How to Register and Verify Account on Exness

How to Register an Account in Exness

How to Register an Exness Account

Register an Exness Account

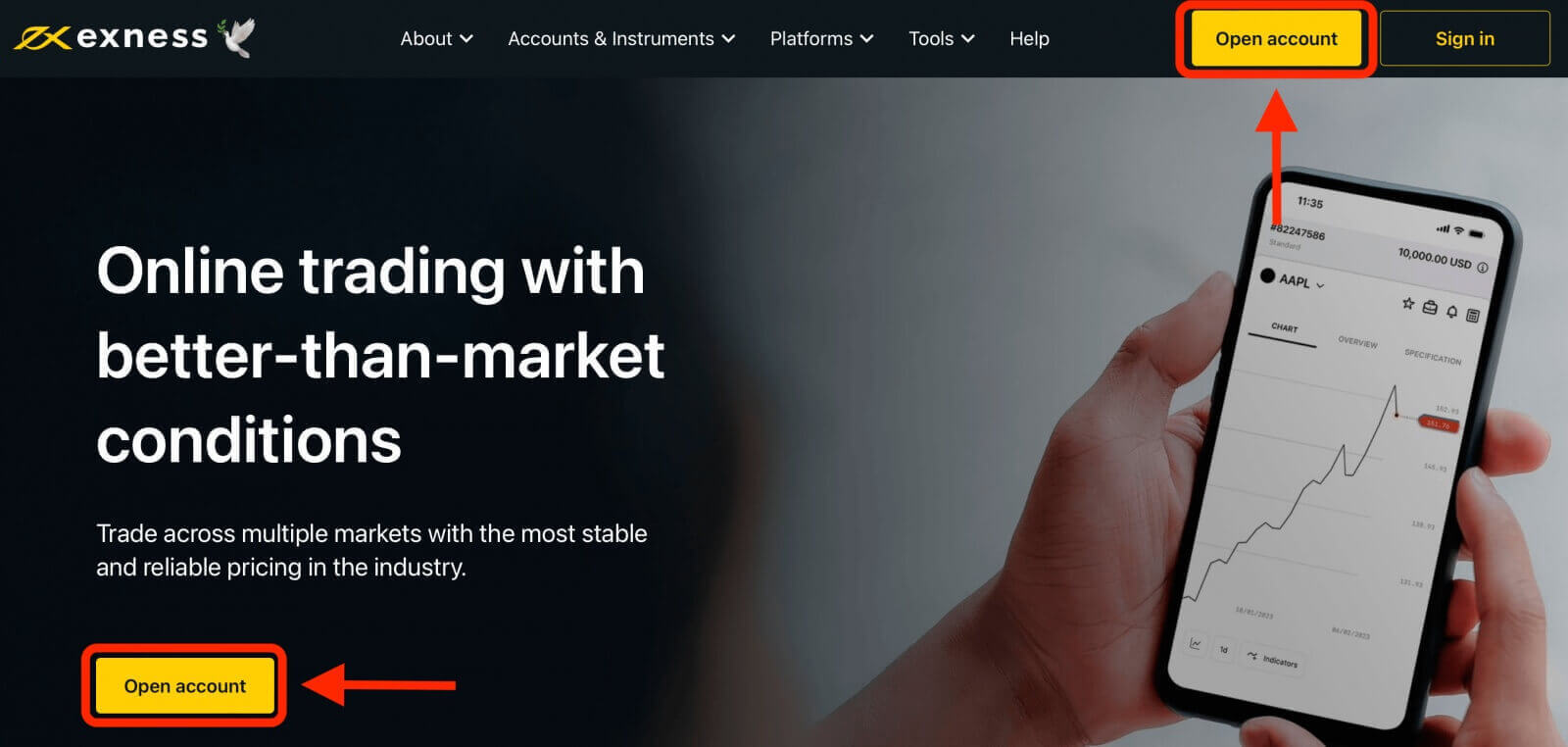

Step 1: Visit the Exness websiteTo start the registration process, you will need to visit the Exness website. On the homepage, click on the "Open account" button at the top right corner of the page.

Step 2: Fill in your personal details

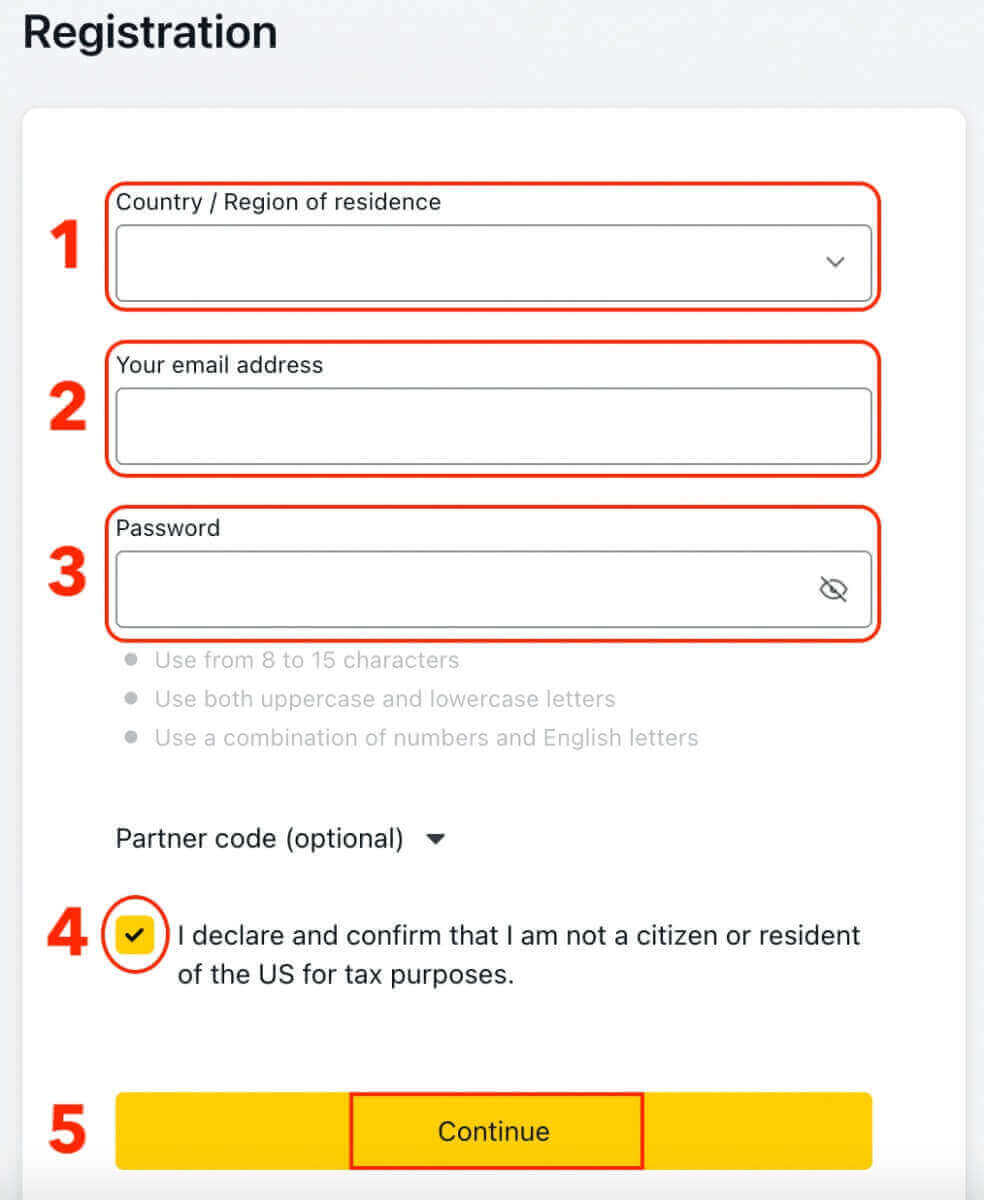

After clicking on the Open account button, you will be directed to a registration form where you will need to provide your personal information:

- Select your country of residence.

- Enter your email address.

- Create a password for your Exness account following the guidelines shown.

- Tick the box declaring you are not a citizen or resident of the US.

- Click Continue once you have provided all the required information. Make sure you enter valid and accurate information, as you will need to verify your identity later.

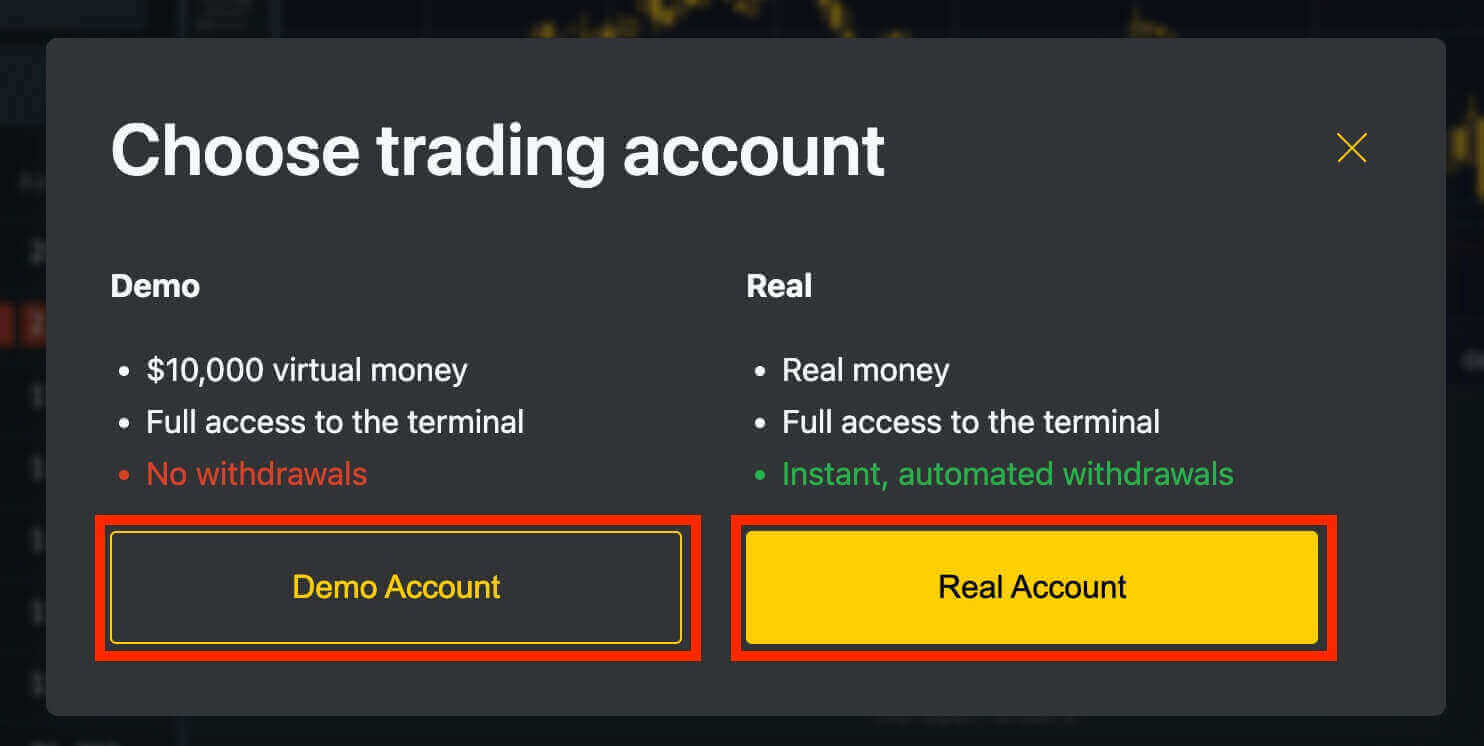

Step 3: Choose your account type

Choose the type of account you want to open. Exness offers various account types, including demo accounts and real trading accounts with different features and trading conditions. Choose the account type that suits your trading needs and experience level.

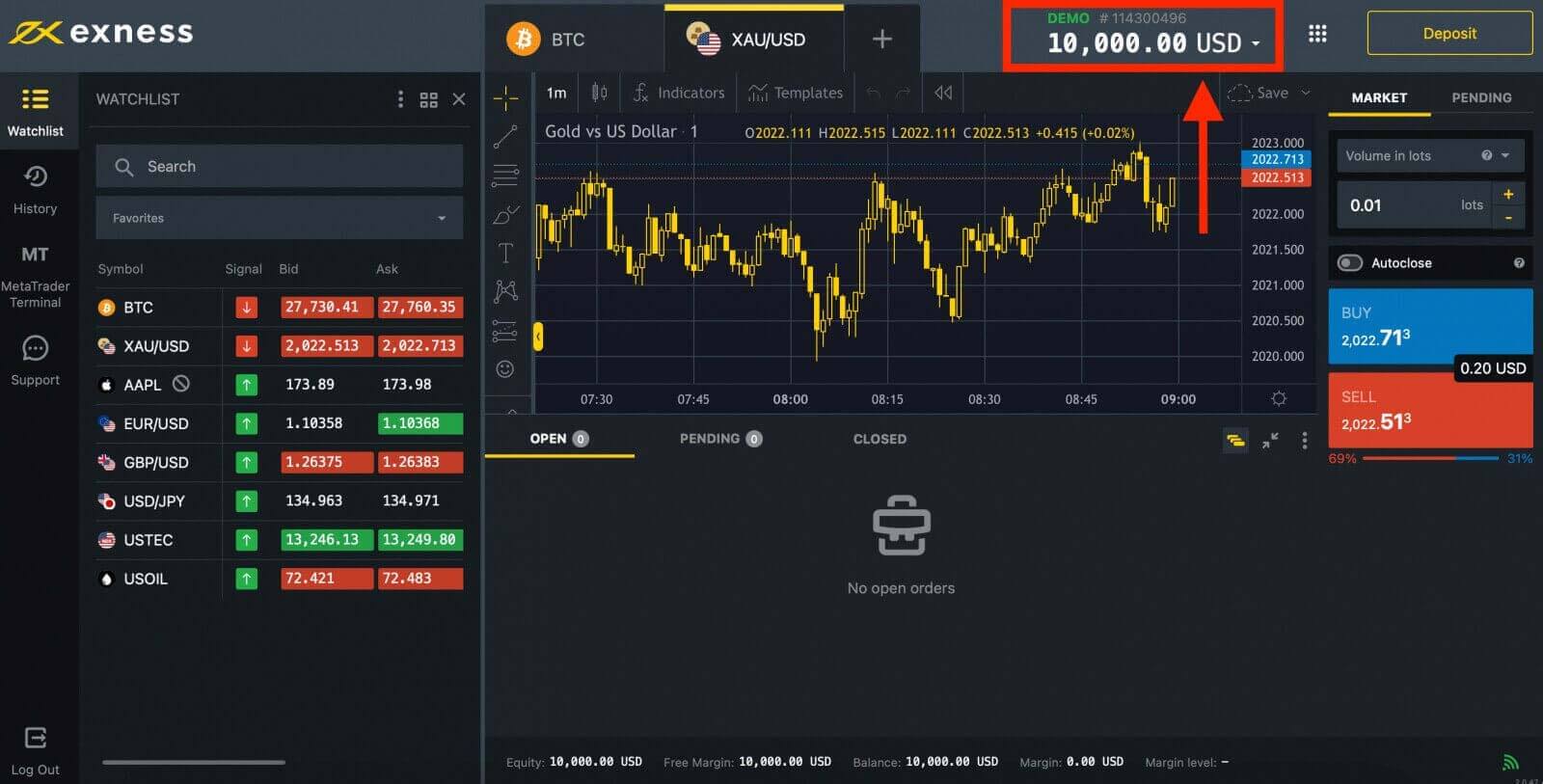

A demo account is a practice account that allows you to trade in a simulated environment using virtual funds ($10,000). Exness offers a demo account to its users to help them practice trading and get familiar with the platform’s features without risking real money. They are an excellent tool for beginners and experienced traders alike and can help you improve your trading skills before moving on to trading with real money.

Once you’re ready to start trading with real funds, you can switch to a real account and deposit your money.

Once you have registered, it is advised that you fully verify your Exness account to gain access to every feature available only to fully verified Personal Areas.

Once your account is verified, you can fund it using various payment methods, such as bank transfer, credit card, e-wallet or cryptocurrency.

Open a Trading Account on Exness

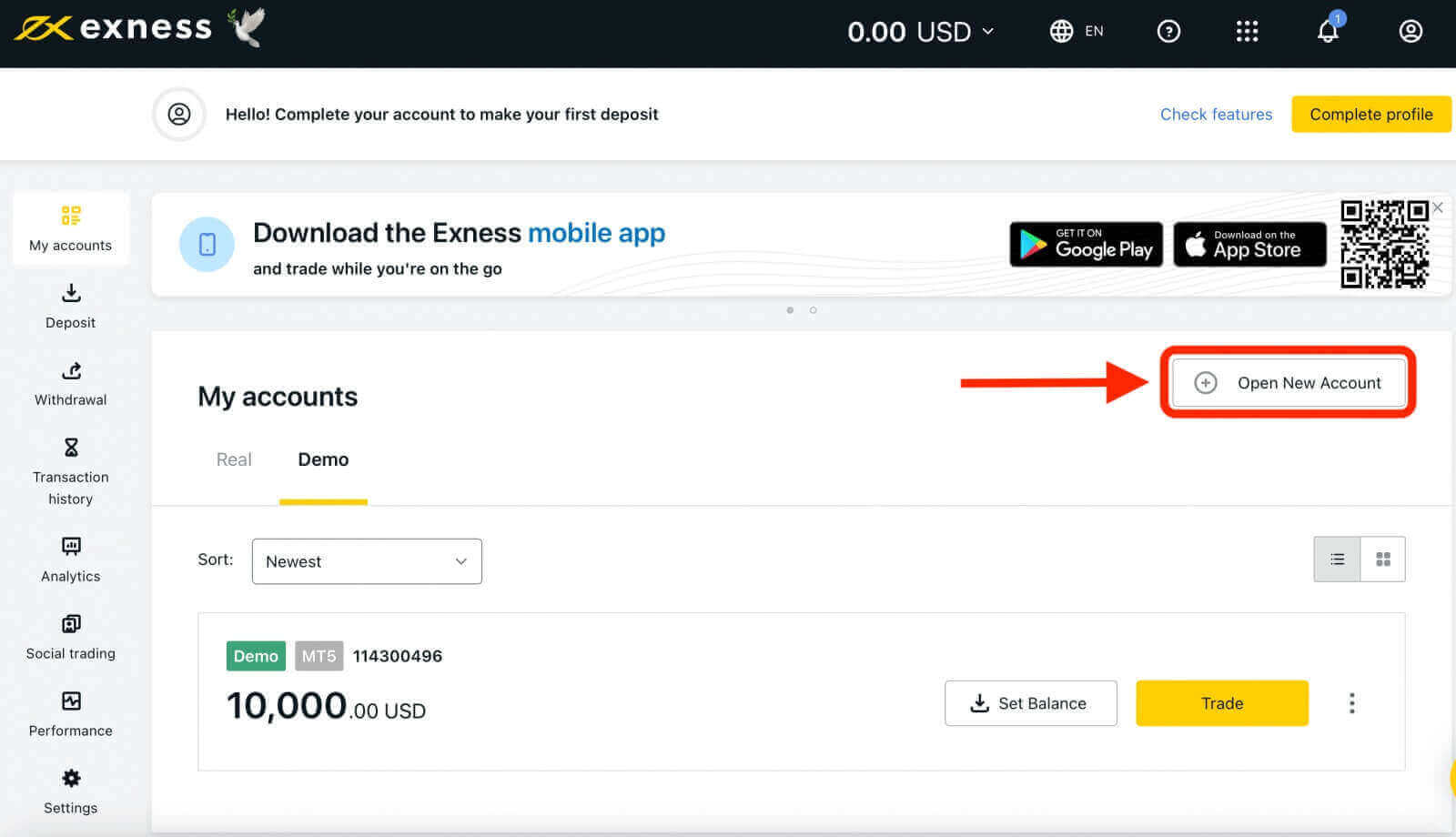

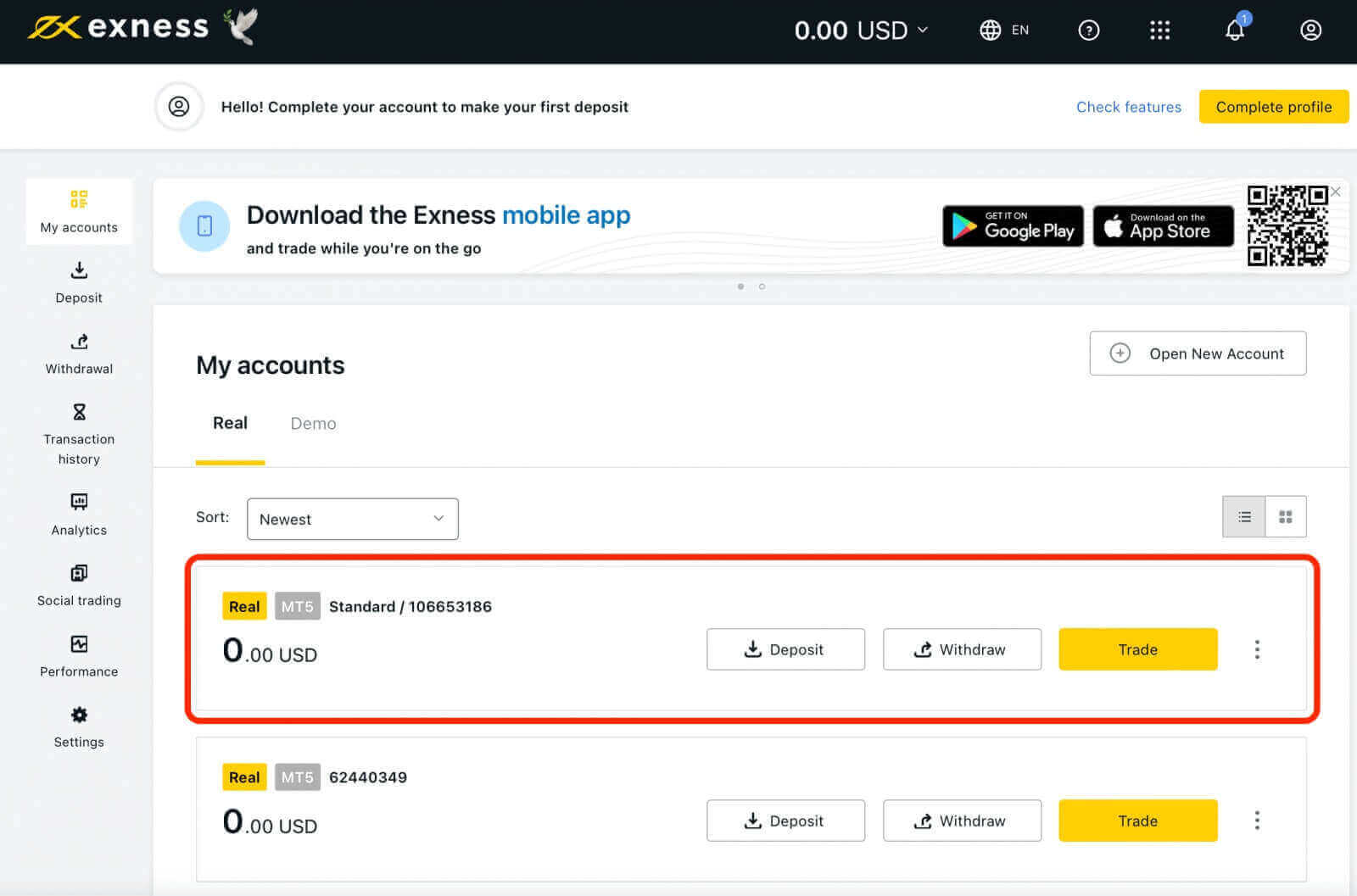

When you create a new Personal Area on Exness, a real trading account and a demo trading account (both for MT5) are automatically created, but you also have the option to create additional trading accounts if needed1. Go to Personal Area to open more trading accounts.

2. From your new Personal Area, click the "Open New Account" button in the ‘My Accounts’ area.

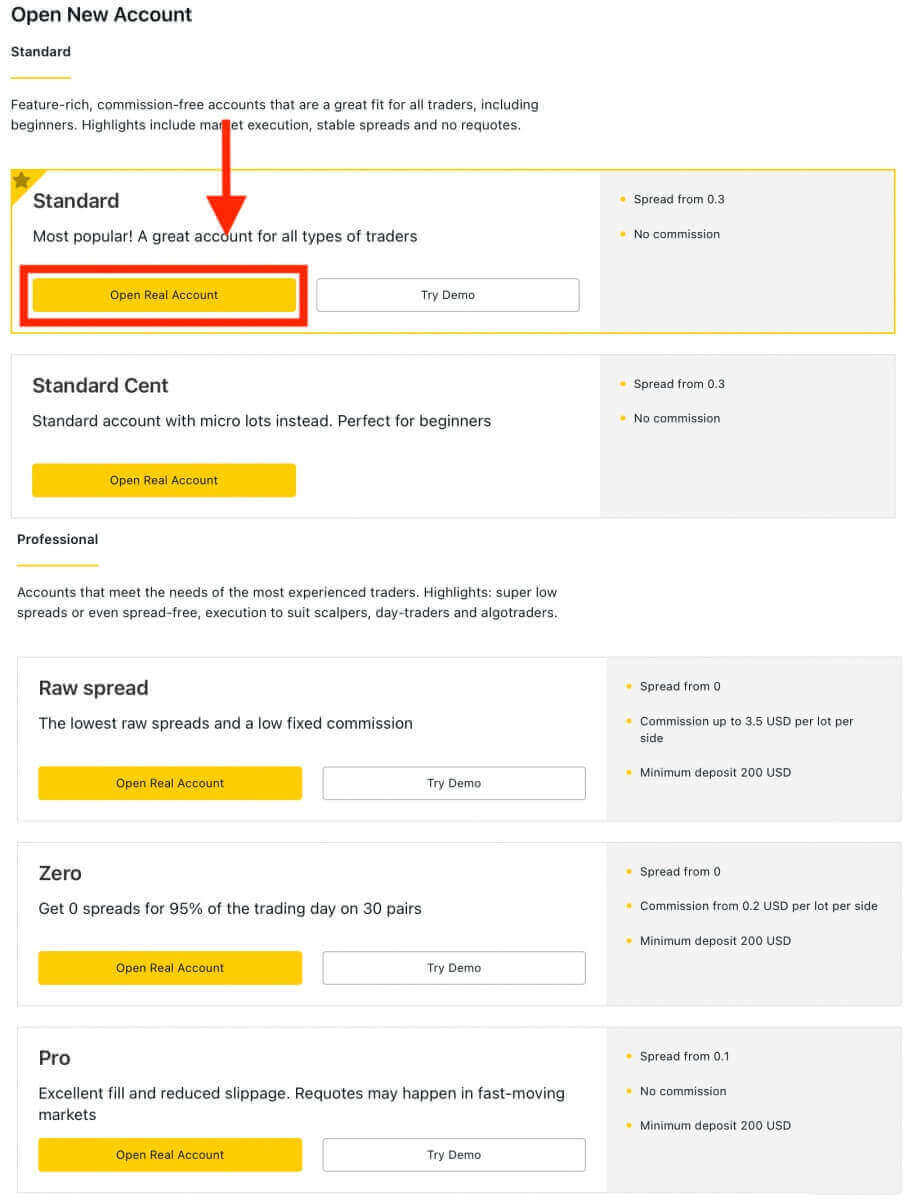

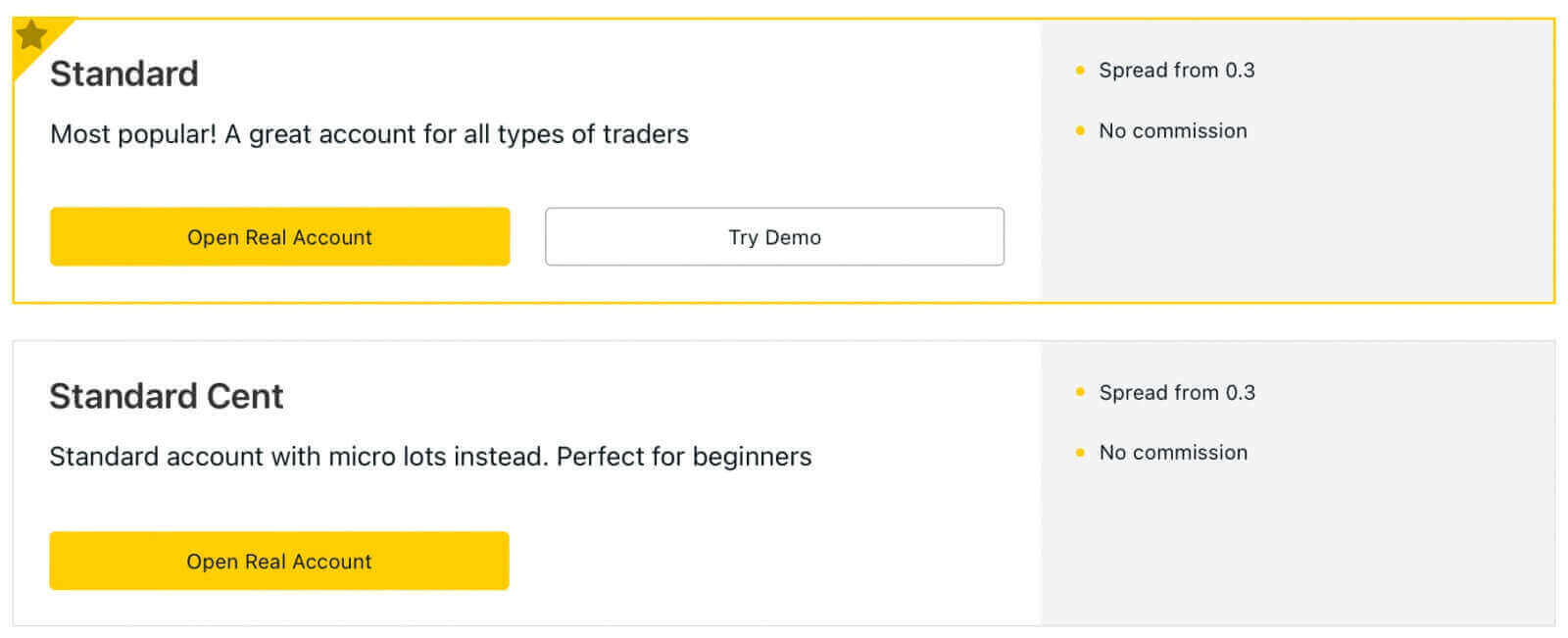

3. Choose from the available trading account types, and whether you prefer a real or demo account.

Exness provides a variety of account types to accommodate different trading styles. These accounts are categorized into two primary types: Standard and Professional. Each account type has different features and specifications, such as minimum deposit, leverage, spreads and commissions.

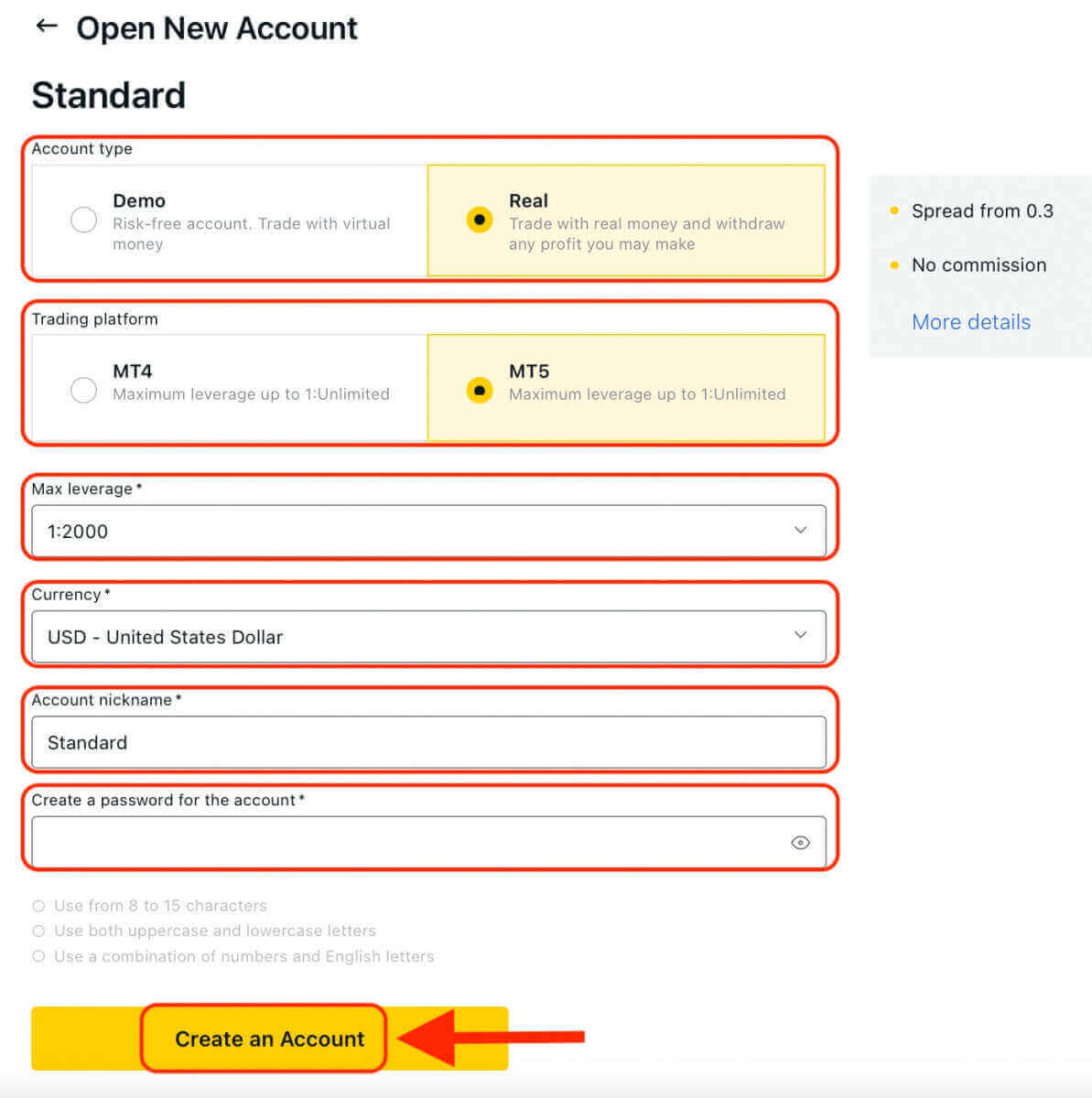

4. On the next screen, you will be presented with several settings:

- Choose between a Real or Demo account, as well as select between MT4 and MT5 trading platform.

- Set your Maximum Leverage.

- You can choose the currency for your account (note that this cannot be changed once set).

- Create a nickname for this trading account.

- Set a trading account password.

- Once you have reviewed and are satisfied with your settings, you can click the "Create an Account" button.

5. Congratulations, you’ve opened a new trading account. Your new trading account will show up in the ‘My Accounts’ tab.

Exness Account Types

Exness offers a range of account types to suit different trading needs. These account types can be broadly classified into two categories: Standard and Professional. You can compare the account types and choose the one that suits your trading style and preferences.Standard Accounts

- Standard

- Standard Cent

- Pro

- Zero

- Raw Spread

Note: Trading accounts created by clients registered with our Kenyan entity have fewer account currency options, with a maximum available leverage of 1:400, and trading on cryptocurrencies is unavailable.

Standard Accounts

Feature-rich, commission-free accounts are a great fit for all traders, including beginners as it is the simplest and most accessible account offered. Highlights include market execution, stable spreads and no requotes.

Please note: Demo Accounts are not available for the Standard Cent account type.

Includes the Standard Account and Standard Cent Account.

| Standard | Standard Cent | |

|---|---|---|

| Minimum deposit | Depends on the payment system | Depends on the payment system |

| Leverage |

MT4: 1:Unlimited (subject to conditions) MT5: 1:Unlimited |

MT4: 1:Unlimited (subject to conditions) |

| Commission | None | None |

| Spread | From 0.3 pips | From 0.3 pips |

| Maximum number of accounts per PA: |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 10 |

| Minimum and maximum volume per order* |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) |

Min: 0.01 cent lots (1K cents) Max: 200 cent lots 24 hours a day |

| Maximum volume of concurrent orders |

MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 024 MT5 Real: Unlimited |

Pending orders: 50 Market orders: 1 000 This amount combines both pending and market orders open concurrently. |

|

Maximum volume of a position |

Day time: 200 lots Night time: 20 lots |

Day time: 200 cent lots Night time: 200 cent lots |

| Margin call | 60% | 60% |

| Stop out | 0%** | 0% |

| Order execution | Market Execution | Market Execution |

*The maximum lot size specified is only to be observed while opening positions. Clients can choose any lot size while closing positions.

**Stop out level for Standard accounts is changed to 100% during the daily break hours of stock trading.

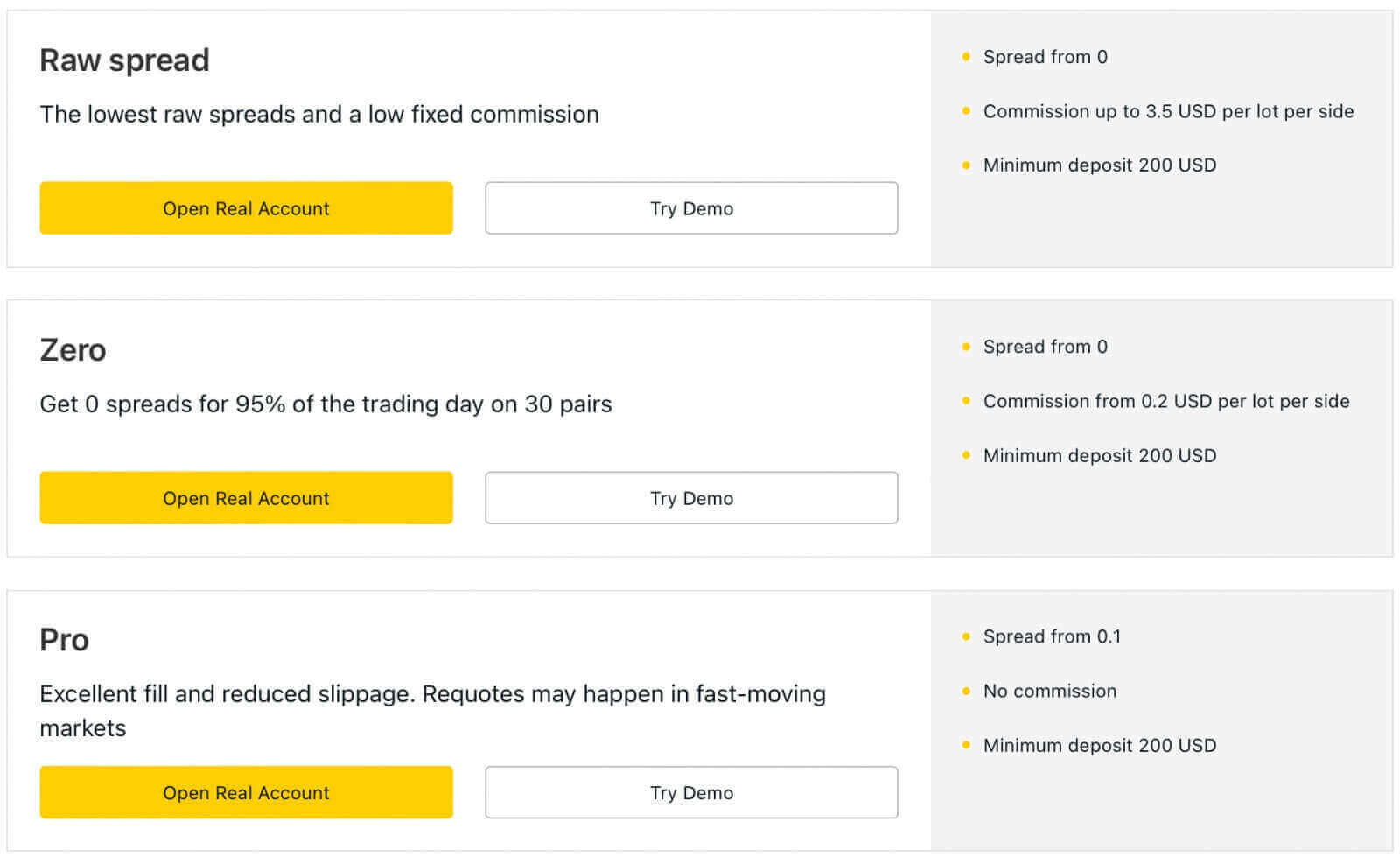

Professional Accounts

Accounts that meet the needs of the most experienced traders as it offers unique features such as instant order executions. Highlights: super low spreads or even spread-free, execution to suit scalpers, day-traders and algotraders.

Note: The minimum initial deposit for Professional accounts is only required for the first deposit; you may deposit any amount more than the minimum requirements of your chosen payment system from then on.

Includes the Pro Account, Zero Account, and Raw Spread Account.

| Pro | Zero | Raw Spread | |

|---|---|---|---|

| Minimum initial deposit* | Starts from USD 200 (depends on your country of residence) | Starts from USD 200 (depends on your country of residence) | Starts from USD 200 (depends on your country of residence) |

| Leverage |

MT4: 1:Unlimited |

MT4: 1:Unlimited |

MT4: 1:Unlimited |

| Commission | None |

From USD 0.2/lot in one direction. Based on the trading instrument |

Up to USD 3.5/lot in one direction. Based on the trading instrument |

| Spread | From 0.1 pips | From 0.0 pips** |

From 0.0 pips Floating (low spread) |

| Maximum number of accounts per PA |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

| Minimum and maximum volume per order |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

| Maximum volume of concurrent orders | MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 024 MT5 Real: Unlimited |

||

|

Maximum volume of a position |

MT4 Demo: 1000 MT4 Real: 1000 |

MT4 Demo: 1000 MT4 Real: 1000 |

MT4 Demo: 1000 MT4 Real: 1000 |

| Margin call | 30% | 30% | 30% |

| Stop out | 0%*** | 0%*** | 0%*** |

| Order execution |

Instant****: Forex, Metals, Indices, Energies, Stocks Market: Cryptocurrency |

Market Execution | Market Execution |

The minimum deposit requirements vary by country of residence and must be met in a single deposit.

For example, if the minimum deposit for a Pro account in your country is USD 200, you need to make a deposit of USD 200 or more in a single transaction to start using the trading account. After this initial deposit, you can deposit any amount without further requirements.

The maximum lot size specified is only applied while opening orders, and any lot size is available while closing orders.

*The minimum initial deposit for Professional accounts is only required for the first deposit; you may deposit any amount more than the minimum requirements of your chosen payment system from then on.

**Zero spread for top 30 instruments 95% of the day but can also be zero spread for other trading instruments 50% of the day depending on market volatility, with floating spread during key periods such as economic news and rollovers.

***Stop out level for Pro, Zero, and Raw Spread accounts is changed to 100% during the daily break hours of stock trading.

****Requotes for these instruments on a Pro account may occur. Requotes occur when there is a price change while a trader is trying to execute an order using instant execution.

Why Traders are Choosing Exness for Their Trading Needs

I will explain why you should open an account on Exness and what benefits you can enjoy as a trader.

- Regulated Broker: Exness is a regulated broker that operates under the supervision of reputable financial authorities, including the Seychelles Financial Services Authority (FSA), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA), FSCA, CBCS, FSC, CMA. This ensures that the broker operates in a fair and transparent manner, providing a level of protection for traders’ funds. Exness segregates client funds from its own funds and provides negative balance protection to its clients.

- Range of Account Types: Exness offers a variety of account types to suit different trading styles and needs. Whether you are a beginner or an experienced trader, there is an account type that can cater to your trading preferences.

- Range of trading instruments: Exness offers a wide range of trading instruments, including forex, metals, cryptocurrencies, indices, stocks, energies and more.

- Various platforms: You can trade on various platforms, such as MetaTrader 4, MetaTrader 5, WebTerminal and mobile apps.

- Low Spreads: Exness is known for offering some of the tightest spreads in the industry. This can help traders reduce their trading costs and potentially increase their profitability.

- High Leverage: Exness provides high leverage on its accounts, which can enable traders to open larger positions with a smaller amount of capital. However, it’s important to note that leverage can also increase the risk of losses and should be used with caution.

- Trading Tools and Resources: Exness offers a range of advanced trading tools, resources, and features, including analytical tools, economic calendars, educational materials, and more, which can help traders make more informed trading decisions.

- Multiple Payment Options: Exness offers multiple payment options for deposits and withdrawals, including credit/debit cards, bank transfers, and e-wallets, and local payment systems, making it easy for traders to manage their funds.

- No commission on deposits and withdrawals: Traders can enjoy the convenience of depositing and withdrawing funds without incurring any additional fees, ultimately optimizing their trading experience.

- Multilingual Customer Support: Exness offers multilingual customer support, which can be especially helpful for traders who are not fluent in English. You can contact the support team 24/7 via live chat, phone or email in various languages.

How to Verify Exness Account

What is Account Verification?

Account verification is the process of confirming your identity and address with Exness by providing some documents. This is required by the regulatory authorities that oversee Exness’s operations, such as the Financial Services Authority (FSA) of Seychelles and the Cyprus Securities and Exchange Commission (CySEC).

Benefits of Verifying Your Exness Account for a Hassle-Free Trading Experience

Verifying your account has several advantages, such as:

- Enhancing your security: By verifying your account, you can protect yourself from identity theft and fraud, as well as comply with the anti-money laundering (AML) and know your customer (KYC) policies of Exness.

- Higher withdrawal limits: Verified accounts have higher withdrawal limits, making it easier to manage larger transactions.

- Accessing more payment methods: Some payment methods, such as bank transfers and e-wallets, are only available for verified accounts.

- Full access to trading features: Verified accounts enjoy complete access to Exness’ trading features, including deposits and withdrawals funds, participate in promotions, and utilize advanced trading tools.

- Faster transactions: Verified accounts can enjoy faster transaction processing times, allowing for quicker deposits and withdrawals.

- Improving your customer service: Verified accounts can enjoy faster and more efficient support from the Exness team.

How to Verify your Exness account: Step-by-Step Guide

When you register your Exness account, you have to complete an Economic Profile and submit Proof of Identity (POI) and Proof of Residence (POR) documents. We need to verify these documents to ensure that all operations on your Exness account are performed by you, the genuine account holder.Verifying your identity and address is a crucial step that Exness takes to maintain the security of your account and financial transactions. This process is just one of the many measures implemented by Exness to ensure the highest levels of security.

Let us take you through the steps:

1. Verify Email and your Phone Number

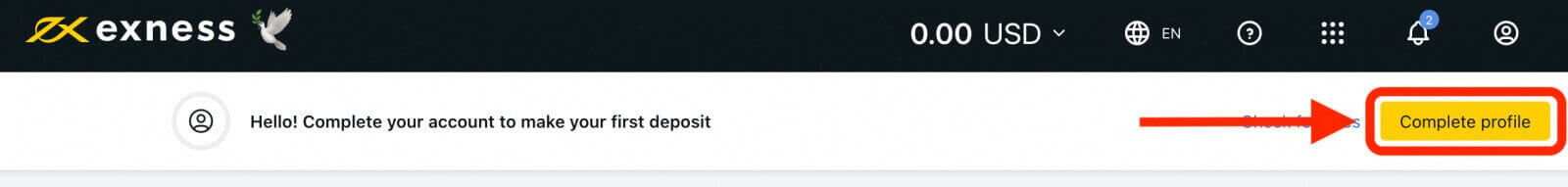

1. Log in to your Personal Area on the Exness website or app.2. Click on the yellow "Complete profile" button located at the top right corner of the page.

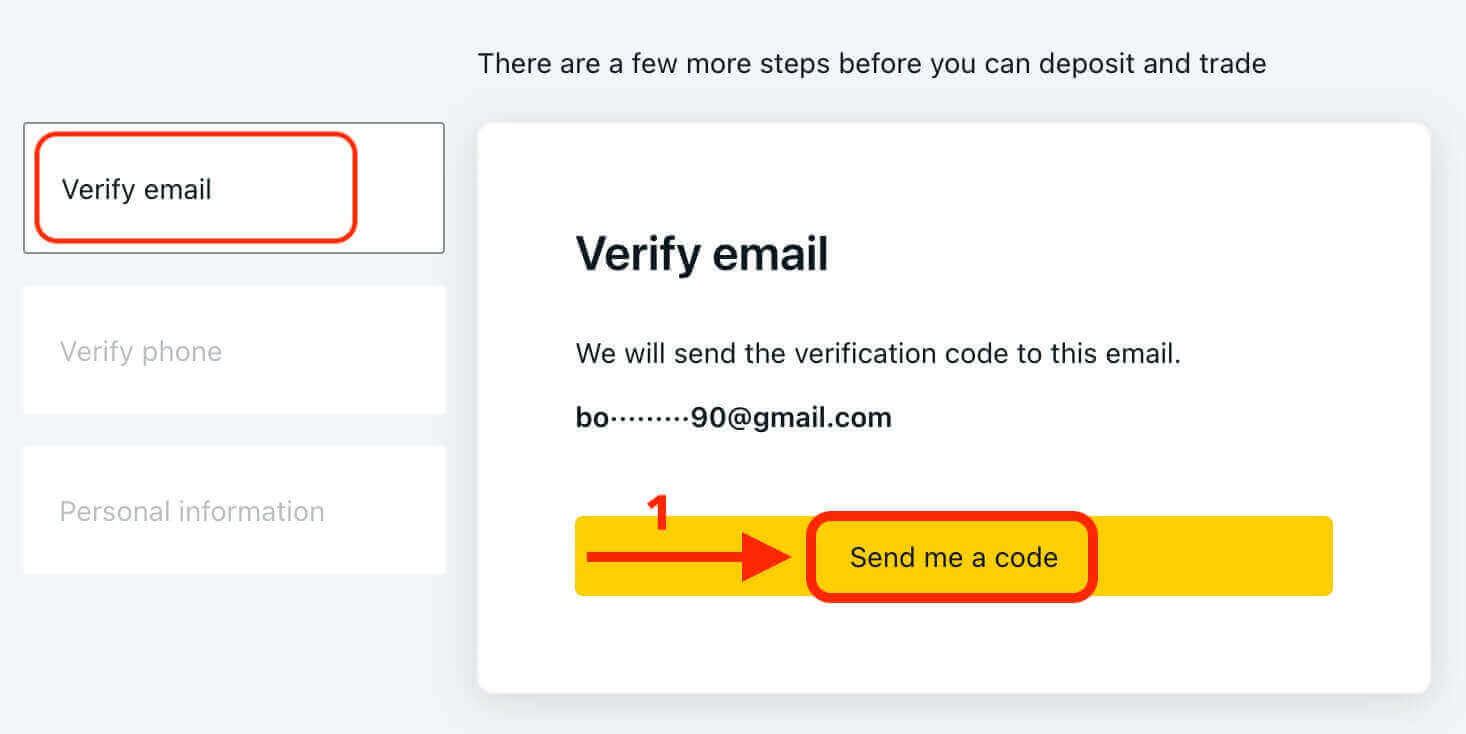

3. Verify email.

- Click on the "Send me a code" button.

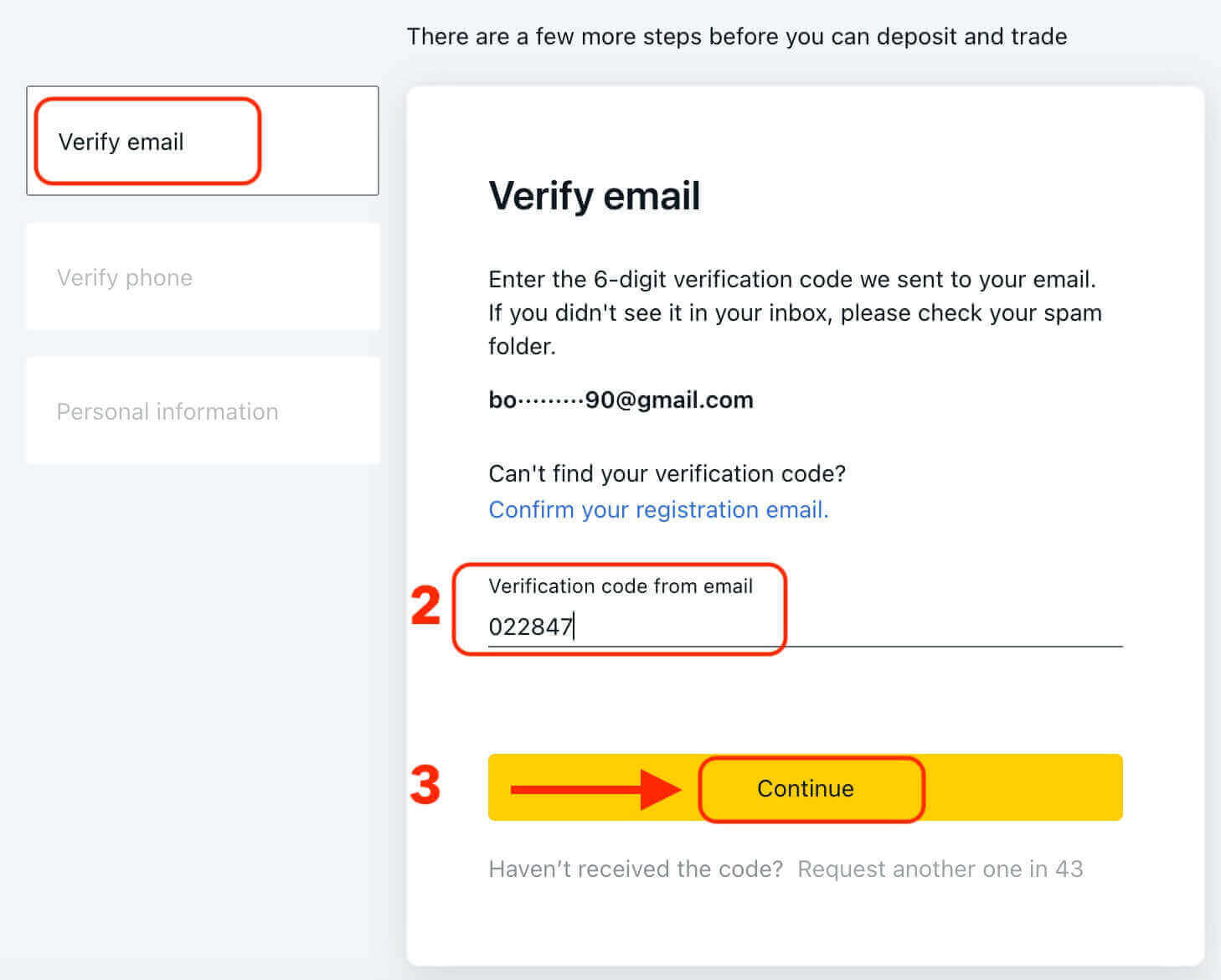

- Enter the verification code that was sent to your email.

- Hit Continue.

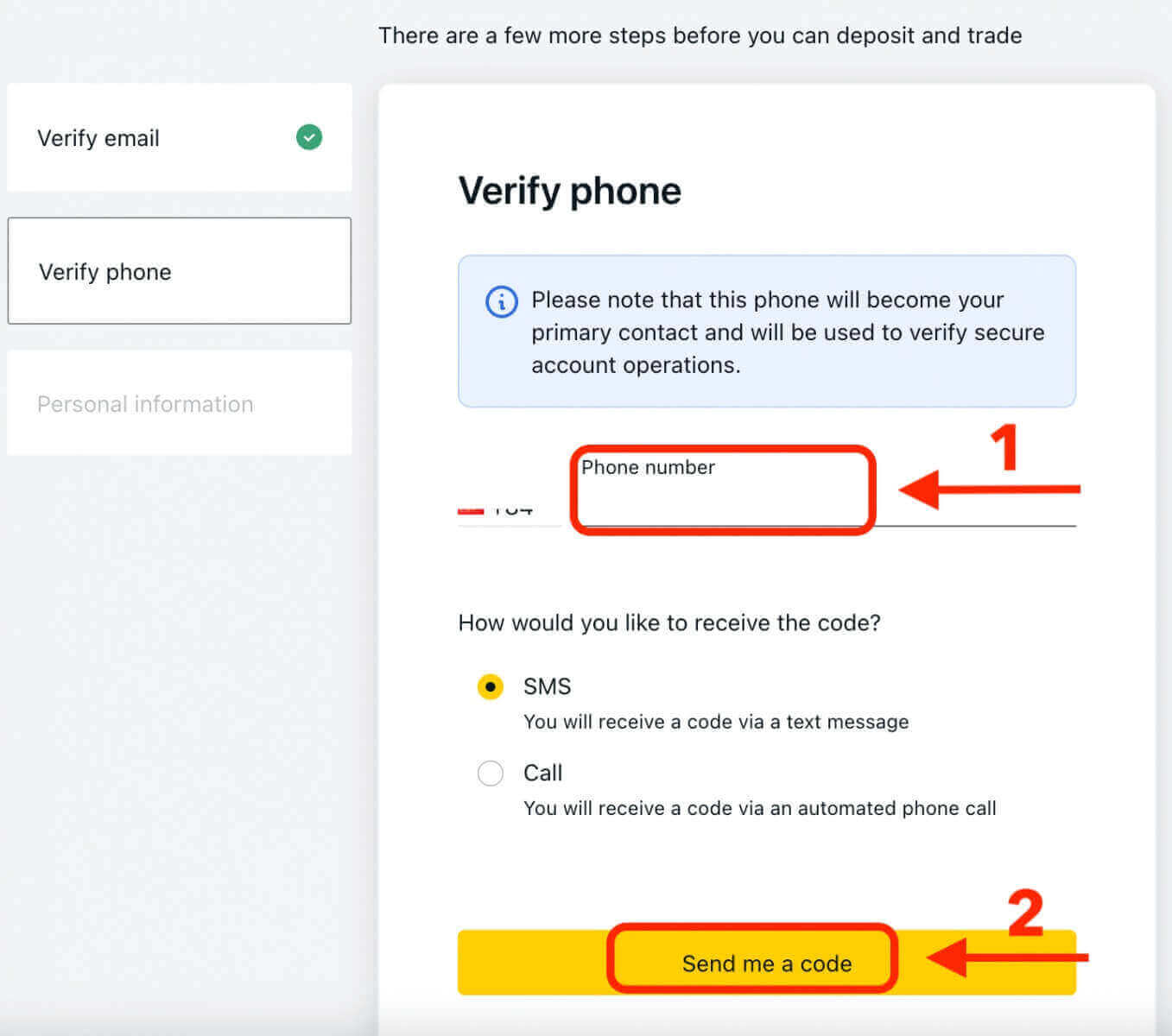

4. Verify Phone Number

- Enter your phone number and then click on the "Send me a code" button.

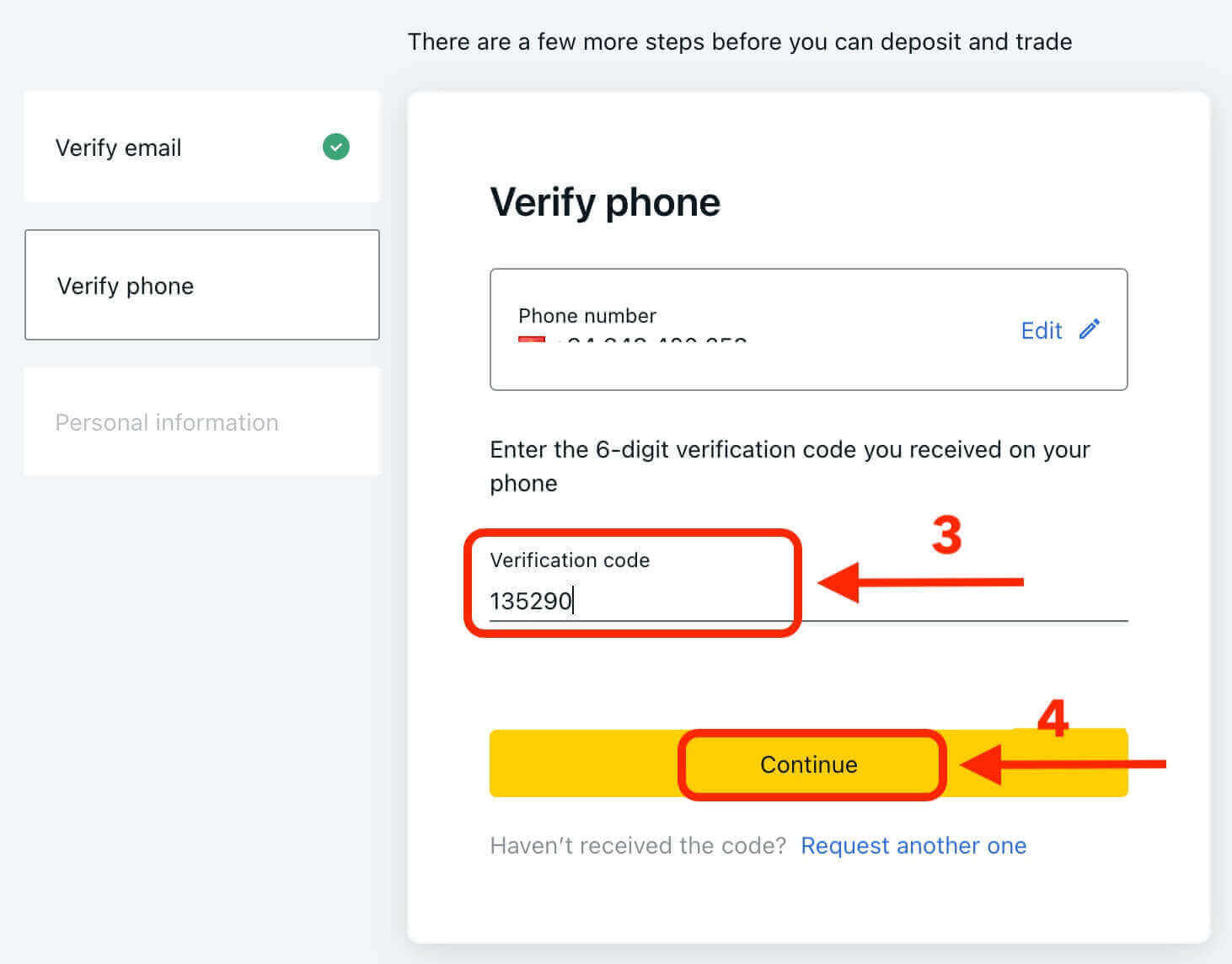

- Enter the verification code that was sent to your phone.

- Hit Continue.

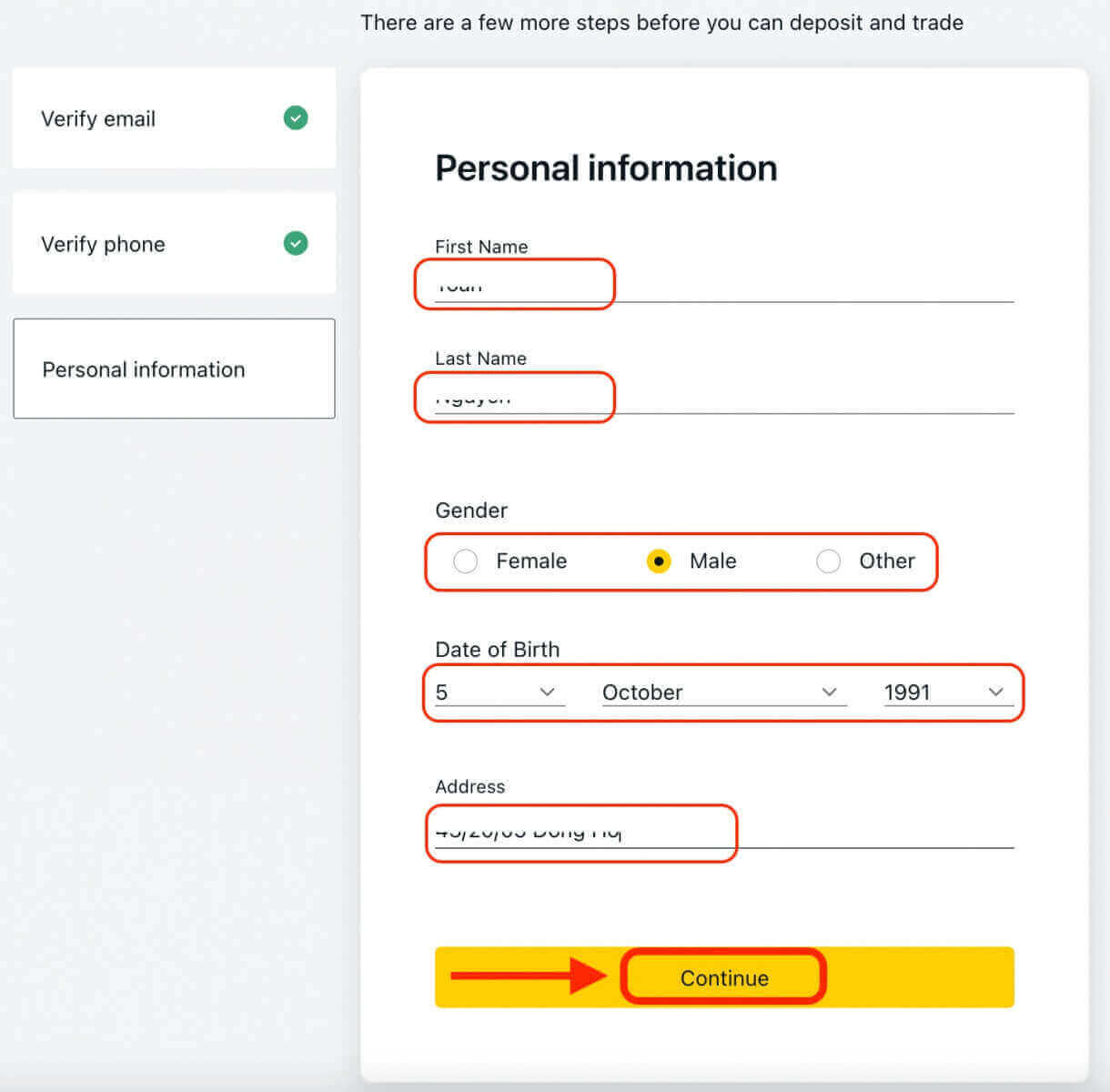

2. Fill in personal information

Fill in your details like name, gender, date of birth, and address. Then, click the "Continue" button.

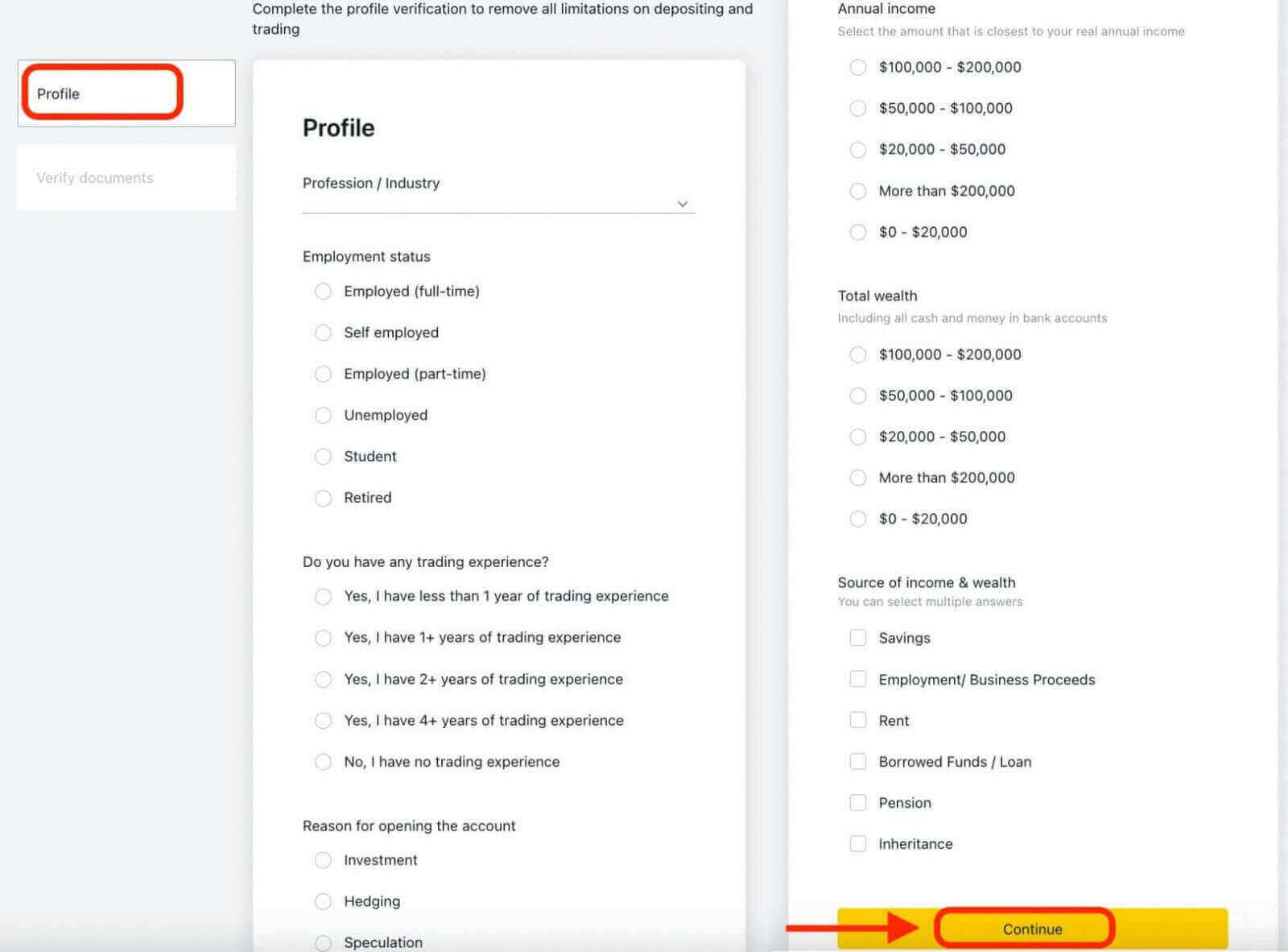

3. Complete the Economic Profile

After verifying your personal information, the next step in the verification process is to complete your economic profile. This involves answering some fundamental questions about your source of income, industry or profession, and trading experience. Once you have filled in all the necessary details, click "Continue" to proceed with the verification process.

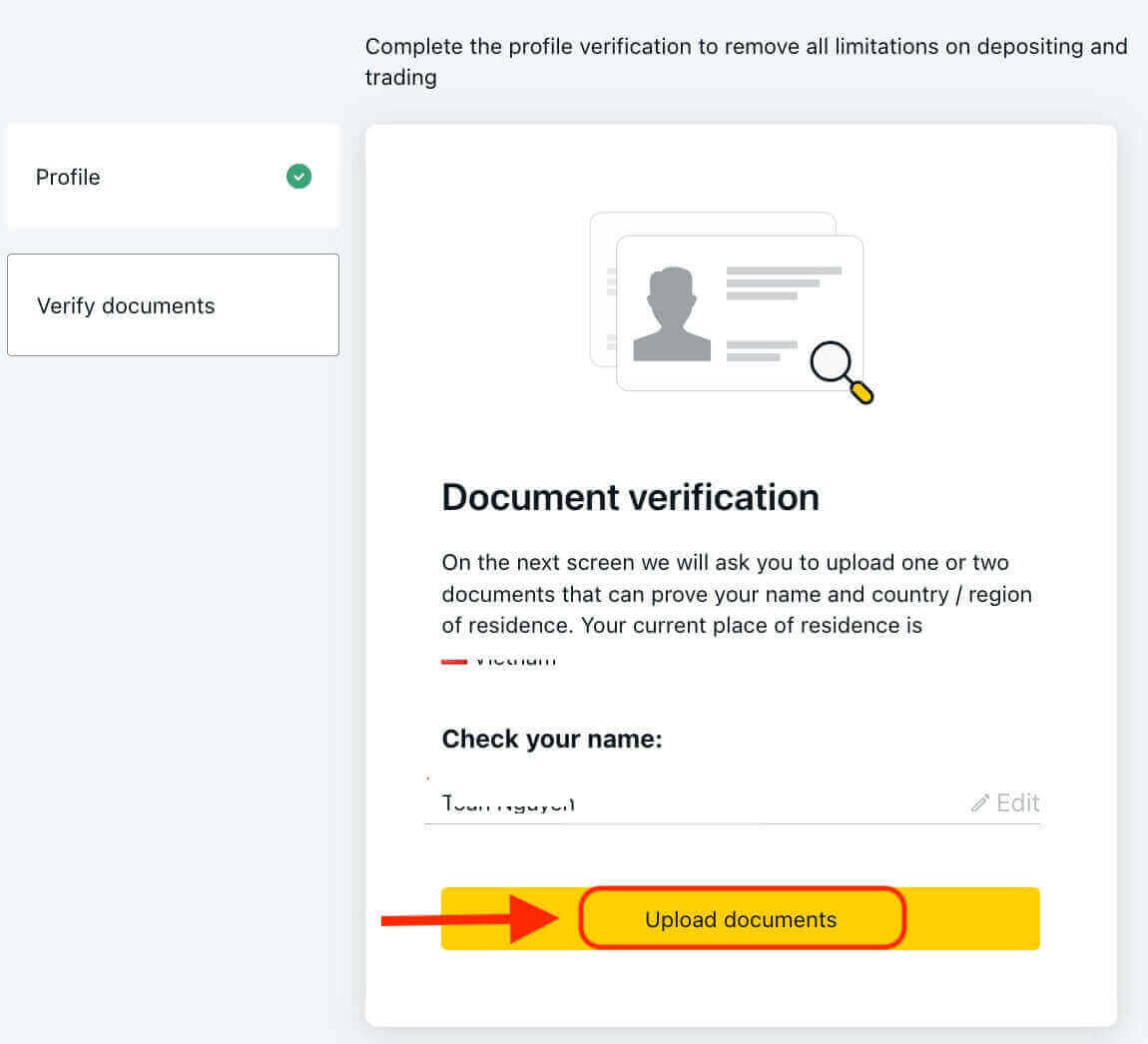

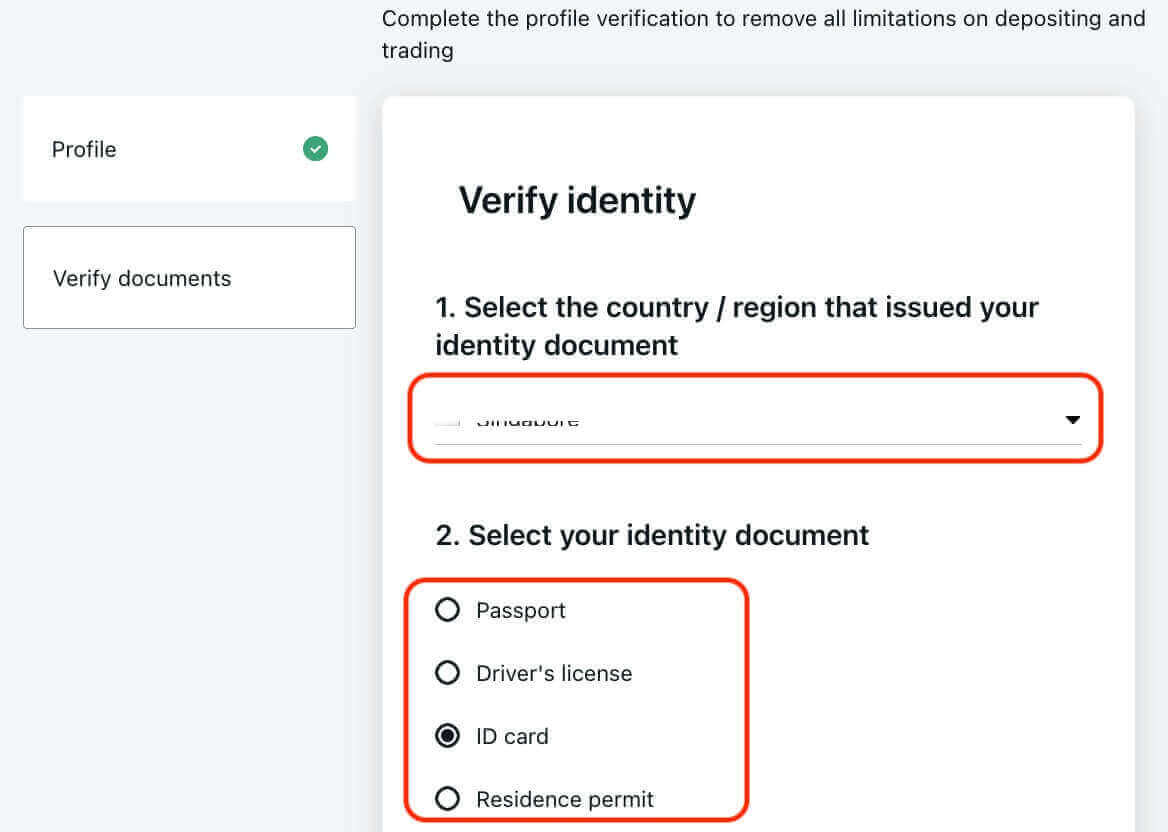

4. Verify your Identity

Identity verification is an essential measure that we take to prevent identity theft and fraudulent activities.To verify your identity:

1. Select the country of issue of your Proof of Identity (POI) document and then select the document.

2. Make sure the document meets the below requirements:

- It is clear and readable.

- All four corners are visible.

- Any photographs and signatures are clearly visible.

- It is a government-issued document.

- Accepted formats: JPEG, BMP, PNG, or PDF.

- Each document size should not exceed 64 MB.

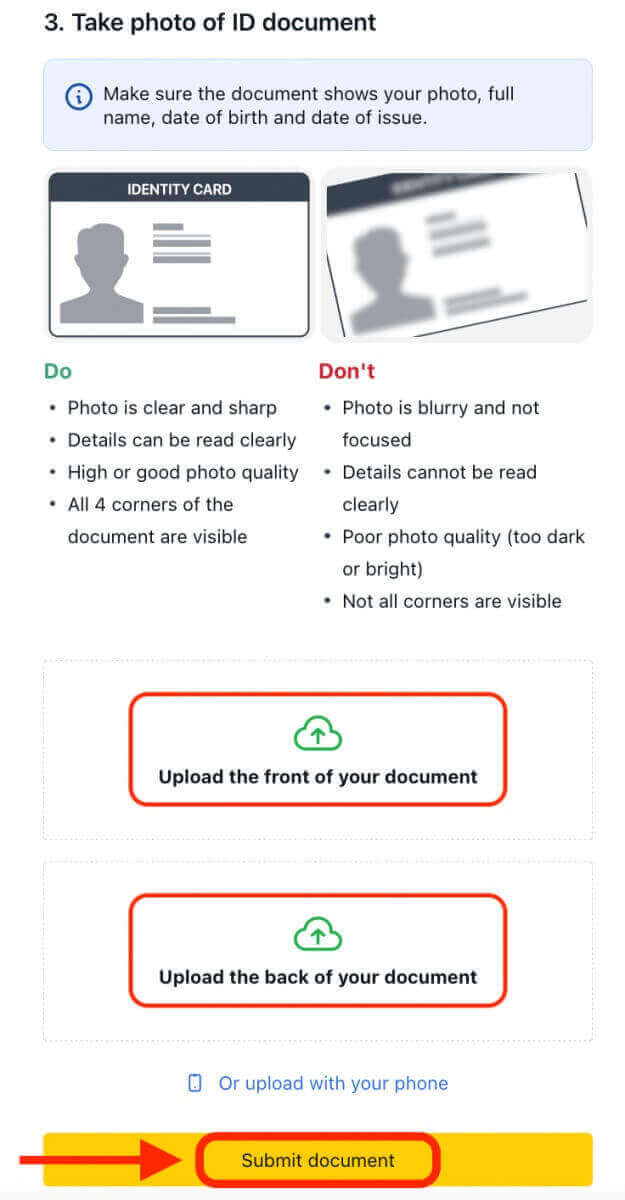

3. Upload the document and click the yellow "Submit document" button.

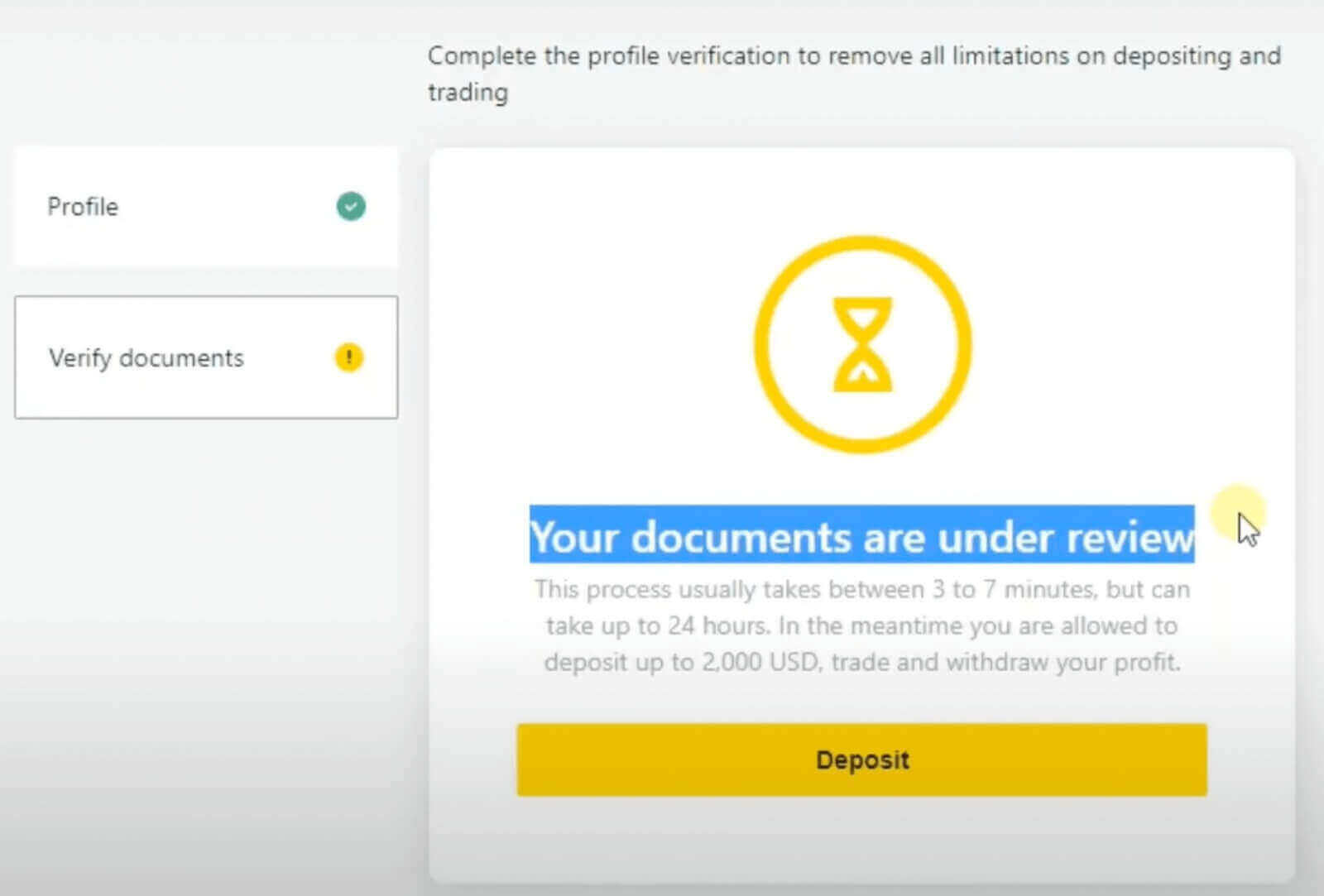

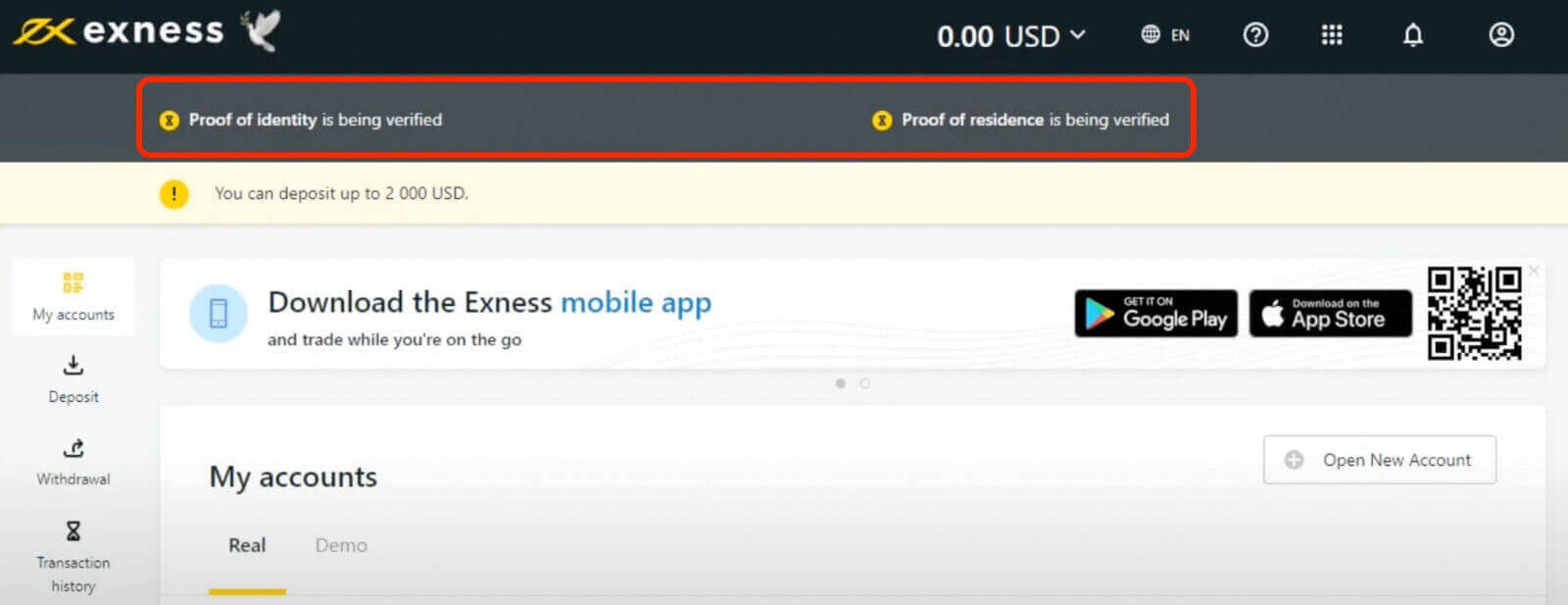

After submitting your document, it will be reviewed and your account status will be updated automatically. You will receive an email confirmation once your Proof of Identity document is successfully verified. At this point, you may proceed with verifying your residence or choose to do so at a later time.

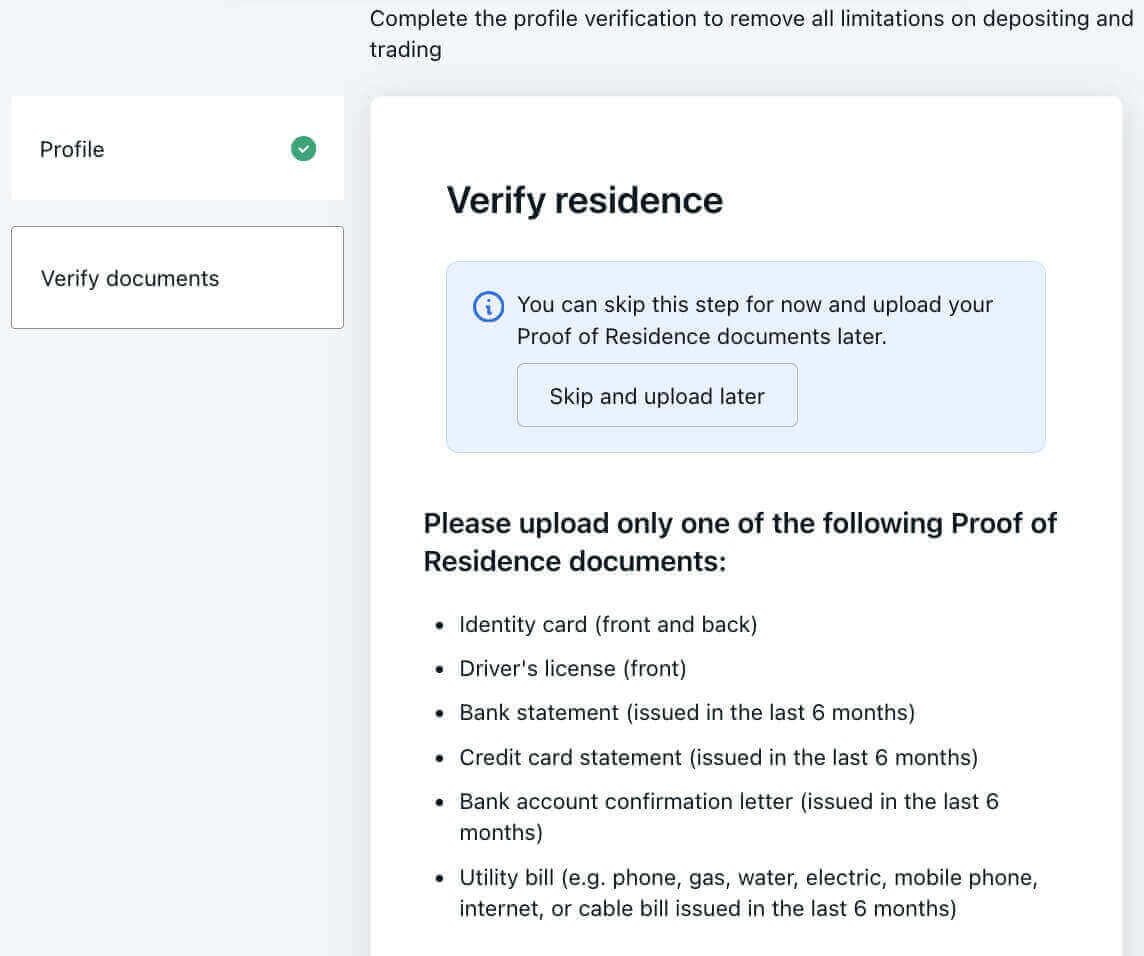

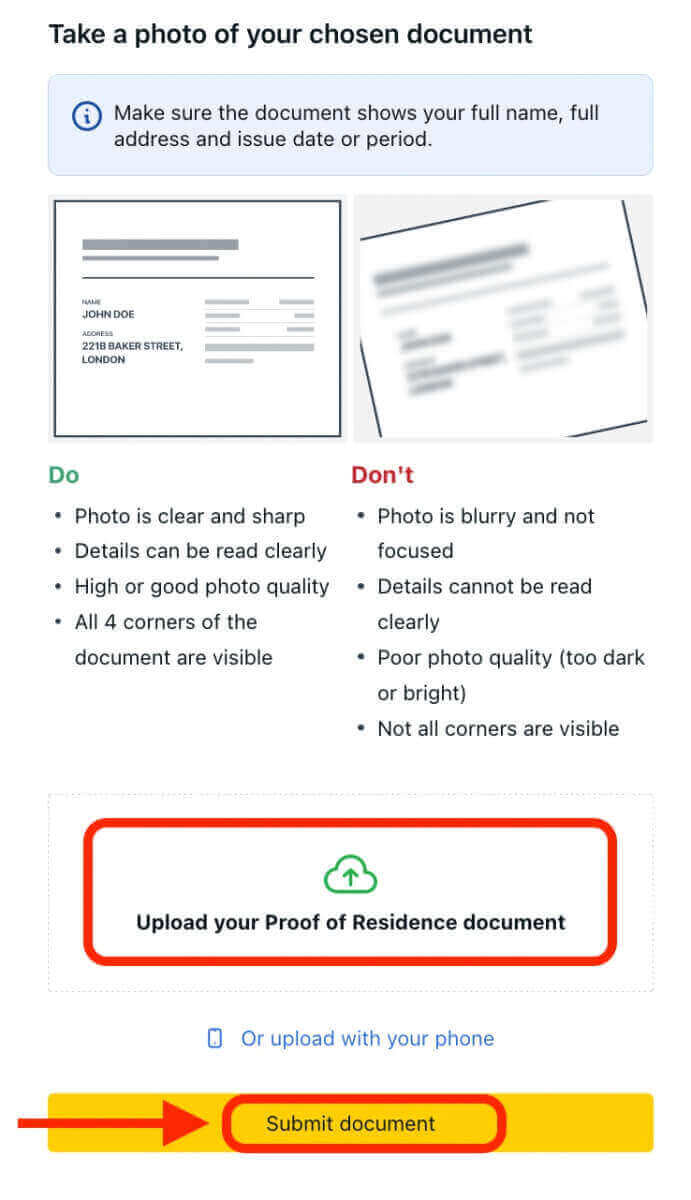

5. Verify your Residence

Once your Proof of Identity (POI) is uploaded, you can proceed to upload your Proof of Residence (POR).For your Proof of Residence (POR), you will need to provide a different document than the one submitted for your Proof of Identity (POI). For instance, if you used your Identification Card for POI, you may use your utility bill (electricity, water, gas, Internet bill) to verify your Proof of Residence (POR).

Your document will be reviewed and your account status will be automatically updated.

How long does it take to Verify an Account on Exness?

You should receive feedback on your submitted Proof of Identity (POI) or Proof of Residence (POR) documents within minutes, but it may take up to 24 hours per submission if the documents require advanced verification (a manual check).Note that you can submit your POI and POR documents at the same time. If you prefer, you can skip uploading your POR and do it later.

Account limitations when Exness account is not verified

The verification process requires providing Exness with information about yourself, including:- Proof of Identity

- Proof of Residence

- An Economic Profile (in the form of a survey)

Limitations:

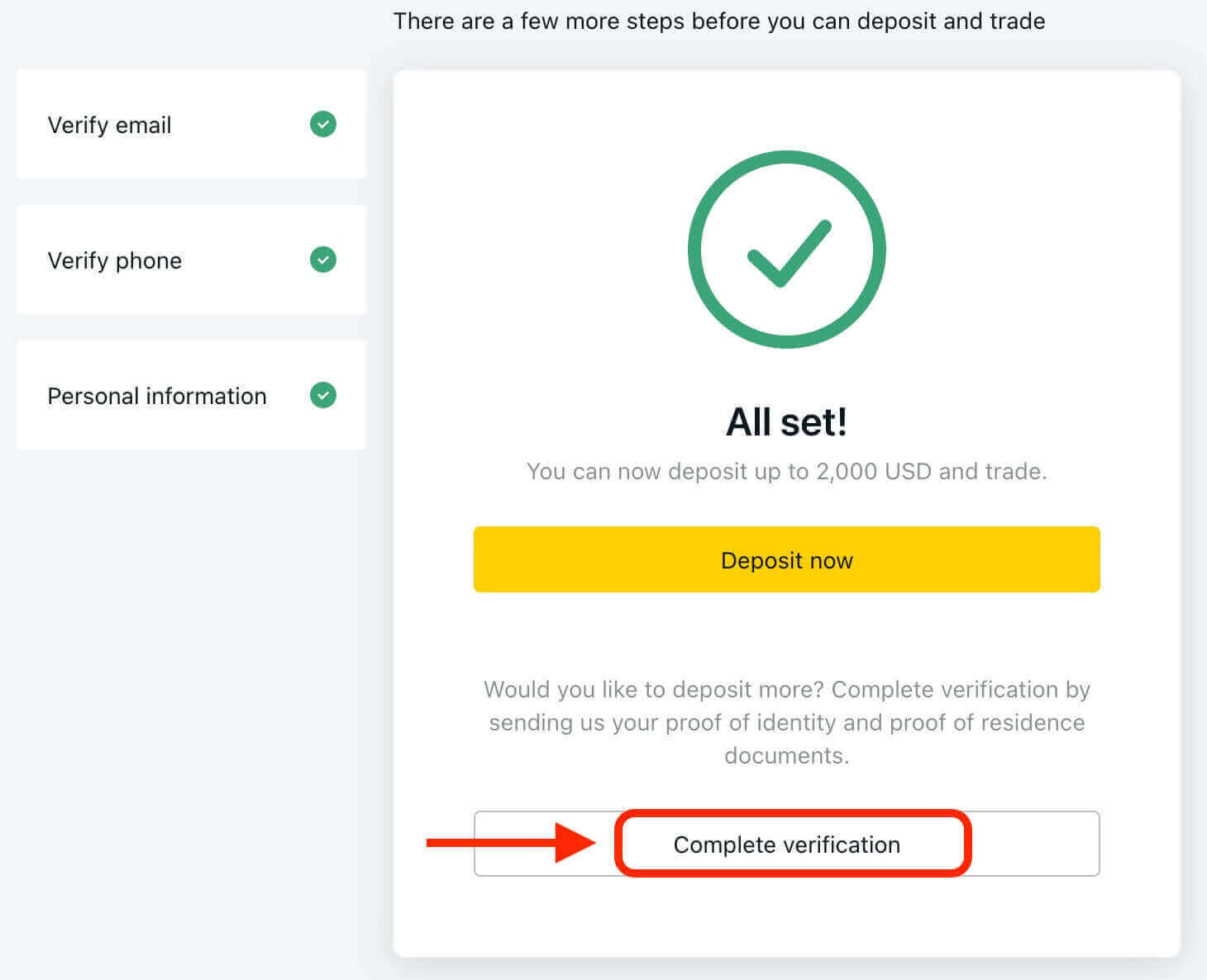

With only a registered email address and/or phone number and personal information form completed:

- Trading accounts have a maximum deposit total of USD 2 000.

- Trading accounts have a maximum deposit total of USD 50 000.

In all cases, you have a 30-day limit within which to fully verify your account, or all deposits, transfers, and trading functions are deactivated until the verification process is completed

A Personal Area only needs to be fully verified once, so it’s highly recommended to do so.