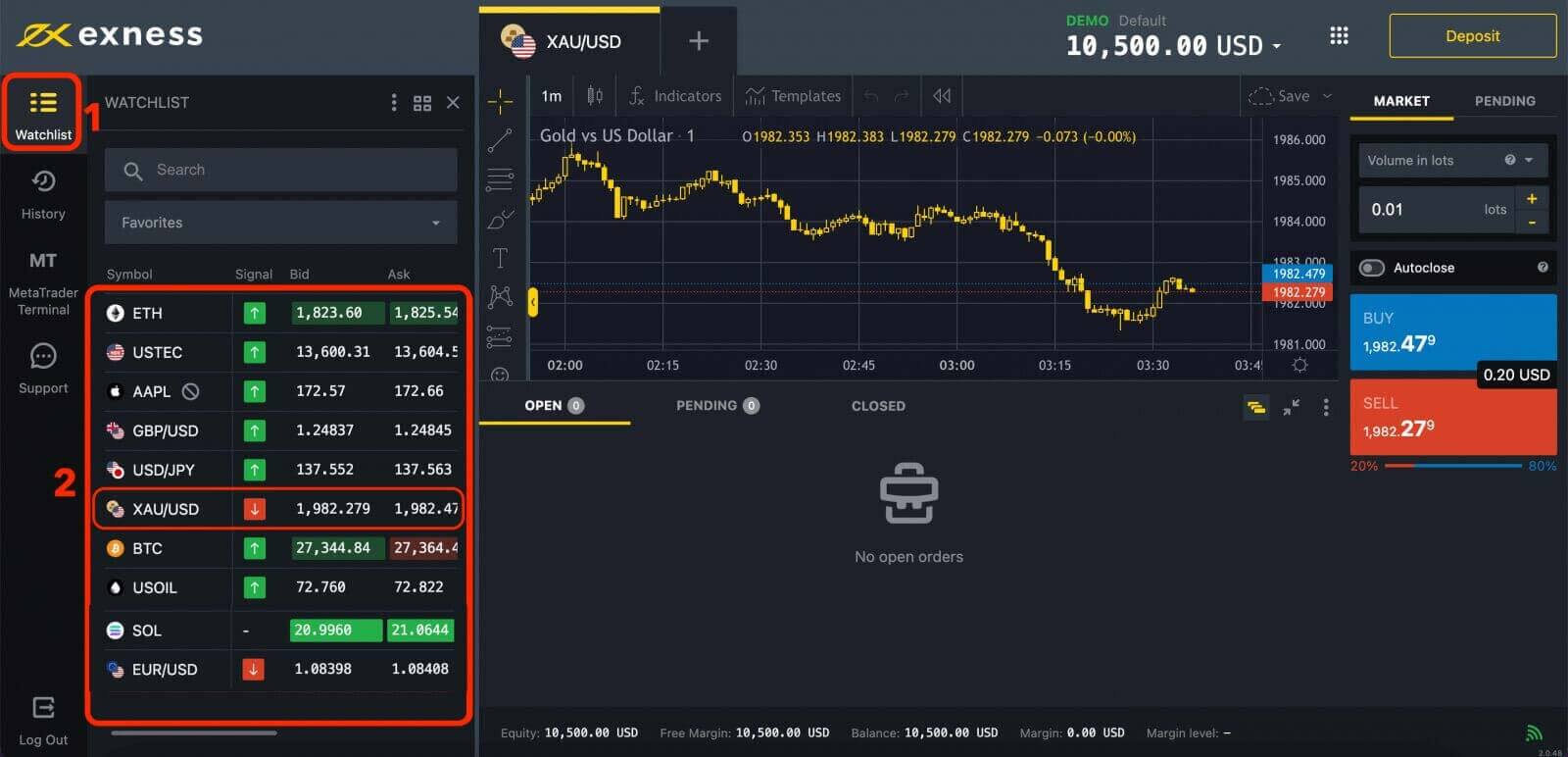

3. Select a currency pair that you want to trade. For example, XAU/USD.

Or click "+" at the top to add instrument(s).

4. Enter the amount of money that you want to trade. This is also known as the lot size or volume. The lot size determines how much profit or loss you will make for every pip movement in the exchange rate. A pip is the smallest unit of change in a currency pair. The minimum trading volume on our platform is 0.01 contracts.

To calculate pips for XAU/USD (gold), you need to know that 1 pip gain represents a 0.01 move in XAU/SUD (gold). So, for example, when XAU/SUD price changes from 1954.00 to 1954.01. it is 1 pip movement. However, if the price moves from 1954.00 to 1955.00, it is 100 pips movement.

5. Decide whether you want to buy or sell the currency pair. Buying means that you expect the base currency (XAU) to rise in value against the quote currency (USD), while selling means that you expect the opposite.

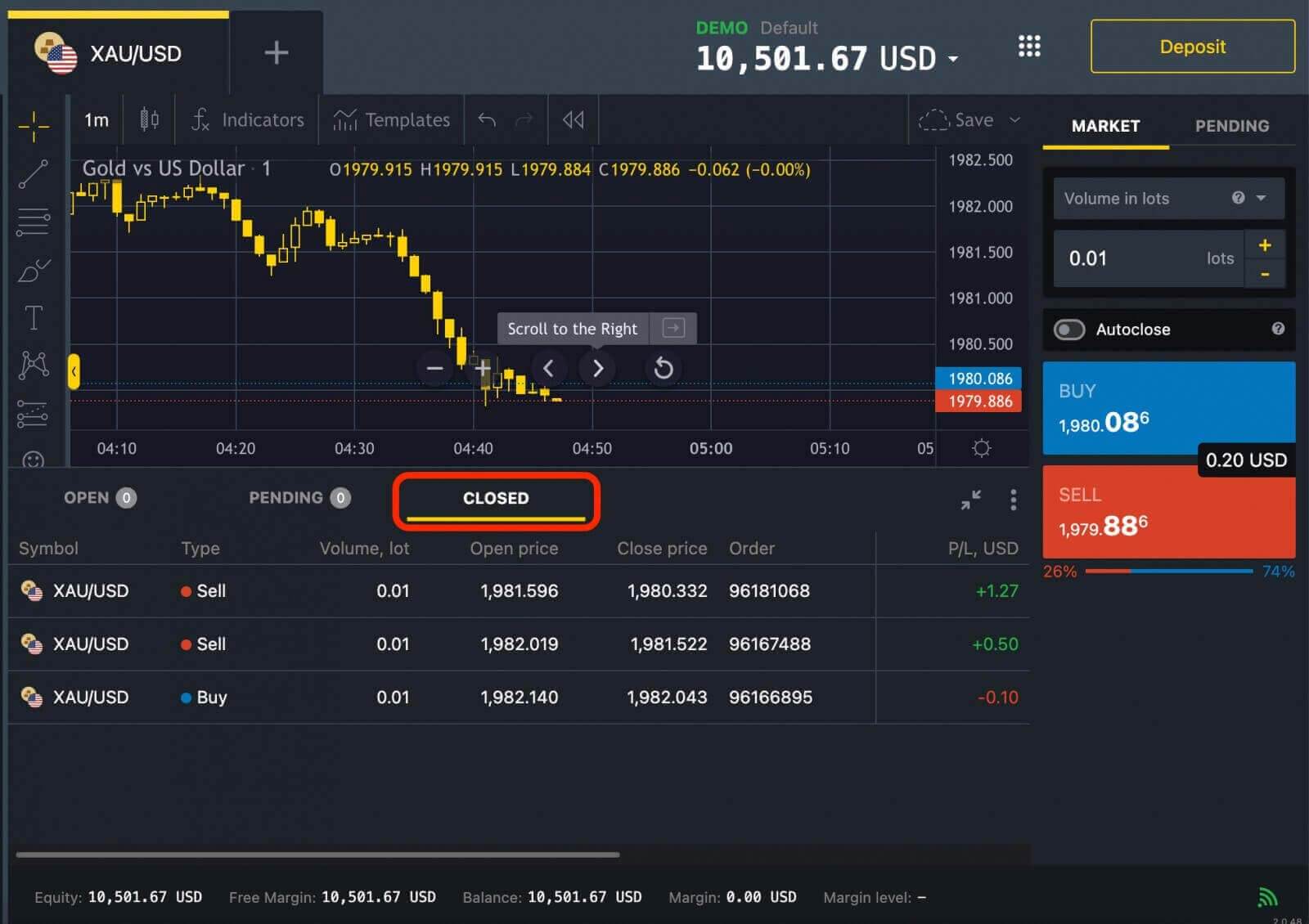

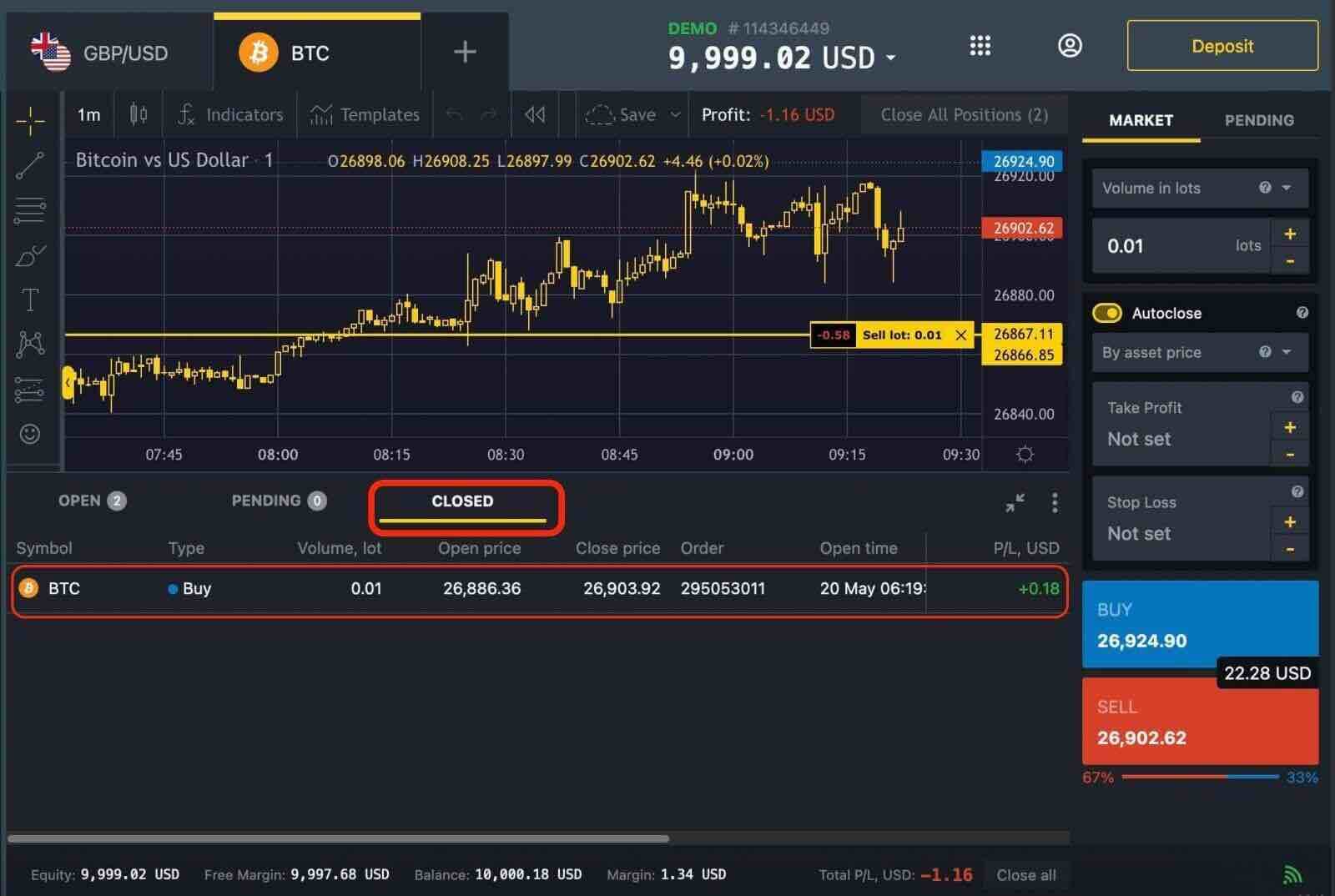

After setting up your trade, you can click on the "Sell" or "Buy" button to execute it. You will see a confirmation message on the screen and your trade will appear in the "OPEN" session.

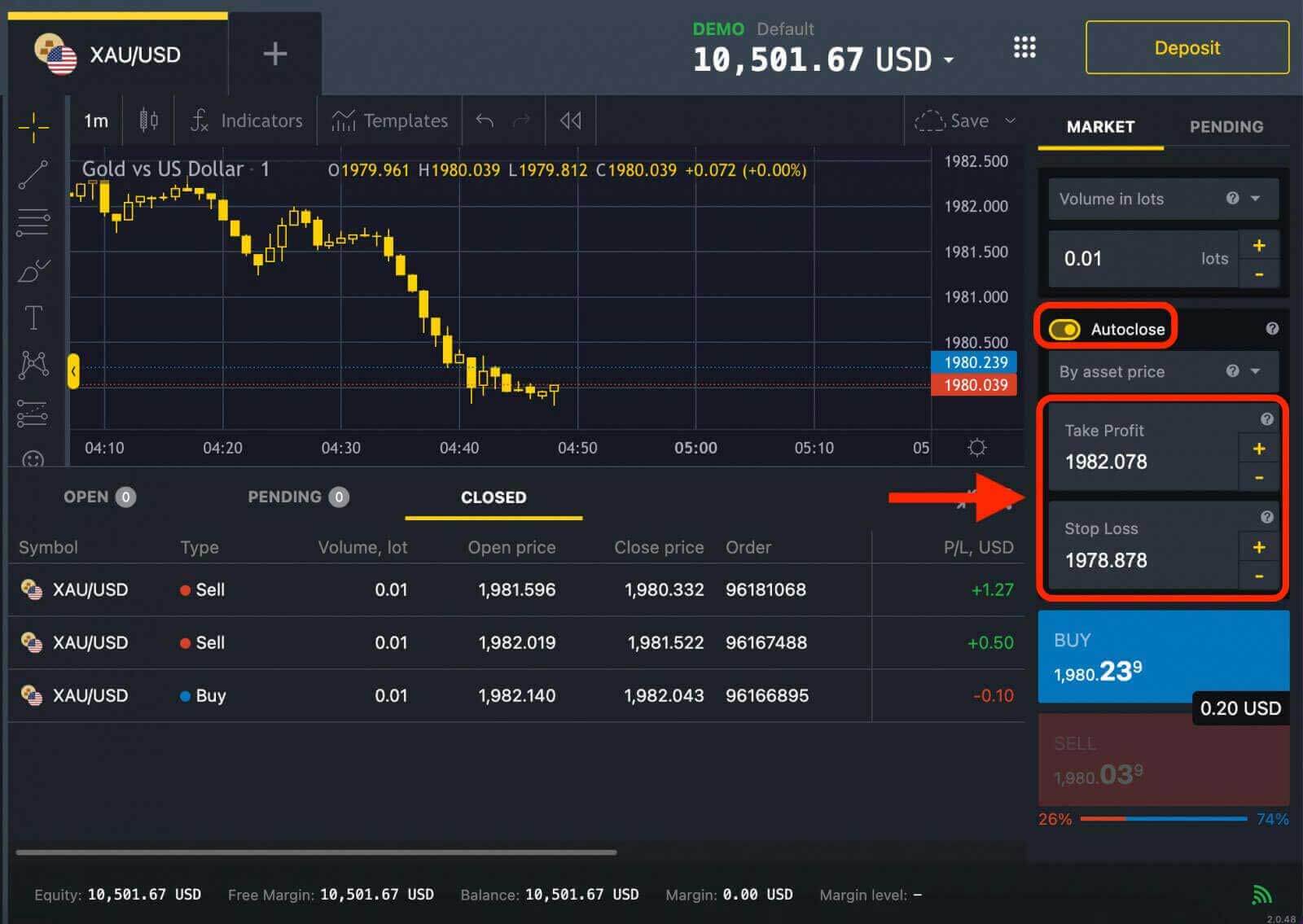

6. Confirm your trade and monitor it until it is closed. You can close your trade manually at any time by clicking on the close button or wait until it hits your stop loss or take profit order.

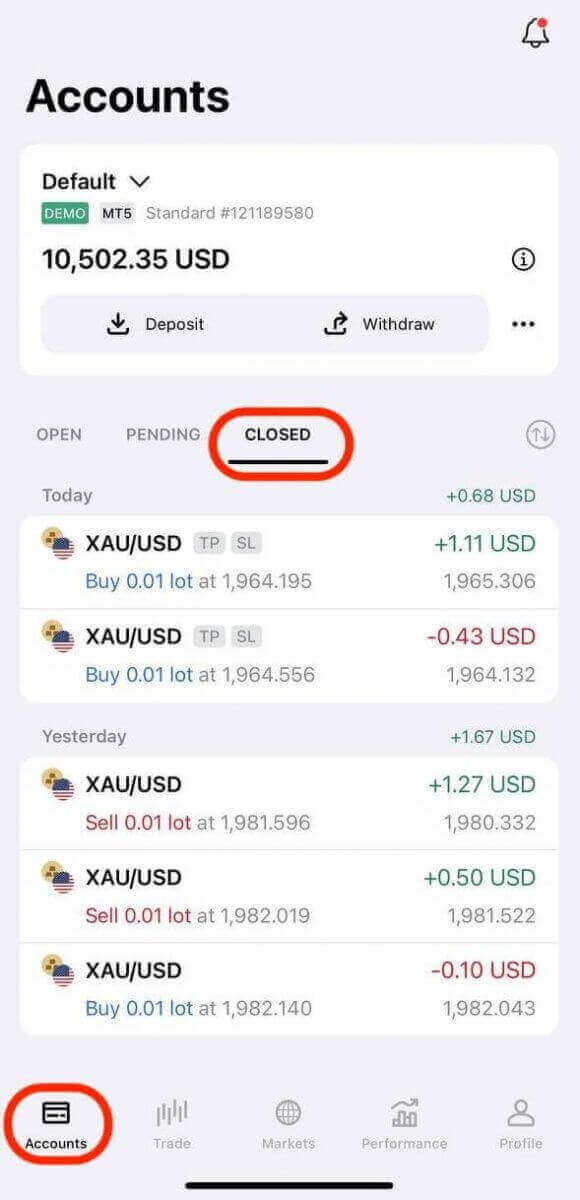

Your trade will appear in the "CLOSED" section.

Set a stop loss and take profit order. A stop loss order is an instruction to close your trade automatically if the market moves against you by a certain amount. This helps you limit your risk and protect your capital. A take profit order is an instruction to close your trade automatically if the market moves in your favor by a certain amount. This helps you lock in your profit and avoid missing out on potential gains.

That’s it! You have just placed a forex trade on Exness. You can start your own forex trading journey.

How to Open an Order: Buy and Sell on the Exness App

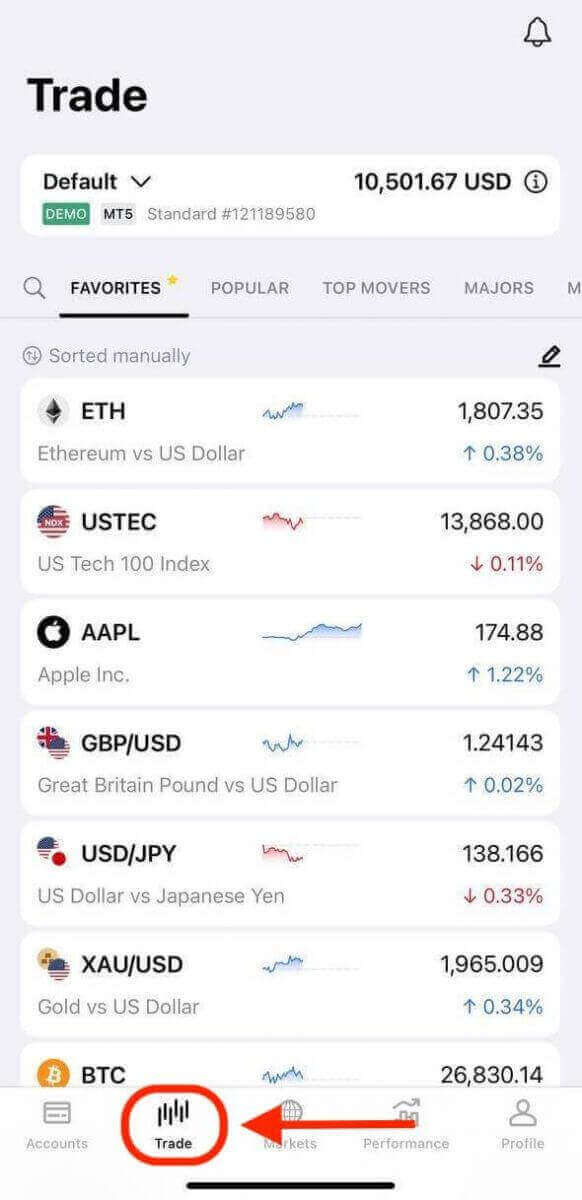

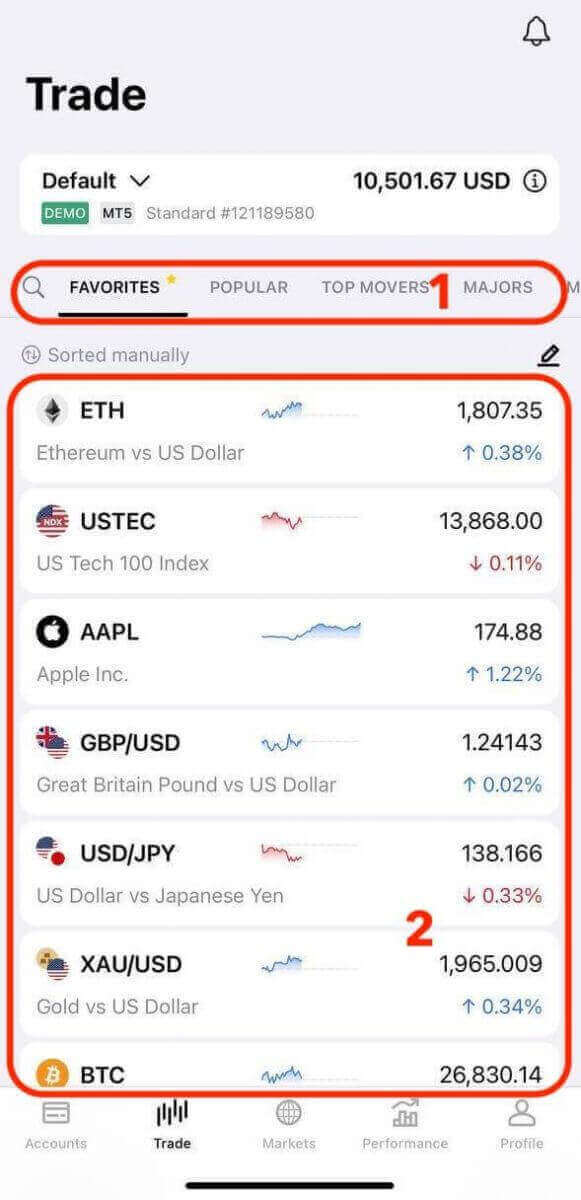

1. Open the Exness Trade app on your mobile device and log in using your account credentials.

2. Tap on the Trade tab.

3. Explore the available trading instruments and tap on any instrument to expand its chart and access the trading terminal.

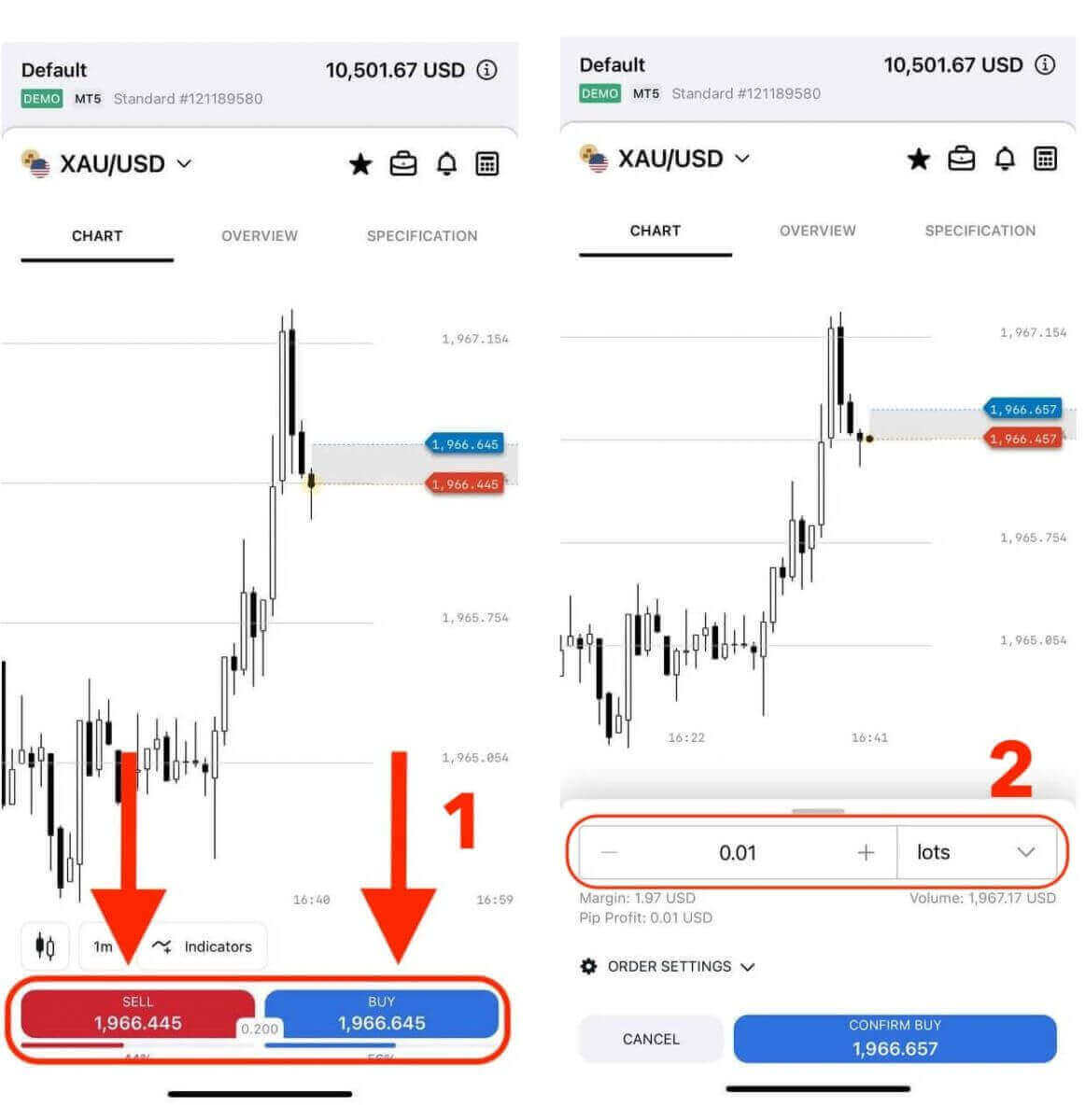

4. Tap Sell or Buy to expand its basic order settings, such as lot size.

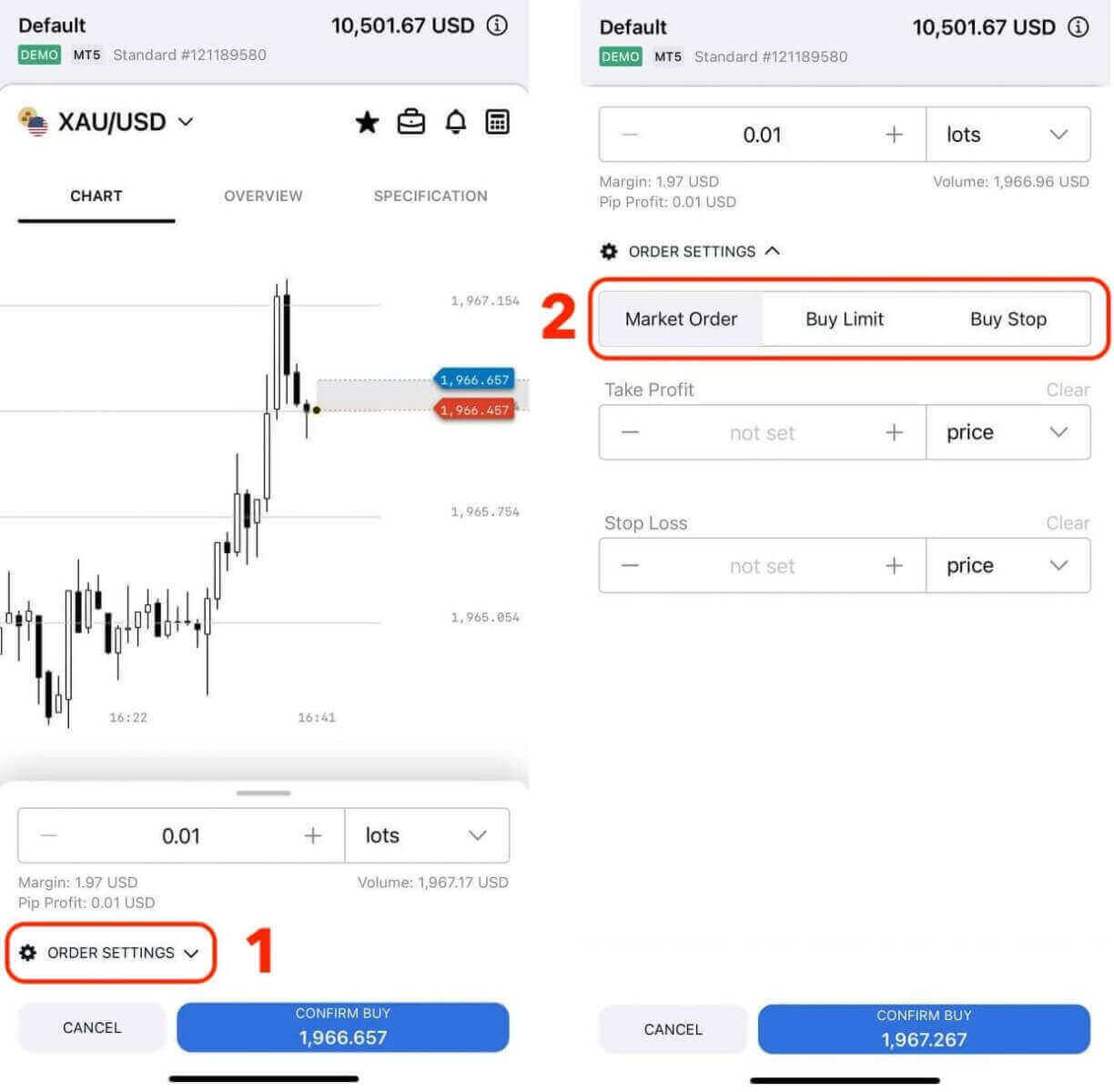

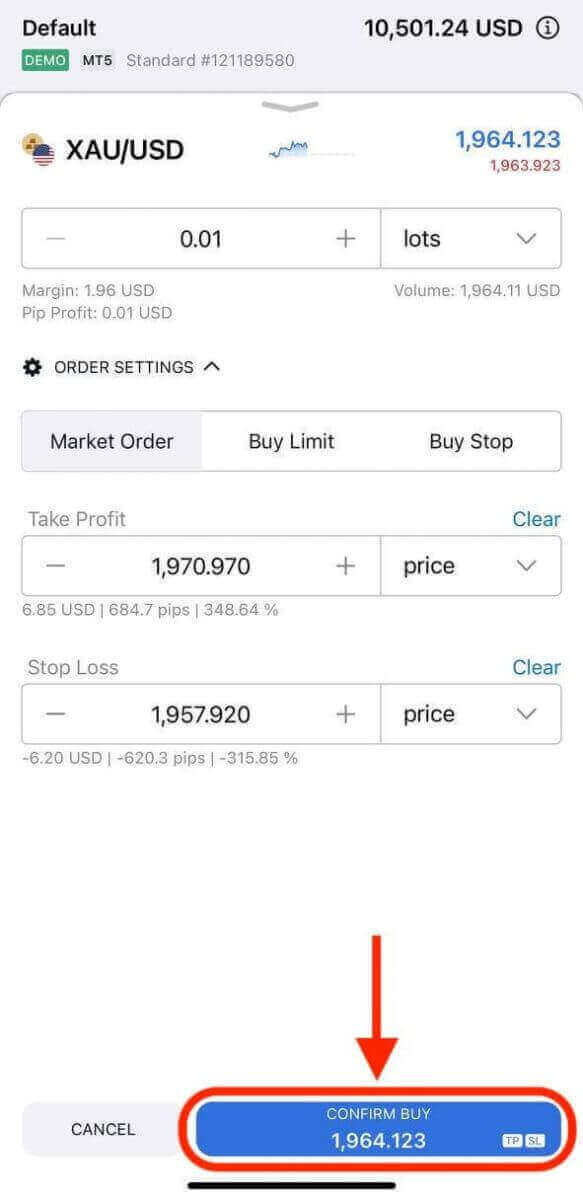

You can tap Order settings to bring up more advanced options including. These parameters define your risk management and profit targets:

- The choice of 3 order types; market order, limit order and stop order types.

- Take profit and stop loss options for each order type.

When any options are entered, real-time data will display below that option.

5. Once you are satisfied with the trade details, tap the appropriate Confirm button to open the order. The Exness app will process the order and execute it at the prevailing market price or the specified price, depending on the order type.

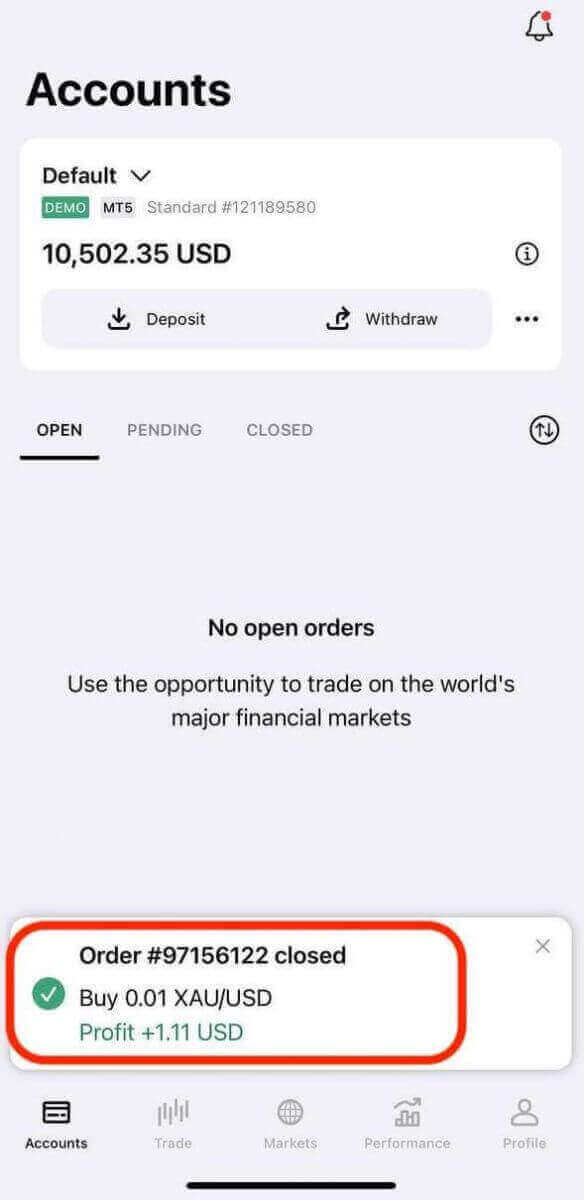

6. A notification confirms that the order has been opened.

How to Close an Order on Exness

Close an Order on the Exness Website

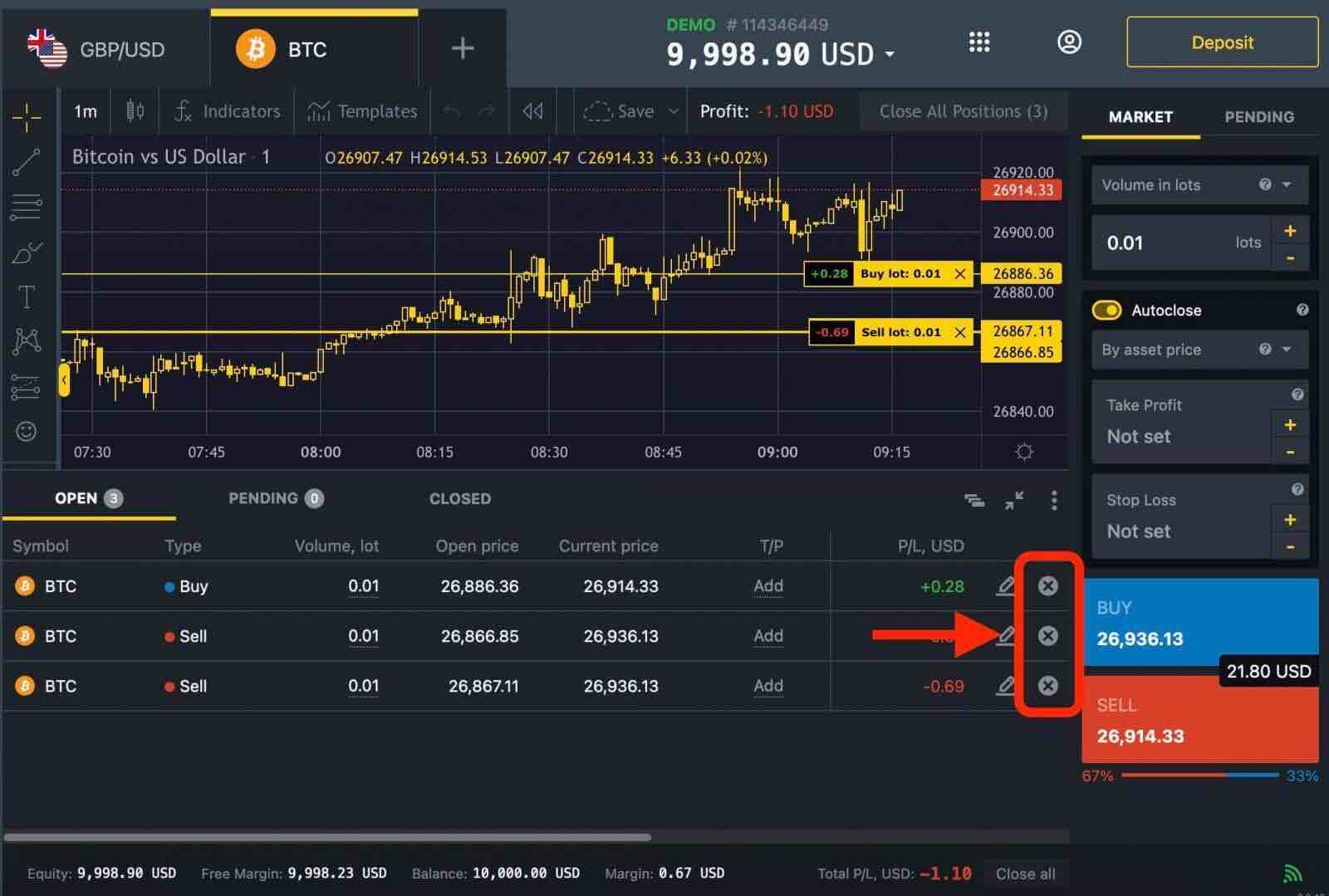

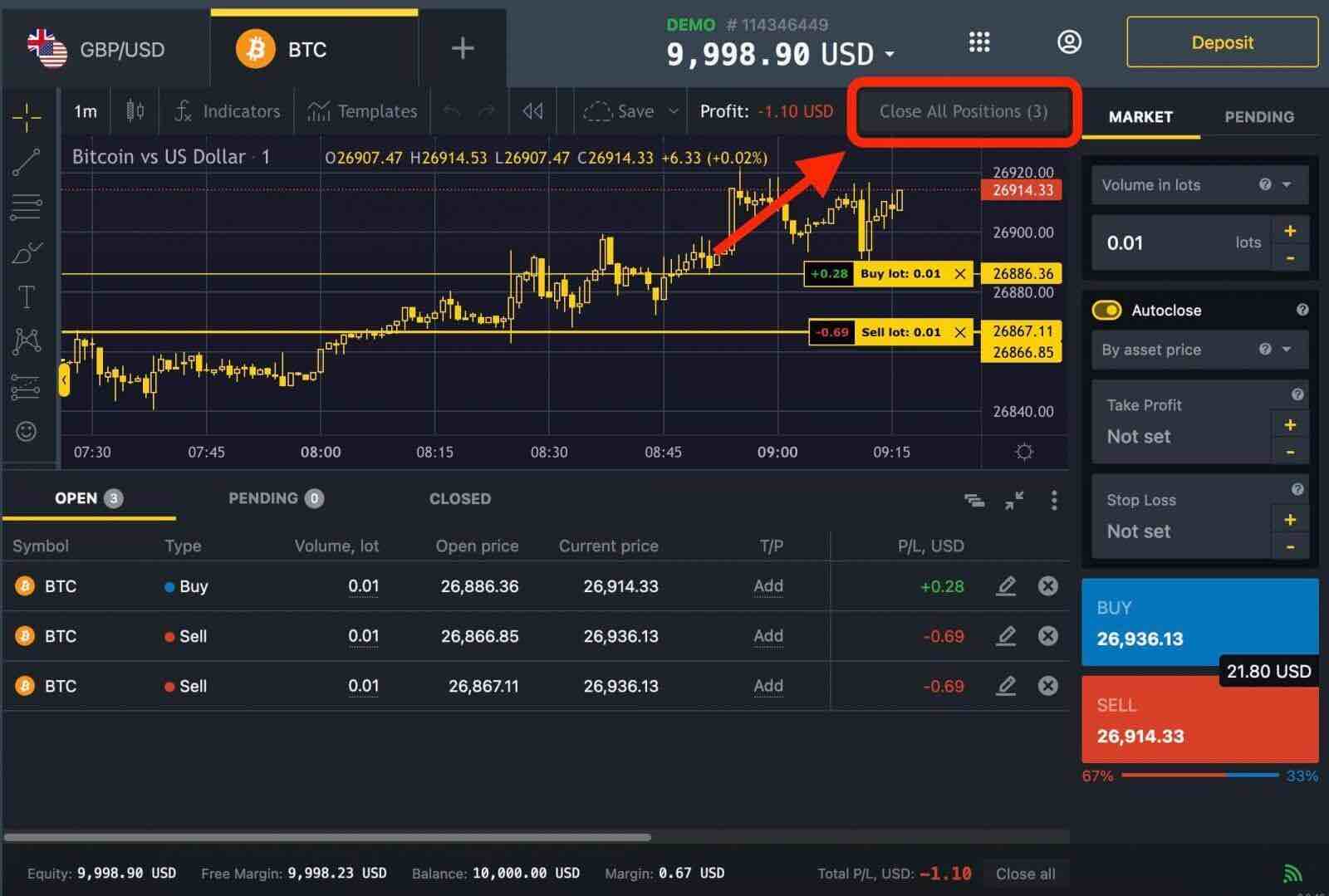

1. Close an order from that trading instrument’s chart by clicking the x icon for the order, or from the portfolio tab with the x icon.

2. To close all active orders for a particular instrument, click on the "Close All Positions" button located at the top-right of the chart (next to the Profit displayed).

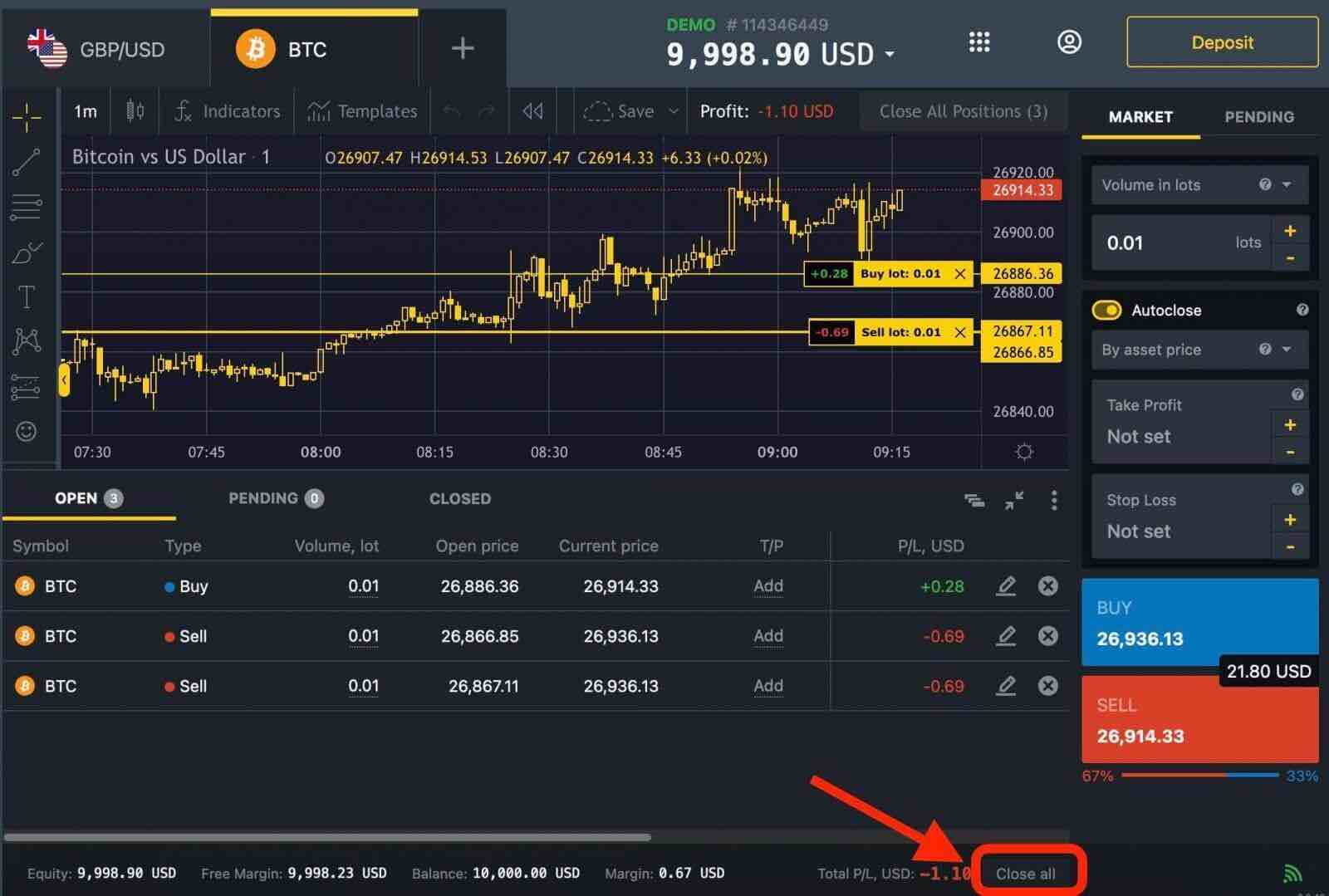

3. Close all open positions for every traded instrument by clicking on the "Close All" button at the bottom-right of the portfolio area.

Your trade will appear in the "CLOSED" section.

Close an Order on the Exness App

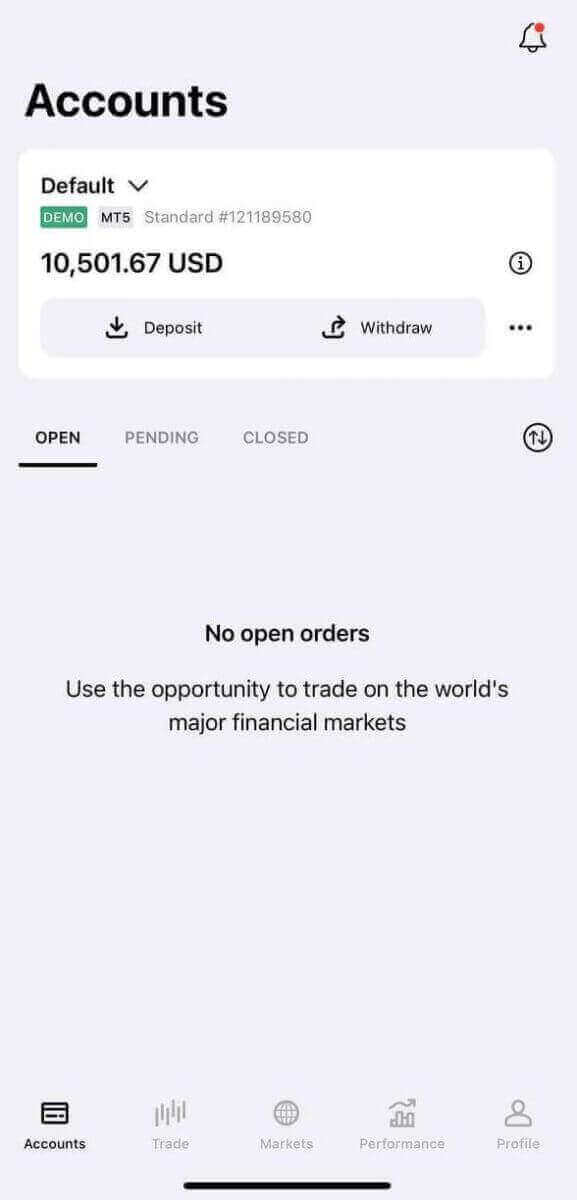

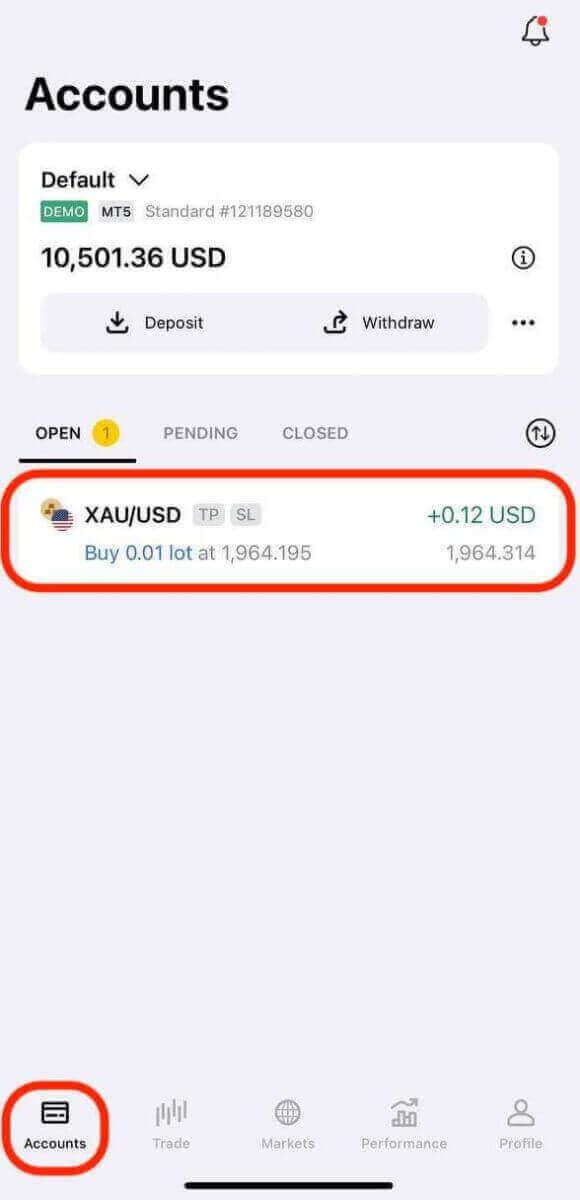

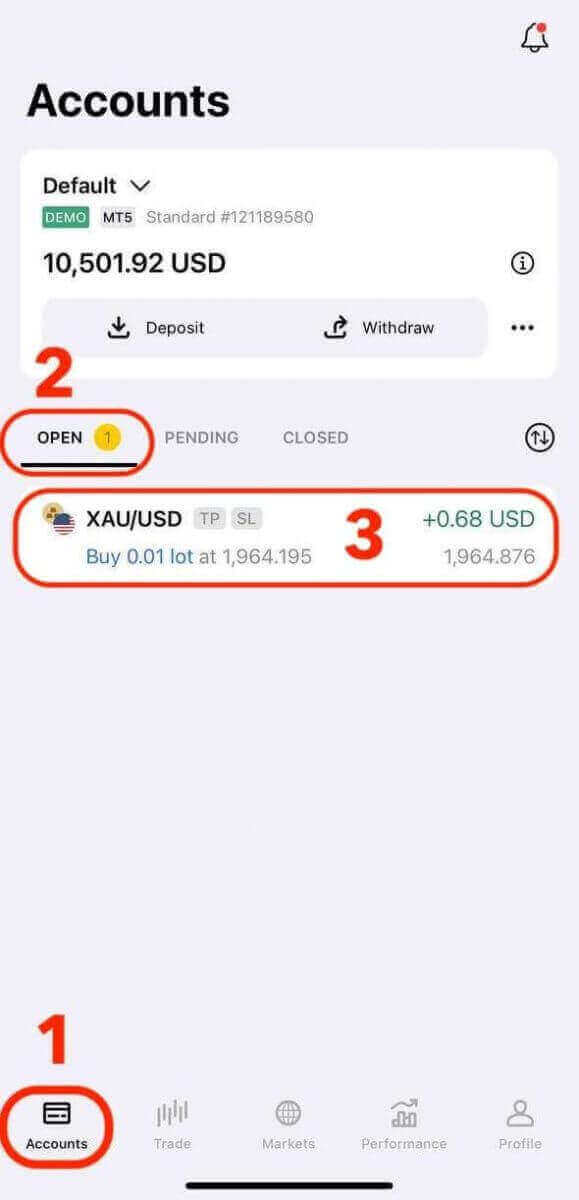

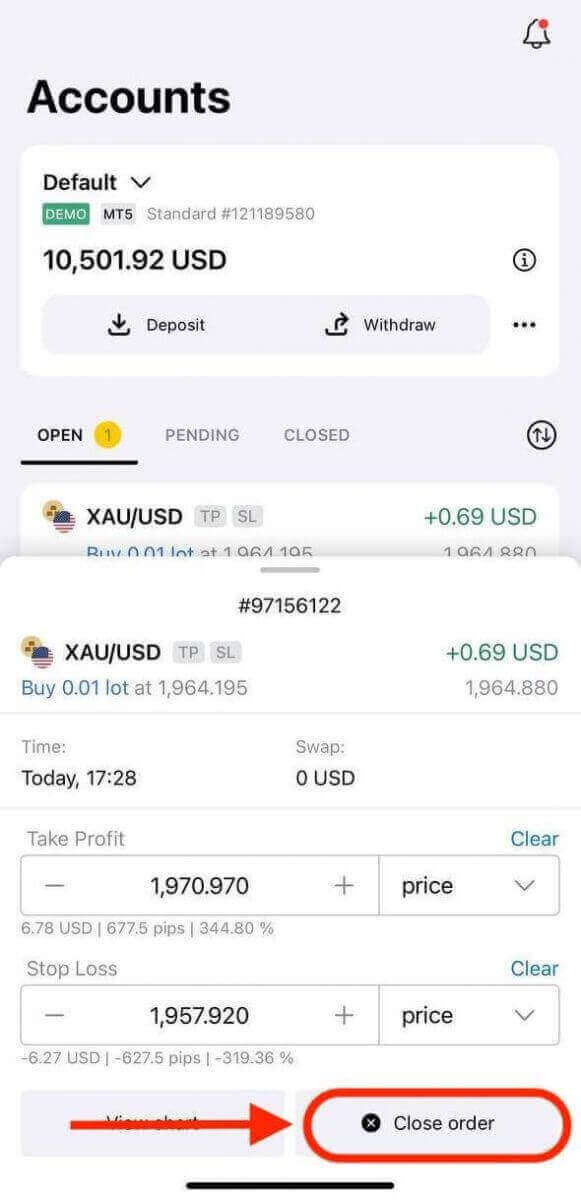

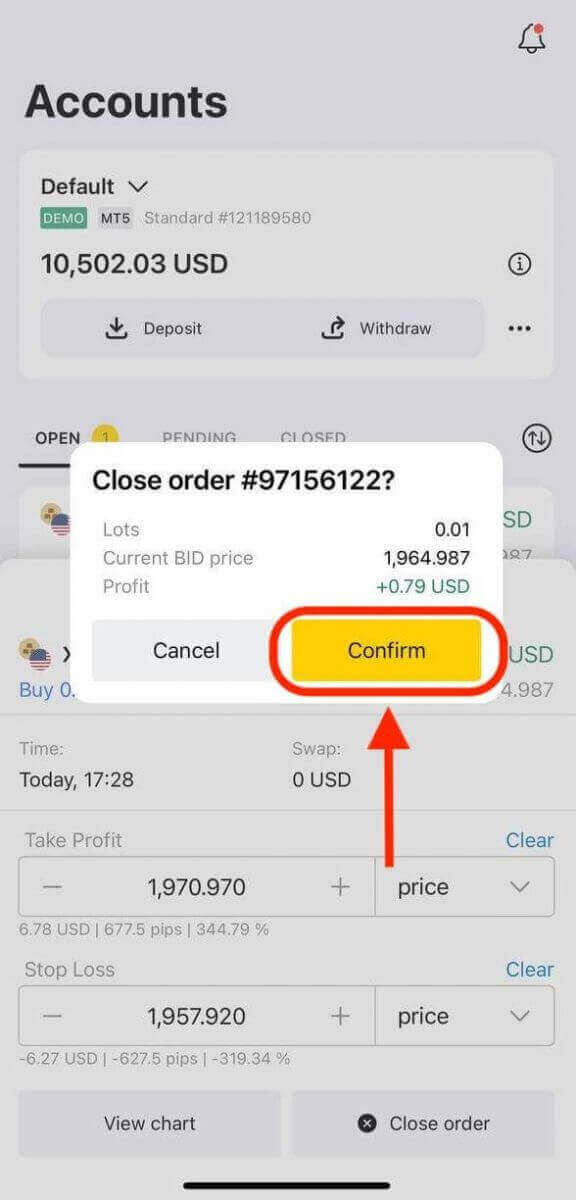

1. Open the Exness Trade app.

2. From the Accounts tab, locate the order you wish to close under the "OPEN" tab.

3. Tap the order you wish to close, and then tap Close order.

4. A confirmation pop-up will display the order’s information. Review the details once again to ensure accuracy. If you are certain, tap on "Confirm" to close the order.

5. You will receive a confirmation message indicating that the order has been closed successfully. The order will be removed from your list of open positions.

Review Closed Orders: You can access your closed orders under the "CLOSED" tab. This allows you to track your trading activity and analyze your performance.

How do Traders make Profits on Exness

A trade is said to be in profit when the price is moving in your favor. To understand this, you will need to know what is the favorable price direction for Buy and Sell orders.- Buy orders make a profit when the price rises. In other words, if the closing Bid price is higher than the opening Ask price when the order is closed, the Buy order is said to have made a profit.

- Sell orders make a profit when the price falls. In other words, if the closing Ask price is lower than the opening Bid price when the order is closed, the Sell order is said to have made a profit.

Tips for Successful Trading on the Exness

These are some of the tips that can help you trade successfully on the Exness app:

Educate Yourself: Continuously improve your trading knowledge by learning about market analysis techniques, trading strategies, and risk management principles. The Exness app offers a variety of educational resources and expert insights to help you improve your trading skills and knowledge, such as webinars, tutorials, and market analysis articles, to help you stay informed.

Develop a Trading Plan: Set clear trading goals and establish a well-defined trading plan. Define your risk tolerance, entry and exit points, and money management rules to guide your trading decisions and minimize emotional trading.

Utilize Demo Accounts: Take advantage of the Exness app’s demo accounts to practice your trading strategies without risking real money. Demo accounts allow you to familiarize yourself with the platform and test different approaches before transitioning to live trading.

Stay Updated with Market News: Keep track of economic news, geopolitical events, and market trends that can influence your trading positions. Exness provides access to real-time market news and analysis, helping you make well-informed trading decisions.

Use technical analysis tools and indicators: The Exness app provides a range of technical analysis tools and indicators to help you identify trends, patterns, support and resistance levels, and potential entry and exit points. You can use different chart types, time frames, drawing tools, and indicators to analyze market movements and signals. You can also customize your charts and indicators according to your preferences and save them as templates for future use.

Set your risk management parameters: The Exness app allows you to set various risk management parameters to protect your capital and limit your losses. You can use stop loss and take profit orders to close your positions automatically at predefined levels. You can also use trailing stop orders to lock in your profits as the market moves in your favor. Additionally, you can use margin alerts and notifications to keep track of your account balance and margin level.

Keep Emotions in Check: Emotional decisions can lead to poor trading outcomes. Emotions such as fear, greed, and excitement can cloud judgment. Maintain a rational mindset and make decisions based on logical analysis rather than impulsive reactions to market fluctuations.

Conclusion: Exness stands out as a reliable and regulated brokerage

Trading on Exness provides traders with a reputable and trustworthy platform to participate in the dynamic world of Forex, ensuring a secure trading environment for its clients. The diverse range of trading instruments, including major, minor, and exotic currency pairs, offers ample opportunities for traders to explore and capitalize on global markets.Practicing with Exness’ demo accounts allows traders to sharpen their skills and gain confidence before engaging in live trading. The availability of risk management tools, such as stop-loss orders and position sizing techniques, helps traders protect their capital and manage risks efficiently.

Access to market analysis tools, including real-time price quotes, customizable charts, and economic calendars, enables traders to conduct thorough analysis and stay updated on market-moving events. The educational resources provided by Exness, including tutorials, webinars, and trading guides, further contribute to traders’ knowledge enhancement and continuous growth.

Overall, Trading Forex on Exness offers a comprehensive and reliable platform for traders to engage in the currency markets with confidence. With a focus on regulatory compliance, diverse trading instruments, powerful trading platforms, and a range of risk management tools, Exness equips traders with the necessary resources to pursue profitability in Forex trading. By leveraging their educational resources and dedicated customer support, traders can continue to enhance their skills and stay informed in this dynamic market. Start your Forex trading journey with Exness and unlock the potential for financial growth and success.