About Exness

- Very well regulated

- Min Deposit $1

- Impressive range of Forex pairs to trade on

- Commission-free trading available

- Flexible leverage

- Copy Trading System

- Support in 20 languages

- Good Customer Support

- Platforms: MT4, MT5, Exness Trader

Introduction

Exness is a popular global broker with nine different trading accounts and one of the lowest-cost Cent Accounts in the industry. Exness also has 100+ Forex pairs to trade, many more than most other brokers, and a great range of trading platforms and tools.

Exness is a forex and CFD broker that offers its clients access to trading in currencies, crypto, stocks, indices, metals, and commodities. Exness makes a proprietary Trading Terminal platform plus MetaTrader 4 and 5 available partnered with a wide variety of account types to cater to different types of traders.

Exness is licensed and regulated by multiple leading international governing bodies, allowing Exness clients to trade with financial security.

Pros and Cons

| PROS | CONS |

|

|

Accounts

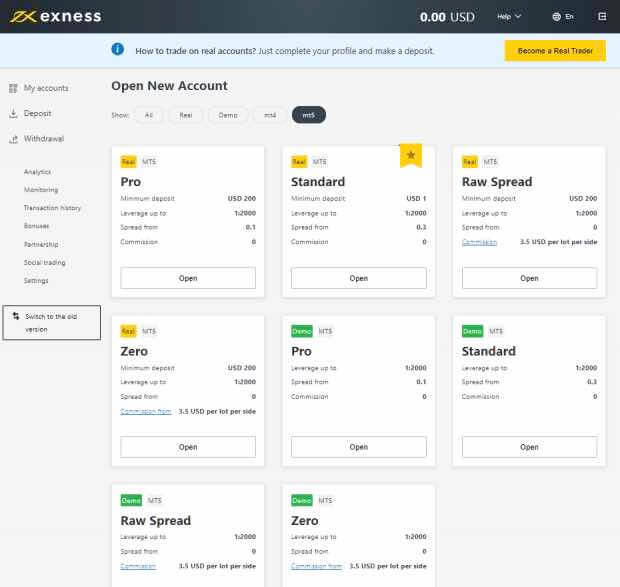

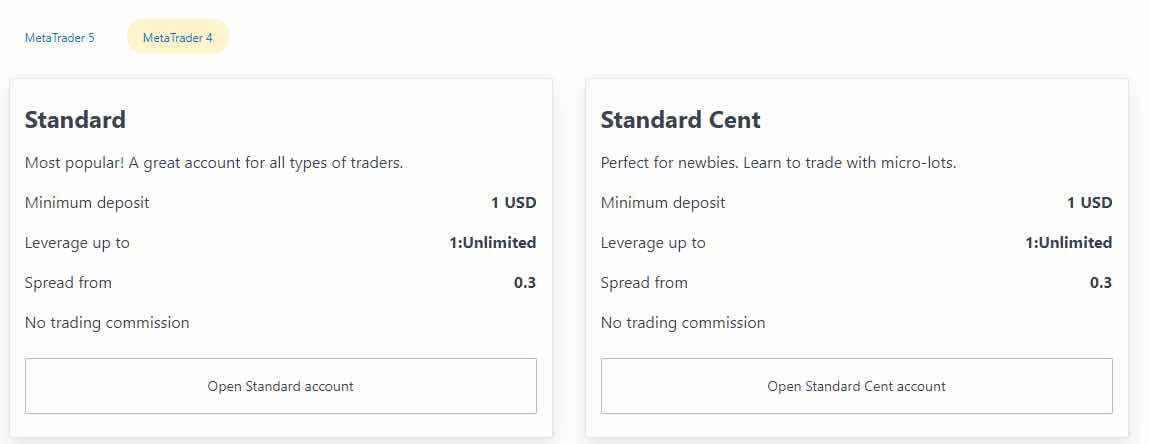

“Exness offers 5 different trading accounts. Standard Accounts include the Standard and Standard Cent. Professional Accounts include Raw Spread, Pro and Zero. Demo accounts and Islamic swap-free accounts are also available.”

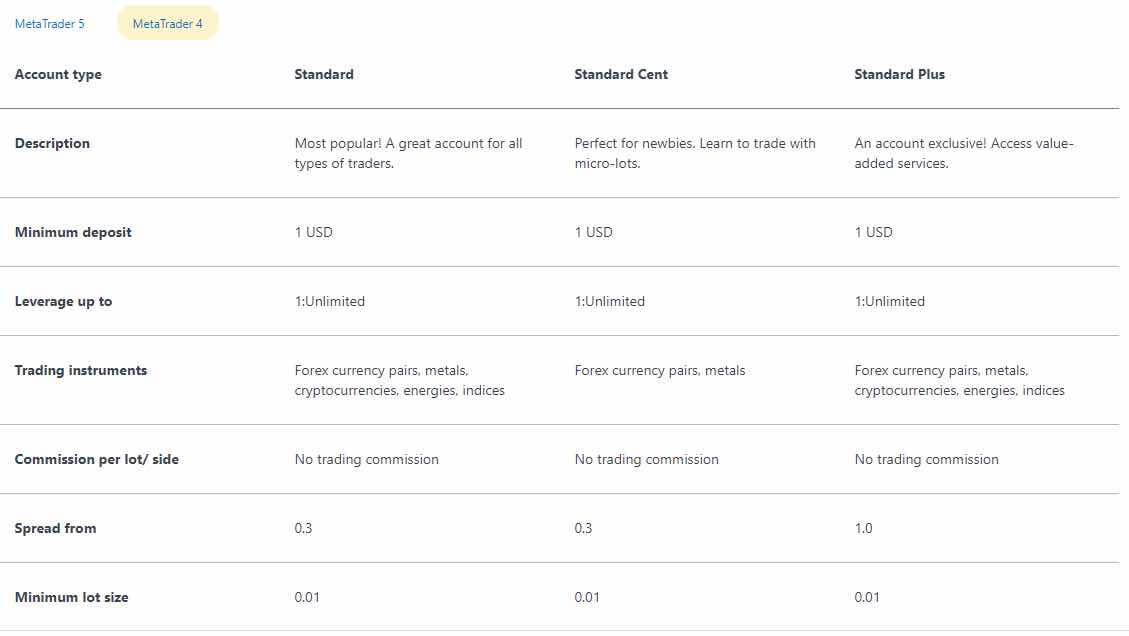

The Standard Accounts include the Standard and Standard Cent account which are both commission-free, as shown below:

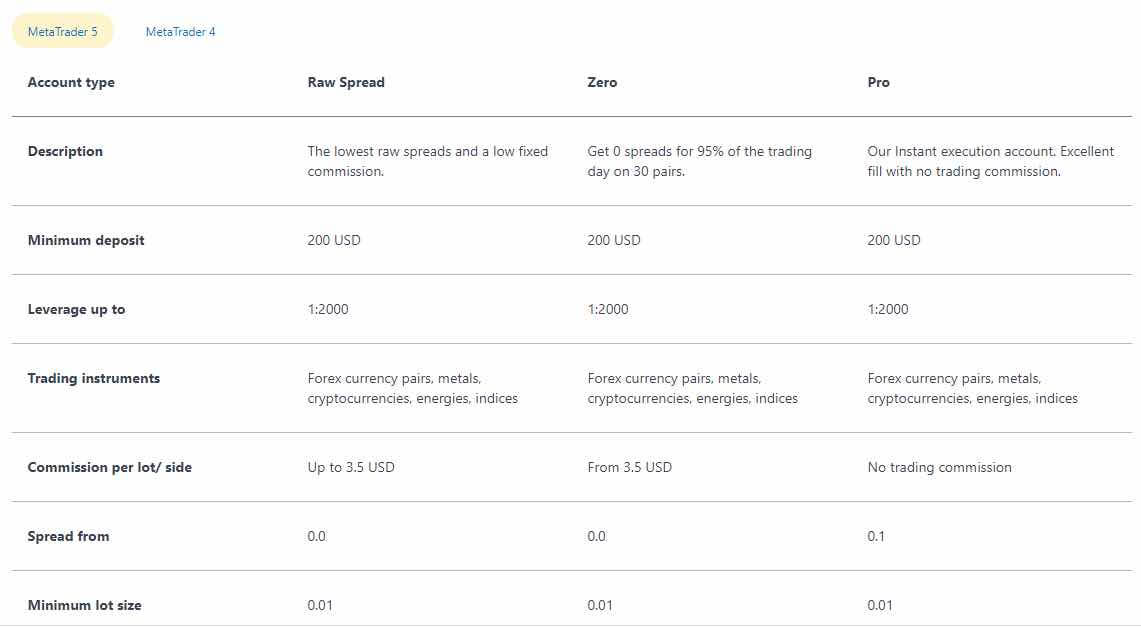

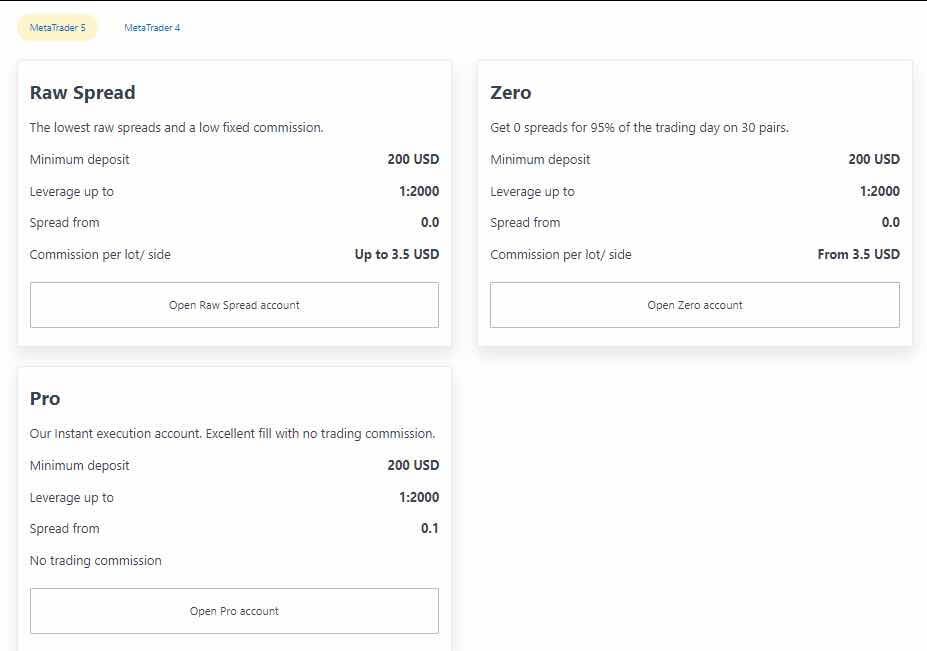

The Professional Accounts include the Raw Spread, Pro and Zero Accounts, as shown below:

The Professional Accounts include the Raw Spread, Pro and Zero Accounts, as shown below:

The Standard Cent account is only available on MetaTrader 4 and not on MetaTrader 5. The Professional Accounts offer differing leverage with some advertised as ‘unlimited’ and others a maximum of 1:2000.

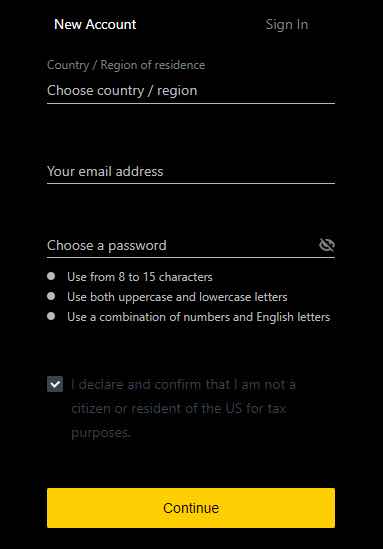

Users can open an account by clicking on Open Account or New Account on the broker’s website.

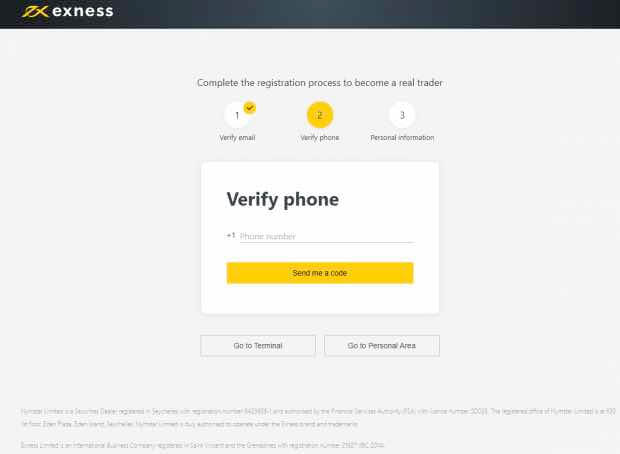

To complete the registration process, users are asked to verify their phone number and personal information as shown below:

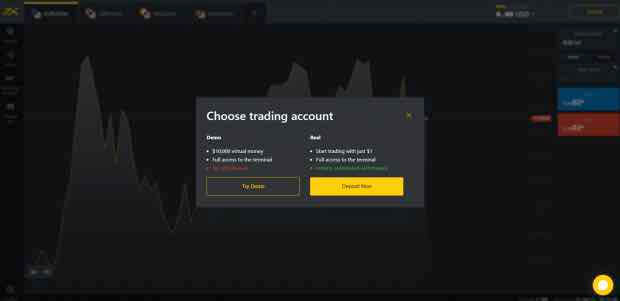

This can also be done at a later stage. However, at this point, users can access the My.Exness personal area to view and open new accounts, as well as access deposit, withdrawals, trading platforms, bonuses, social trading and more, as shown below:

Exness does not accept clients from these restricted countries: the USA, Malaysia, Russia, Saint Vincent and the Grenadines, Vatican City, Israel, American Samoa, Baker Island, Guam, Howland Island, Kingman Reef, Northern Mariana Islands, Puerto Rico, Midway Islands, Wake Island, Palmyra Atoll, Jarvis Island, Johnston Atoll, Navassa Island.

Products

To cater for the various needs of all its traders, Exness offers a wide range of quality products to trade on covering Forex and CFDs on Metals, Energies, Crypto, Indices and Stocks.

Below is a list of just some of the available markets for trading:

| FOREX | METALS | STOCKS |

| AUDTRY | XAGAUD | Apple |

| CADMXN | XAGEUR | eBay |

| EURUSD | XPDUSD | Intel |

| GBPJPY | XPTUSD | JP Morgan |

| NOK.SEK | Crypto | Indices |

| USD.SGD | BCHUSD | Germany 30 |

| Energies | BTCJPY | France 40 |

| UKOil | ETHUSD | Japan 225 |

| USOil | XRPUSD | US Wall Street 30 |

* Details regarding the available assets are taken from the Exness website and trading platform and are correct at the time of this review.

Trading costs such as spreads, commissions and overnight funding (swap) rates vary depending on the instrument being traded and are covered further down this review.

Leverage

Leverage levels always depending on the instrument you trade, as well defined by the regulatory restrictions and your personal level of proficiency.

Since FCA and CySEC along with its European directive miFID significantly lowered the possibility for leverage levels, the maximum leverage you may use as a retail trader is

- 1:30 for major currencies,

- 1:20 for minor ones

- 1:10 for commodities.

Yet, a global entity of Exness may allow much higher leverage ratios up to 1:1000, which are also defined by the country of your origin.

And of course, always learn how to use leverage correctly, as leverage may increase your potential loses as well and is a different feature in various instruments.

Commissions and Spreads

“Trading costs with Exness vary depending on the account type opened and the market being traded. Some accounts offer commission-free trading and some are commission-based with raw spreads from 0 pips.”

The Standard and Standard Cent (MT4 only) Accounts offer commission-free trading with spreads starting from 0.3 pips.

The professional Pro Account offers commission-free trading with spreads starting from 0.1 pips. The professional Raw Spread account offers commission-based trading up to 3.5 USD per lot/per side with spreads starting from 0 pips. Zero account offer commission-based trading starting from 3.5 USD per lot/per side with spreads starting from 0 pips.

Spreads and swap-rates vary depending on the instrument being traded and the account type opened.

See some of the examples below for a better understanding of Exness costs and comparison with other brokers, as well compare fees to another broker DF Markets.

Comparison between Exness fees and similar brokers

| Asset/ Pair | Exness Fees | ETFinance Fees | OctaFX Fees |

| EUR USD | 1.2 | 0.7 | 0.5 |

| Crude Oil WTI | 4 | 3 | 2 |

| Gold | 0.3 | 0.37 | 0.2 |

| Inactivity fee | Yes | Yes | Yes |

| Deposit fee | No | Average | Low |

| Fee ranking | Low/ Average | High | Average |

Platforms

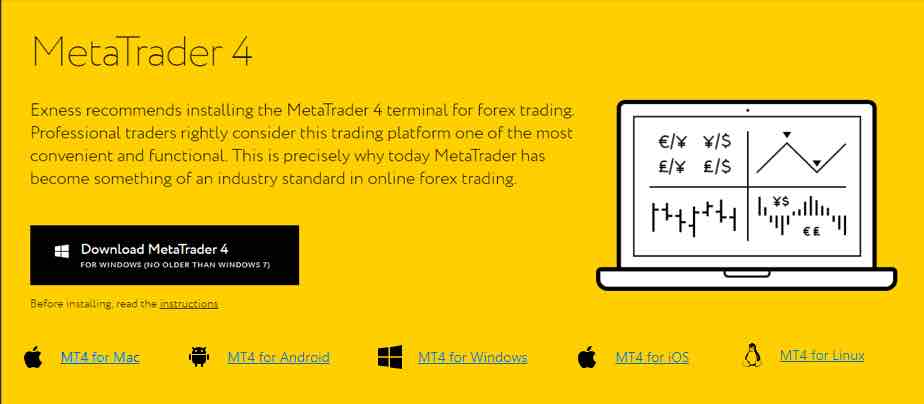

The broker offers its various services on both MetaTrader 4 and MetaTrader 5. The MetaTrader 4 platform is available in a web-based version, desktop version as well as mobile apps.

MetaTrader 5 is considered to be an improved version of MetaTrader 4. However, many online Forex brokers prefer the MetaTrader 4 platform because MetaTrader 5 doesn’t support hedging. Additionally, the MT5 platform does not support MT4’s Expert Advisors popularly known as EA. The two platforms (MT4 and MT5) are highly encrypted to safeguard the personal details of traders.

Exness offers users the ability to trade on the globally-recognised MetaTrader 4 trading platform

- 30 inbuilt indicators.

- Instant and Market order execution types.

- Autotrading via MQL4.

- Real-time prices.

The Exness MetaTrader 5 trading platform allows users to:

- View 38 inbuilt indicators and 22 analytical tools.

- Access fundamental analysis via an inbuilt economic calendar and news events.

- View up to 21 different timeframes.

- Develop automated systems via MQL5.

Web trading

While both platforms are well known software in the industry, MetaTrader4 features a convenient and functional trading platform that has been recognized by professional world traders and retail traders as well. While MT5 is a more developed version of the previous one with powerful features and new possibilities. You can access both via Web Trading, which is free from download or installation platform accessible via the browser.

Yet, Web version is always less advanced as desktop one, so if you develop a comprehensive strategy and need more customization and charting features go for the desktop version.

Desktop platform

Both MT4 and MT5 support all devices including PC and MAC, so the choice is yours which platform you prefer to use either industry standard or its new developed version MT5. Good to mention again that each account supports both platforms, so there is no need to specify, you can use two at the same time, which is great.

The Exness Terminal

Users can also trade on the Exness Web Terminal which offers quick, simple trading functionality but with limited features. This can be accessed from the My.Exness Personal Area, as shown below:

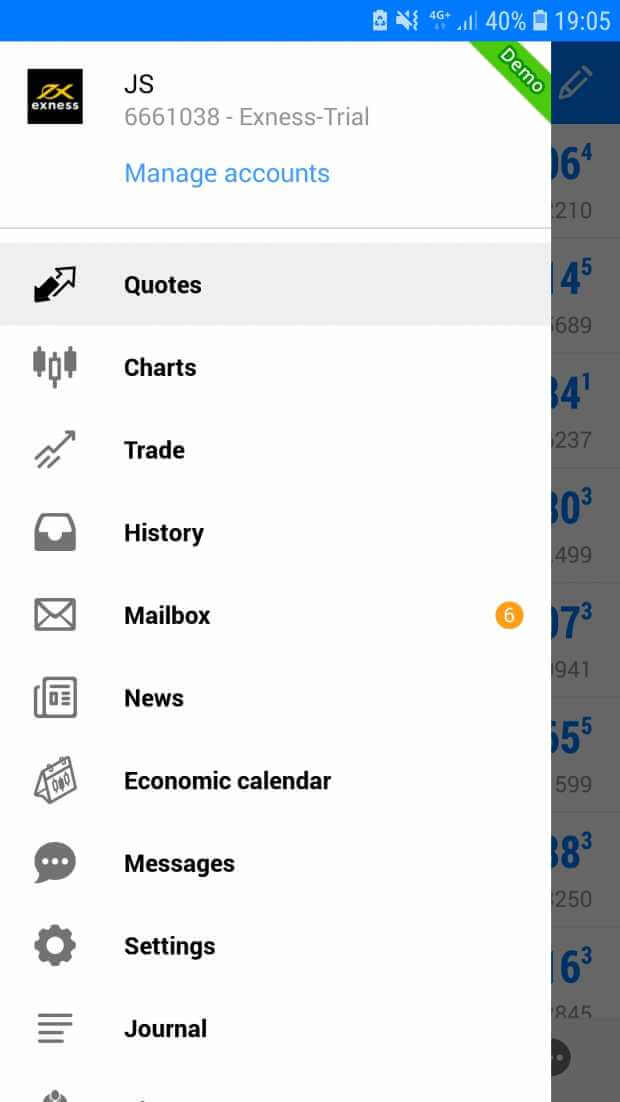

Moile Trading

From the comfort of their mobile devices, Exness traders are in a position to carry out almost all the functions of both MT4 and MT5 platforms. Thanks to Mobile trading, clients can complete various trading activities from anywhere in the world provided they are connected to the internet.

Traders especially those who are constantly on the move prefer mobile Forex trading because of its convenience and reliability. The fact that Exness supports mobile trading is a huge plus and the company will continue to enjoy an upward growth pattern.

- Apple iOS App

- Android App

- Trading- CFDs and Fore

Trading styles

Since there are many traders who still prefer the MT4, both options are available along with the analytical service with free technical analysis from Trading Central, high-quality VPS hosting, economical calendars, quotes history and a constant monitor of the accounts.

The most relevant news affecting the Forex market available from Dow Jones News, the leading provider of information in the world, hence included into the streaming line of the platforms. Meanwhile, all trading styles are welcomed making your strategy available and possible to be performed at Exness.

Deposit and Withdrawals

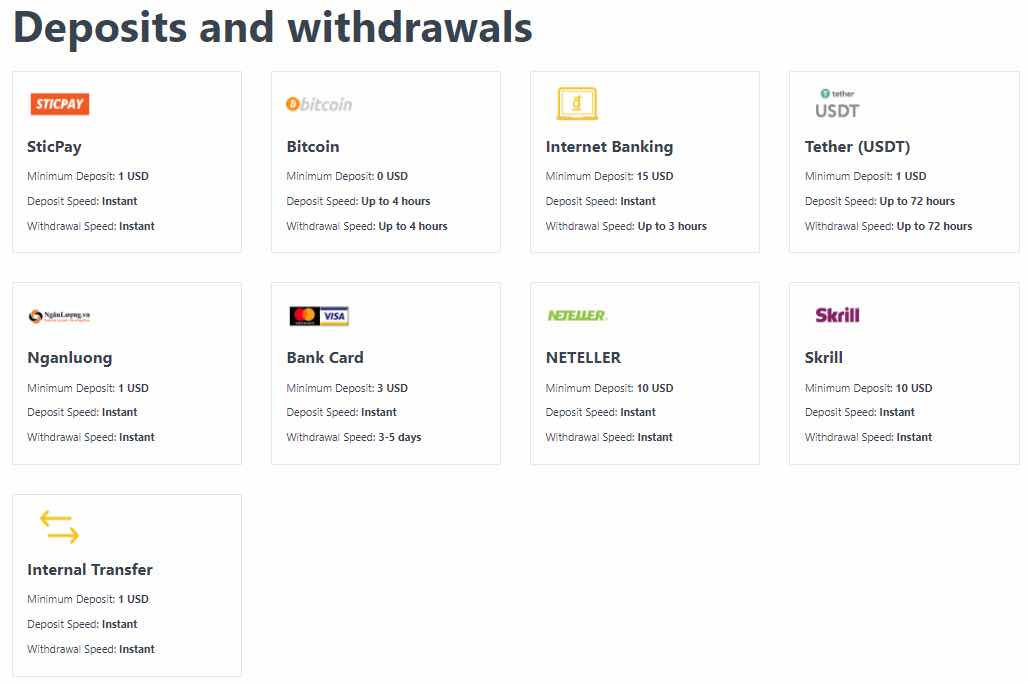

Exness performs instant deposits and withdrawals with no commission charges using a number of electronic payment system that provides control over your trading account funding at convenience.

Deposit Options

Exness offers users the ability to deposit and withdraw funds, fee-free via Bank Card, Perfect Money, WebMoney, Neteller, Skrill, Bitcoin and Tether. There are different minimum deposits and transaction times depending on the chosen method but are shown on the broker’s website, as below:

Minimum deposit

What is more great, Exness does not require a specific amount at the beginning, so you will be able to start as small as 1$. The professional account may demand though 200$, and of course, check on the necessary margin requirements that are usually set for each trading instrument separately. Also, check on the payment methods, as some of them set a minimum transfer amount.

Withdrawals

As been mentioned already, Exness does not charge any fees either for deposits or withdrawals. Nevertheless, check before any transfers are done with customer service in case there are any fees that may be applicable, due to your country of origin or maybe by the payment provider himself.

| PROS | Cons |

|

• Deposit fee may be applicable according to your region |

Conclusion

Exness offers a broad range of Forex pairs to traders and is considered to be one of the most reliable Forex brokers in the industry. It offers some amazing spreads as well as unmatched leverage levels. Thanks to its reasonable pricing and straightforward trading conditions, more and more traders prefer it over other brokers. Their website is multi-language and is full of informative content. Exness’s popularity is increasing by the day. This is evident from the influx of traders reported every year.

Powerful features of the platforms bring the capability to trade effectively along with the secure environment and all trading styles accepted. Moreover, there are pleasant additions alike Trading Central services and free VPS hosting that rewards client even more, making all in all Exness as a good choice to consider for pleasant trading experience.