How to Register and Trade Forex at Exness

This guide aims to demystify the process of registering on Exness and delving into Forex trading. Whether you're a newcomer or an experienced trader, understanding the steps to create an account and initiate Forex trades is crucial to harnessing the potential of the global currency market.

How to Register an Exness Account

How to Register an Account on Exness

Register an Account on Exness

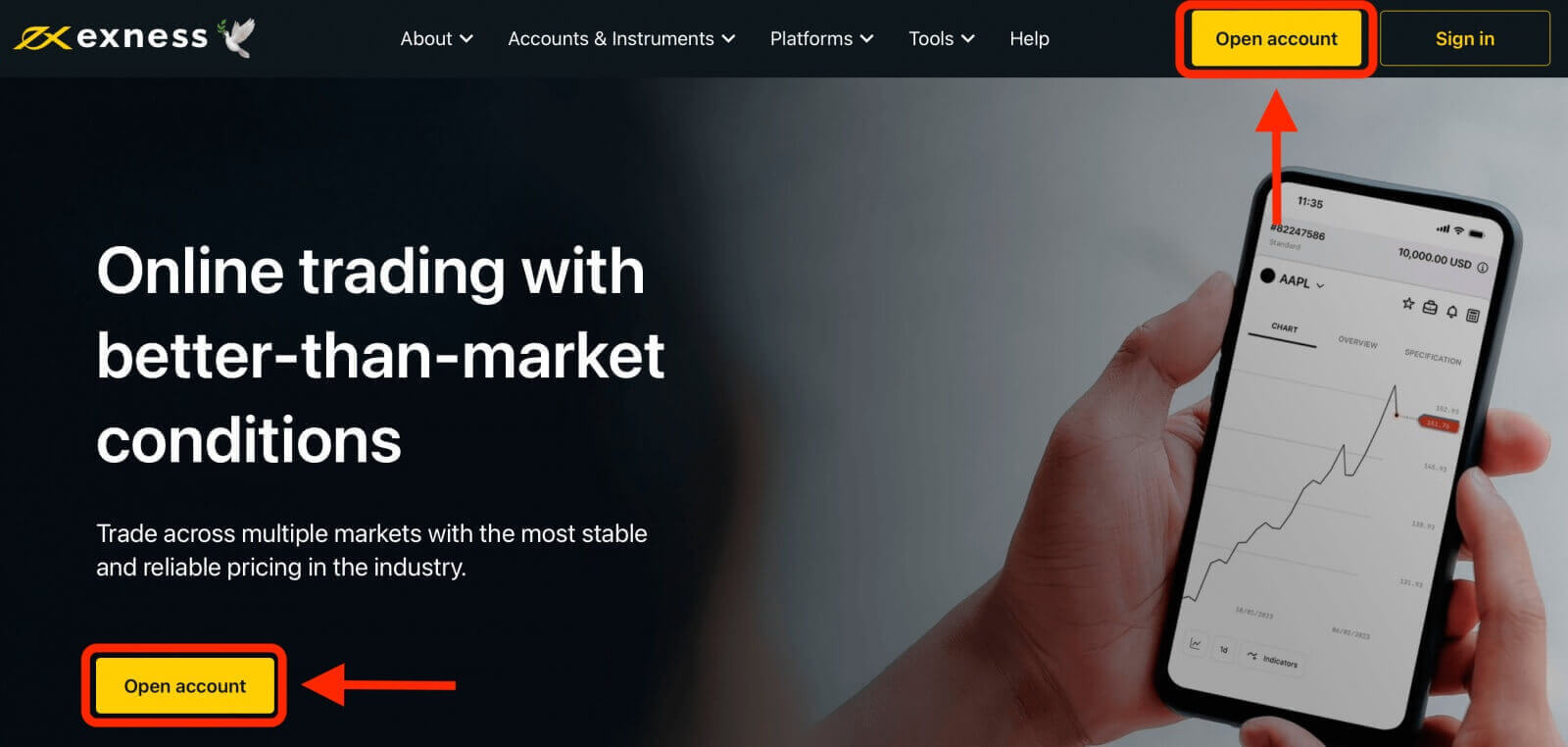

Step 1: Visit the Exness websiteTo start the registration process, you will need to visit the Exness website. On the homepage, click on the "Open account" button at the top right corner of the page.

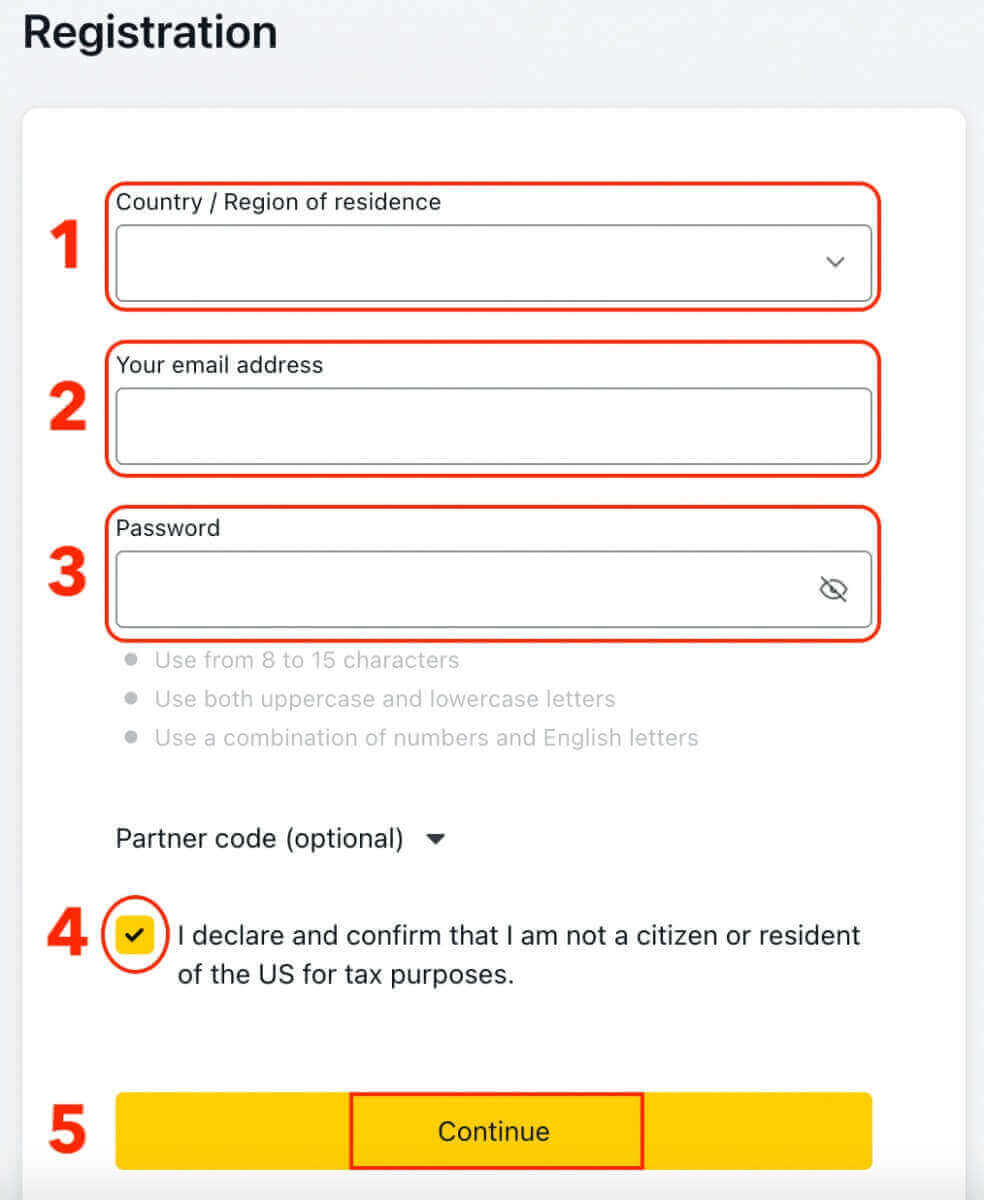

Step 2: Fill in your personal details

After clicking on the Open account button, you will be directed to a registration form where you will need to provide your personal information:

- Select your country of residence.

- Enter your email address.

- Create a password for your Exness account following the guidelines shown.

- Tick the box declaring you are not a citizen or resident of the US.

- Click Continue once you have provided all the required information. Make sure you enter valid and accurate information, as you will need to verify your identity later.

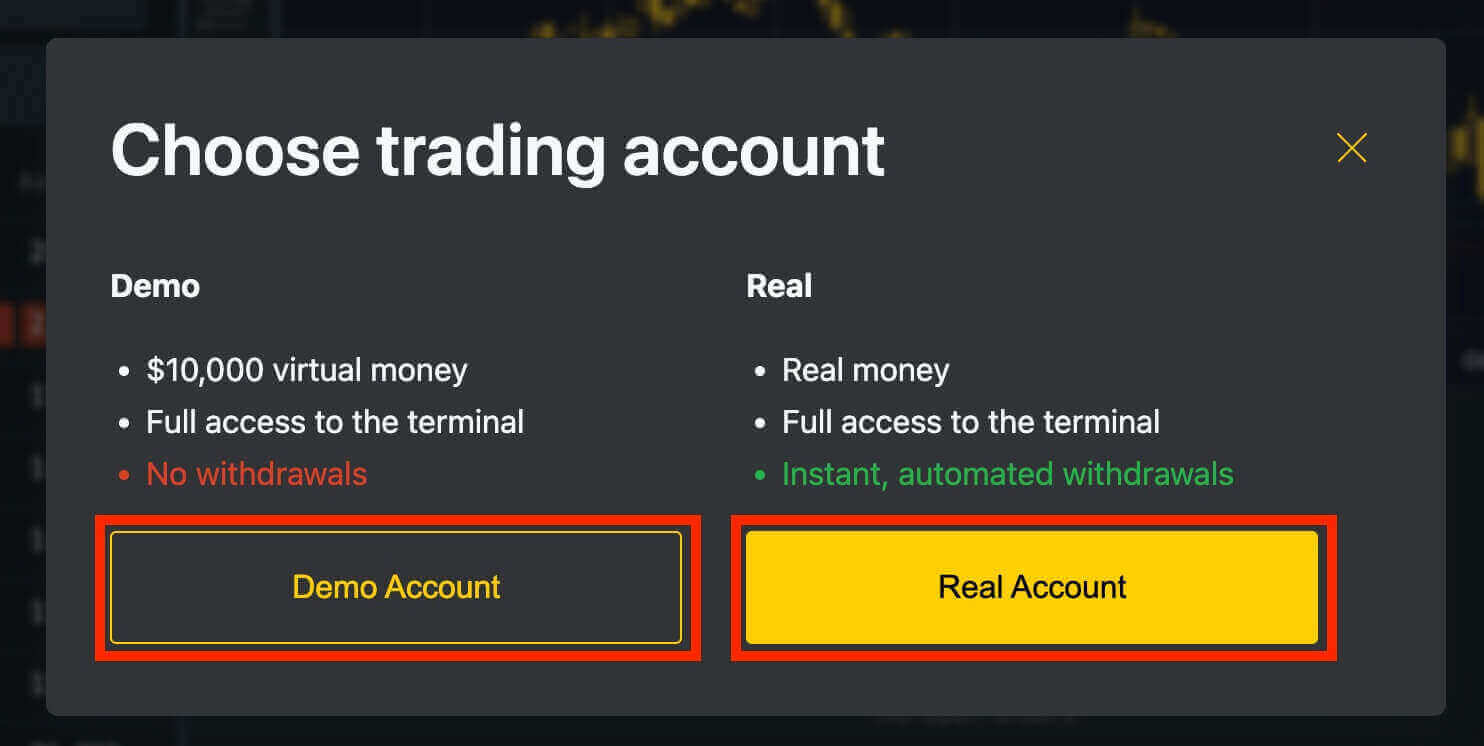

Step 3: Choose your account type

Choose the type of account you want to open. Exness offers various account types, including demo accounts and real trading accounts with different features and trading conditions. Choose the account type that suits your trading needs and experience level.

A demo account is a practice account that allows you to trade in a simulated environment using virtual funds ($10,000). Exness offers a demo account to its users to help them practice trading and get familiar with the platform’s features without risking real money. They are an excellent tool for beginners and experienced traders alike and can help you improve your trading skills before moving on to trading with real money.

Once you’re ready to start trading with real funds, you can switch to a real account and deposit your money.

Once you have registered, it is advised that you fully verify your Exness account to gain access to every feature available only to fully verified Personal Areas.

Once your account is verified, you can fund it using various payment methods, such as bank transfer, credit card, e-wallet or cryptocurrency.

Open a Trading Account on Exness

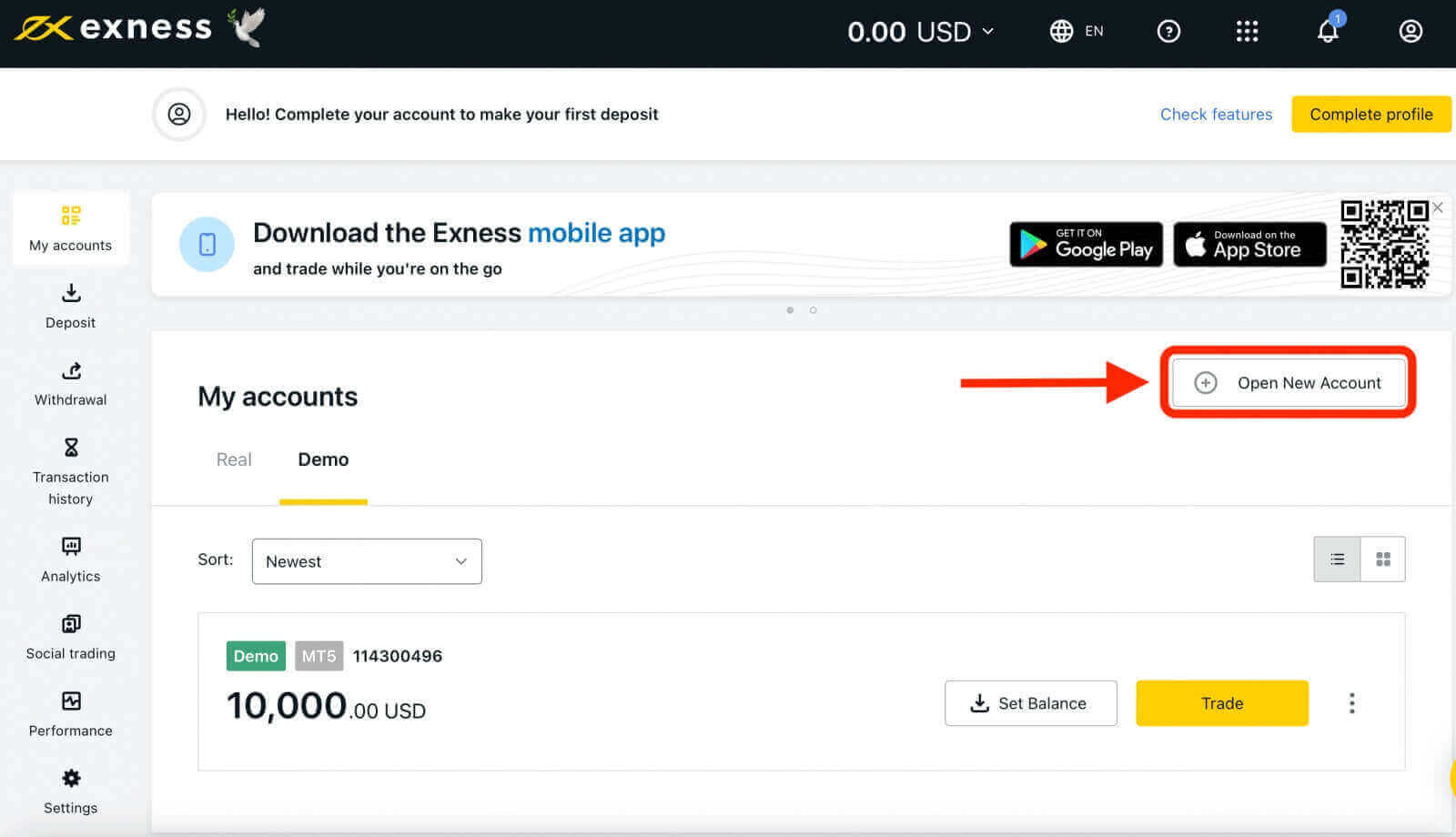

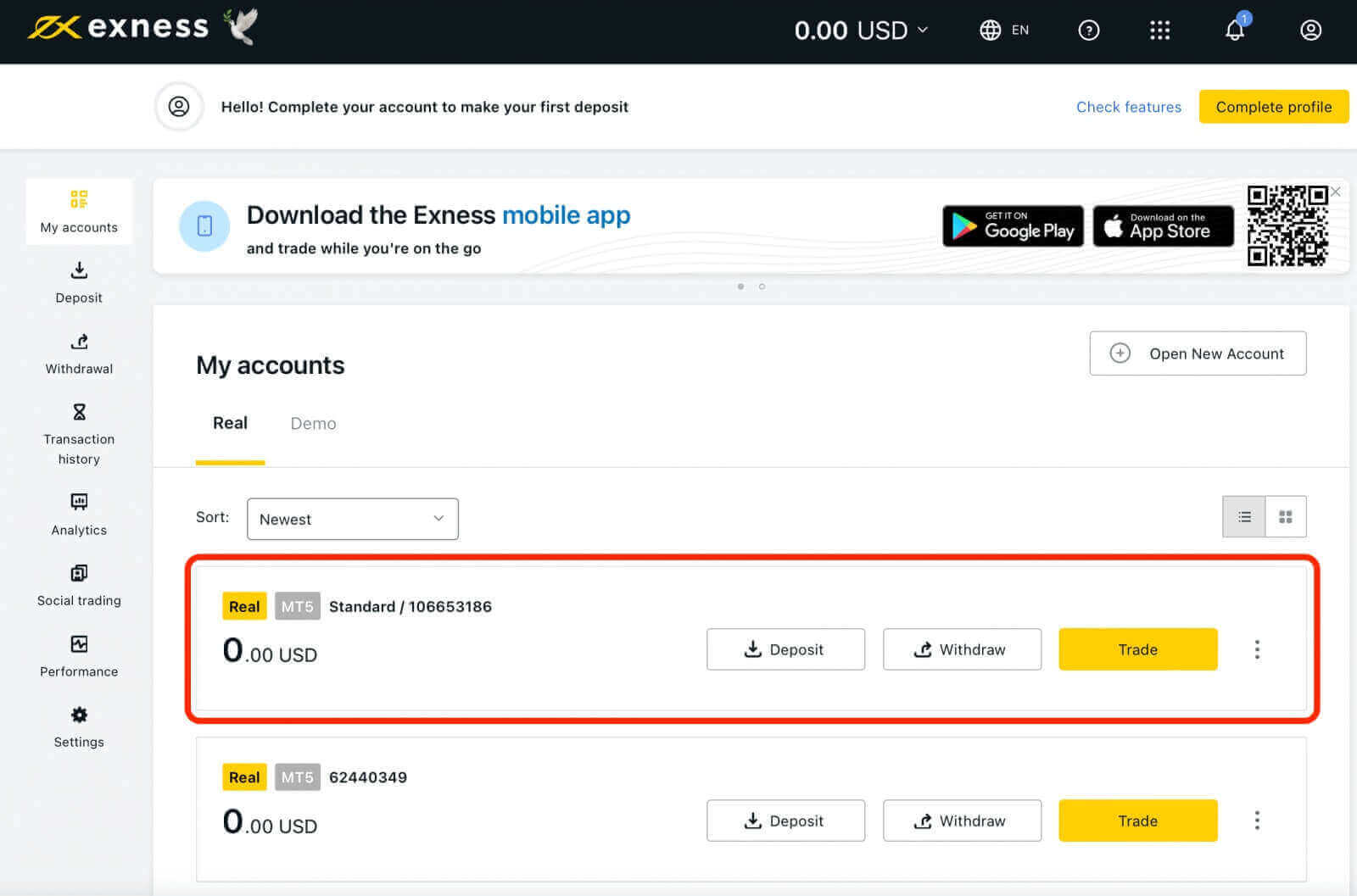

When you create a new Personal Area on Exness, a real trading account and a demo trading account (both for MT5) are automatically created, but you also have the option to create additional trading accounts if needed1. Go to Personal Area to open more trading accounts.

2. From your new Personal Area, click the "Open New Account" button in the ‘My Accounts’ area.

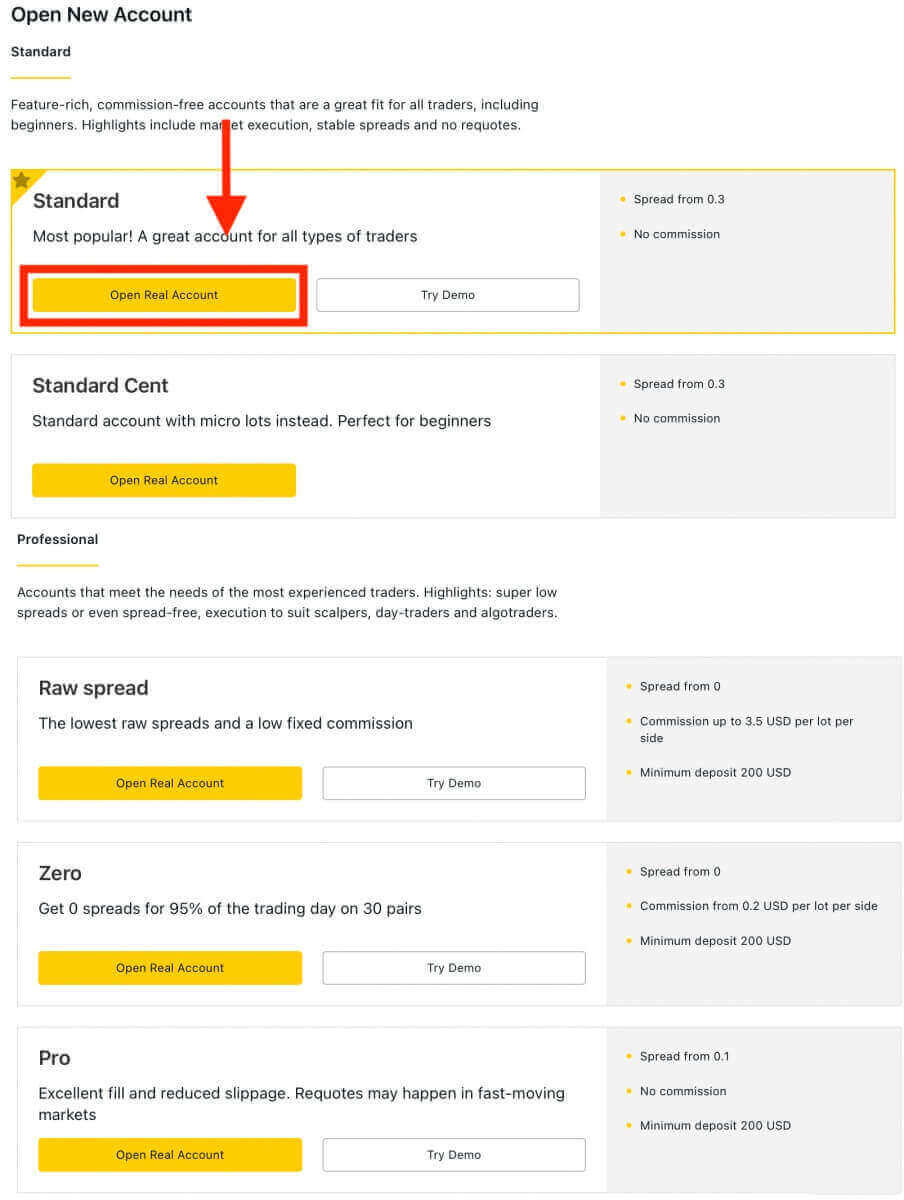

3. Choose from the available trading account types, and whether you prefer a real or demo account.

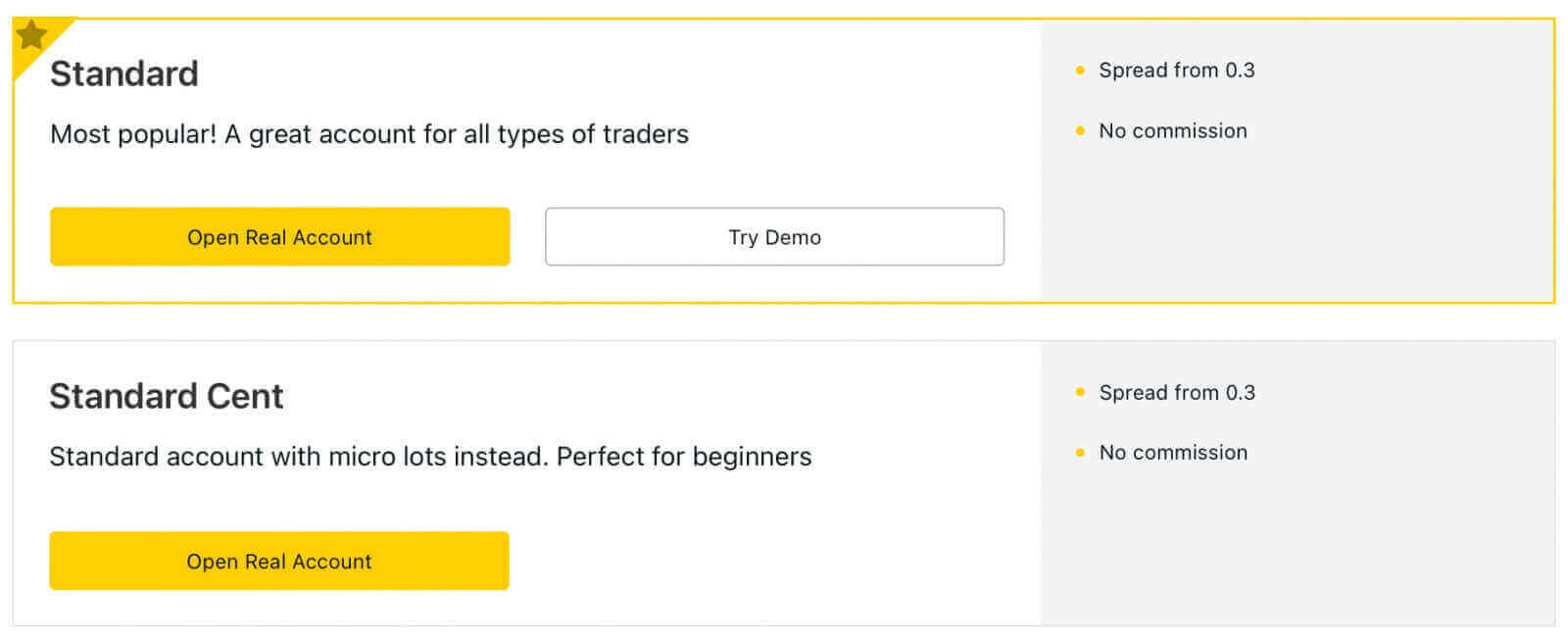

Exness provides a variety of account types to accommodate different trading styles. These accounts are categorized into two primary types: Standard and Professional. Each account type has different features and specifications, such as minimum deposit, leverage, spreads and commissions.

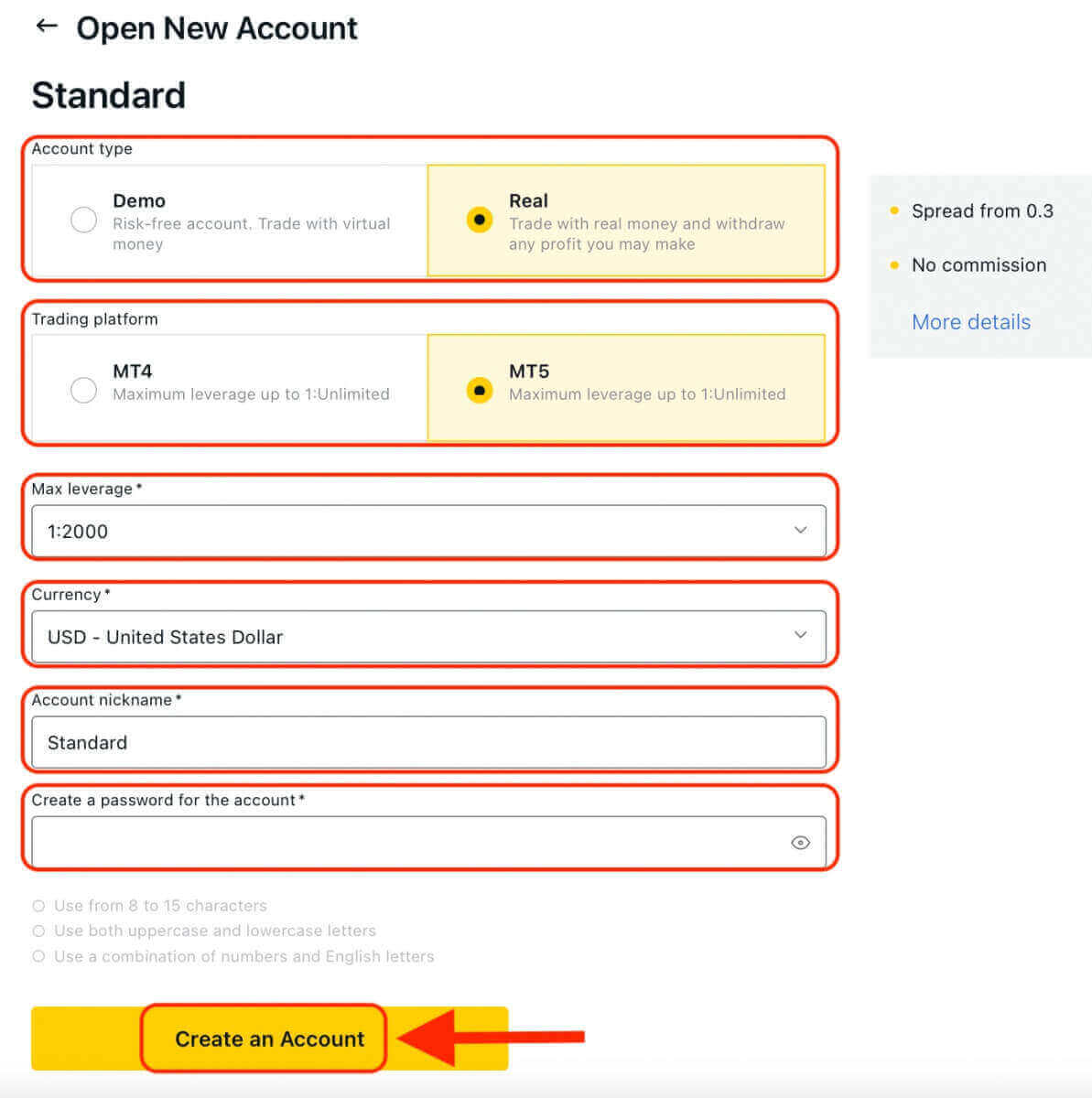

4. On the next screen, you will be presented with several settings:

- Choose between a Real or Demo account, as well as select between MT4 and MT5 trading platform.

- Set your Maximum Leverage.

- You can choose the currency for your account (note that this cannot be changed once set).

- Create a nickname for this trading account.

- Set a trading account password.

- Once you have reviewed and are satisfied with your settings, you can click the "Create an Account" button.

5. Congratulations, you’ve opened a new trading account. Your new trading account will show up in the ‘My Accounts’ tab.

Exness Account Types

Exness offers a range of account types to suit different trading needs. These account types can be broadly classified into two categories: Standard and Professional. You can compare the account types and choose the one that suits your trading style and preferences.Standard Accounts

- Standard

- Standard Cent

- Pro

- Zero

- Raw Spread

Note: Trading accounts created by clients registered with our Kenyan entity have fewer account currency options, with a maximum available leverage of 1:400, and trading on cryptocurrencies is unavailable.

Standard Accounts

Feature-rich, commission-free accounts are a great fit for all traders, including beginners as it is the simplest and most accessible account offered. Highlights include market execution, stable spreads and no requotes.

Please note: Demo Accounts are not available for the Standard Cent account type.

Includes the Standard Account and Standard Cent Account.

| Standard | Standard Cent | |

|---|---|---|

| Minimum deposit | Depends on the payment system | Depends on the payment system |

| Leverage |

MT4: 1:Unlimited (subject to conditions) MT5: 1:Unlimited |

MT4: 1:Unlimited (subject to conditions) |

| Commission | None | None |

| Spread | From 0.3 pips | From 0.3 pips |

| Maximum number of accounts per PA: |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 10 |

| Minimum and maximum volume per order* |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) |

Min: 0.01 cent lots (1K cents) Max: 200 cent lots 24 hours a day |

| Maximum volume of concurrent orders |

MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 024 MT5 Real: Unlimited |

Pending orders: 50 Market orders: 1 000 This amount combines both pending and market orders open concurrently. |

|

Maximum volume of a position |

Day time: 200 lots Night time: 20 lots |

Day time: 200 cent lots Night time: 200 cent lots |

| Margin call | 60% | 60% |

| Stop out | 0%** | 0% |

| Order execution | Market Execution | Market Execution |

*The maximum lot size specified is only to be observed while opening positions. Clients can choose any lot size while closing positions.

**Stop out level for Standard accounts is changed to 100% during the daily break hours of stock trading.

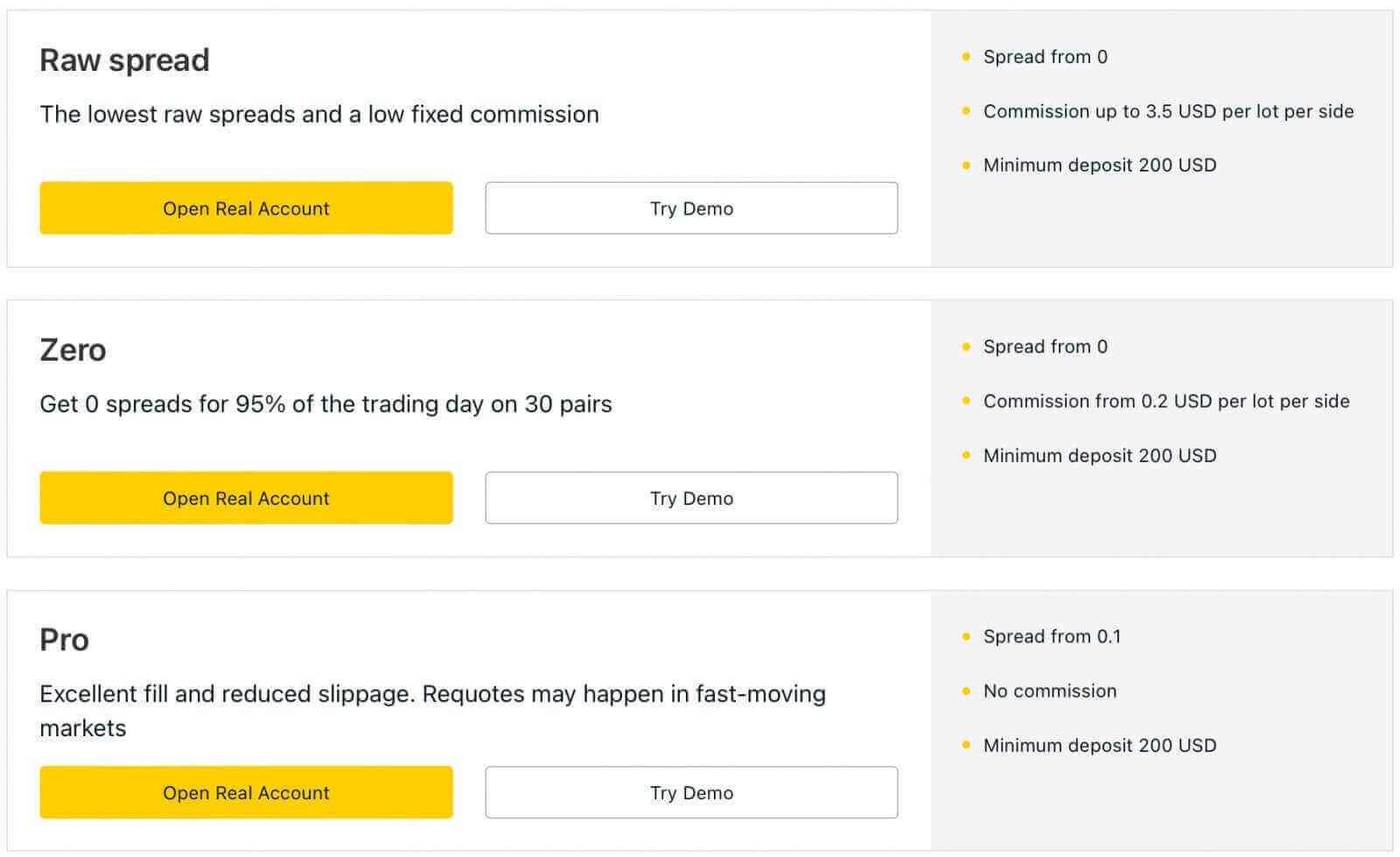

Professional Accounts

Accounts that meet the needs of the most experienced traders as it offers unique features such as instant order executions. Highlights: super low spreads or even spread-free, execution to suit scalpers, day-traders and algotraders.

Note: The minimum initial deposit for Professional accounts is only required for the first deposit; you may deposit any amount more than the minimum requirements of your chosen payment system from then on.

Includes the Pro Account, Zero Account, and Raw Spread Account.

| Pro | Zero | Raw Spread | |

|---|---|---|---|

| Minimum initial deposit* | Starts from USD 200 (depends on your country of residence) | Starts from USD 200 (depends on your country of residence) | Starts from USD 200 (depends on your country of residence) |

| Leverage |

MT4: 1:Unlimited |

MT4: 1:Unlimited |

MT4: 1:Unlimited |

| Commission | None |

From USD 0.2/lot in one direction. Based on the trading instrument |

Up to USD 3.5/lot in one direction. Based on the trading instrument |

| Spread | From 0.1 pips | From 0.0 pips** |

From 0.0 pips Floating (low spread) |

| Maximum number of accounts per PA |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

| Minimum and maximum volume per order |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

| Maximum volume of concurrent orders | MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 024 MT5 Real: Unlimited |

||

|

Maximum volume of a position |

MT4 Demo: 1000 MT4 Real: 1000 |

MT4 Demo: 1000 MT4 Real: 1000 |

MT4 Demo: 1000 MT4 Real: 1000 |

| Margin call | 30% | 30% | 30% |

| Stop out | 0%*** | 0%*** | 0%*** |

| Order execution |

Instant****: Forex, Metals, Indices, Energies, Stocks Market: Cryptocurrency |

Market Execution | Market Execution |

The minimum deposit requirements vary by country of residence and must be met in a single deposit.

For example, if the minimum deposit for a Pro account in your country is USD 200, you need to make a deposit of USD 200 or more in a single transaction to start using the trading account. After this initial deposit, you can deposit any amount without further requirements.

The maximum lot size specified is only applied while opening orders, and any lot size is available while closing orders.

*The minimum initial deposit for Professional accounts is only required for the first deposit; you may deposit any amount more than the minimum requirements of your chosen payment system from then on.

**Zero spread for top 30 instruments 95% of the day but can also be zero spread for other trading instruments 50% of the day depending on market volatility, with floating spread during key periods such as economic news and rollovers.

***Stop out level for Pro, Zero, and Raw Spread accounts is changed to 100% during the daily break hours of stock trading.

****Requotes for these instruments on a Pro account may occur. Requotes occur when there is a price change while a trader is trying to execute an order using instant execution.

Why Traders are Choosing Exness for Their Trading Needs

I will explain why you should open an account on Exness and what benefits you can enjoy as a trader.

- Regulated Broker: Exness is a regulated broker that operates under the supervision of reputable financial authorities, including the Seychelles Financial Services Authority (FSA), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA), FSCA, CBCS, FSC, CMA. This ensures that the broker operates in a fair and transparent manner, providing a level of protection for traders’ funds. Exness segregates client funds from its own funds and provides negative balance protection to its clients.

- Range of Account Types: Exness offers a variety of account types to suit different trading styles and needs. Whether you are a beginner or an experienced trader, there is an account type that can cater to your trading preferences.

- Range of trading instruments: Exness offers a wide range of trading instruments, including forex, metals, cryptocurrencies, indices, stocks, energies and more.

- Various platforms: You can trade on various platforms, such as MetaTrader 4, MetaTrader 5, WebTerminal and mobile apps.

- Low Spreads: Exness is known for offering some of the tightest spreads in the industry. This can help traders reduce their trading costs and potentially increase their profitability.

- High Leverage: Exness provides high leverage on its accounts, which can enable traders to open larger positions with a smaller amount of capital. However, it’s important to note that leverage can also increase the risk of losses and should be used with caution.

- Trading Tools and Resources: Exness offers a range of advanced trading tools, resources, and features, including analytical tools, economic calendars, educational materials, and more, which can help traders make more informed trading decisions.

- Multiple Payment Options: Exness offers multiple payment options for deposits and withdrawals, including credit/debit cards, bank transfers, and e-wallets, and local payment systems, making it easy for traders to manage their funds.

- No commission on deposits and withdrawals: Traders can enjoy the convenience of depositing and withdrawing funds without incurring any additional fees, ultimately optimizing their trading experience.

- Multilingual Customer Support: Exness offers multilingual customer support, which can be especially helpful for traders who are not fluent in English. You can contact the support team 24/7 via live chat, phone or email in various languages.

How to Trade on Exness

Executing Buy and Sell Orders on Exness: A Step-by-Step Guide to Successful Trading

How to Open an Order: Buy and Sell on the Exness Website

Now that you have funded your account, you are ready to trade. You can access the Exness trading platform on your web browser or download it on your desktop or mobile device. The platform offers a user-friendly interface, advanced charting tools, market analysis, indicators and more. You can also use the Exness Trader app to trade on the go.In this article, I will guide you through the easiest way to start trading without downloading anything.

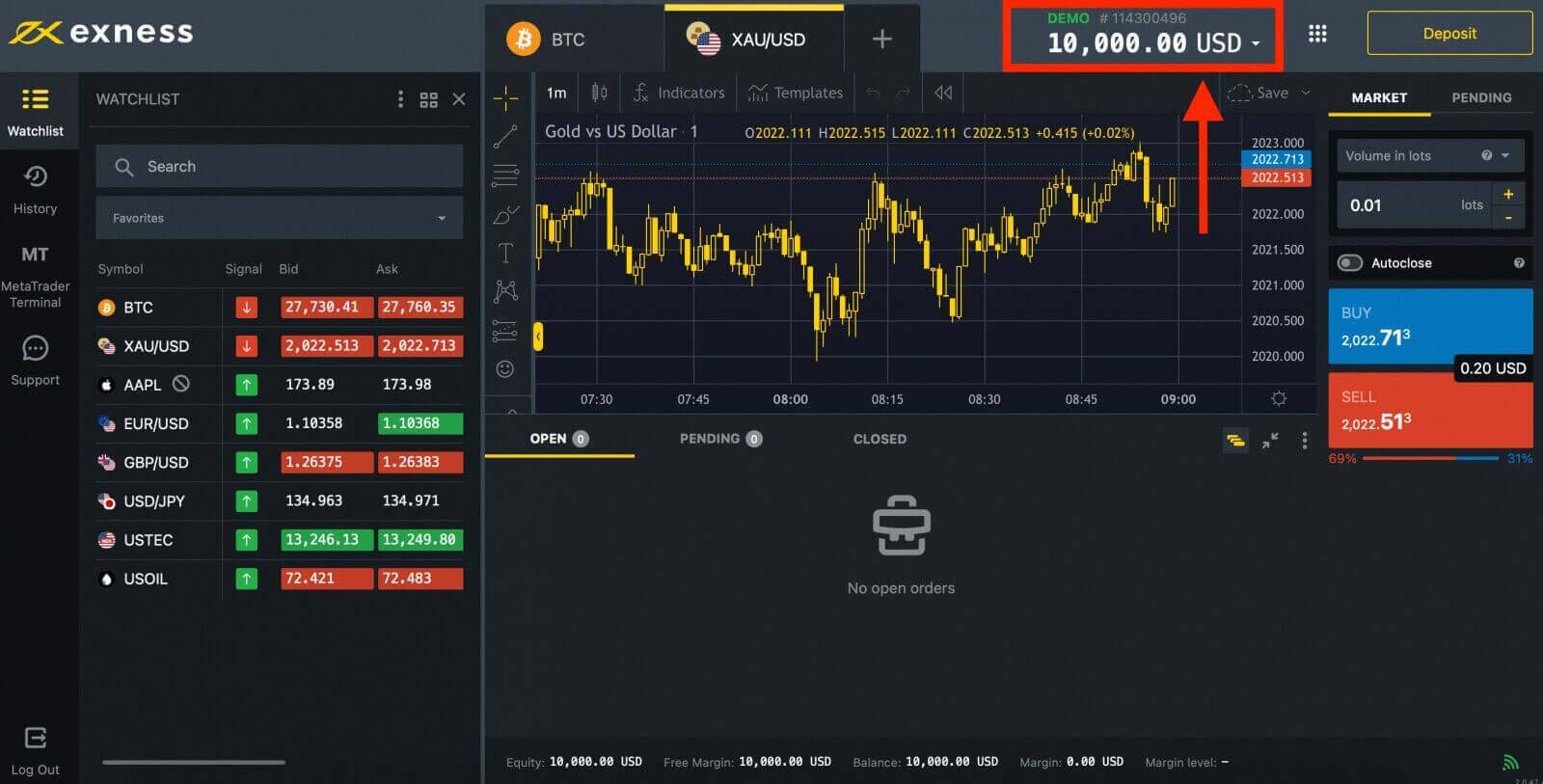

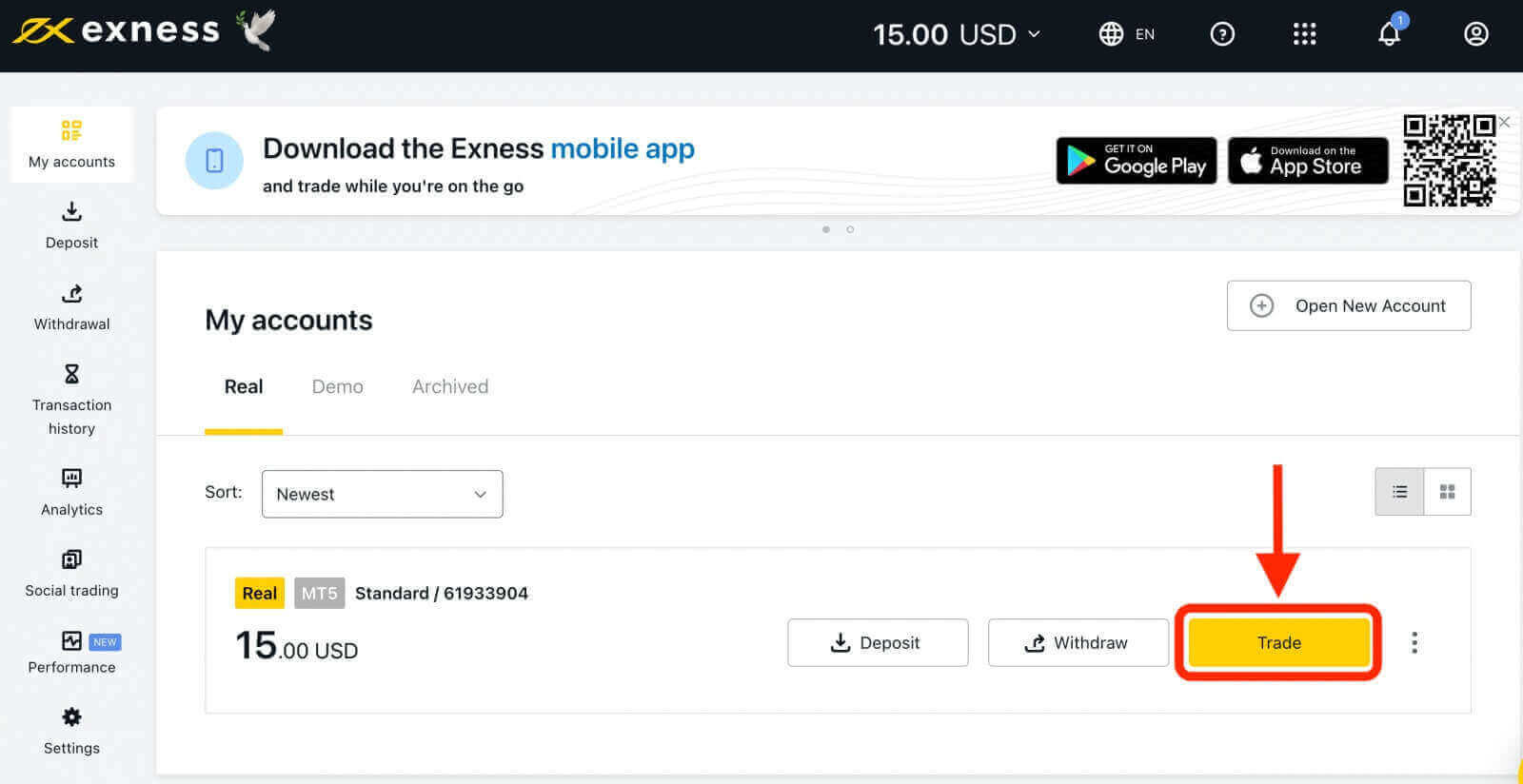

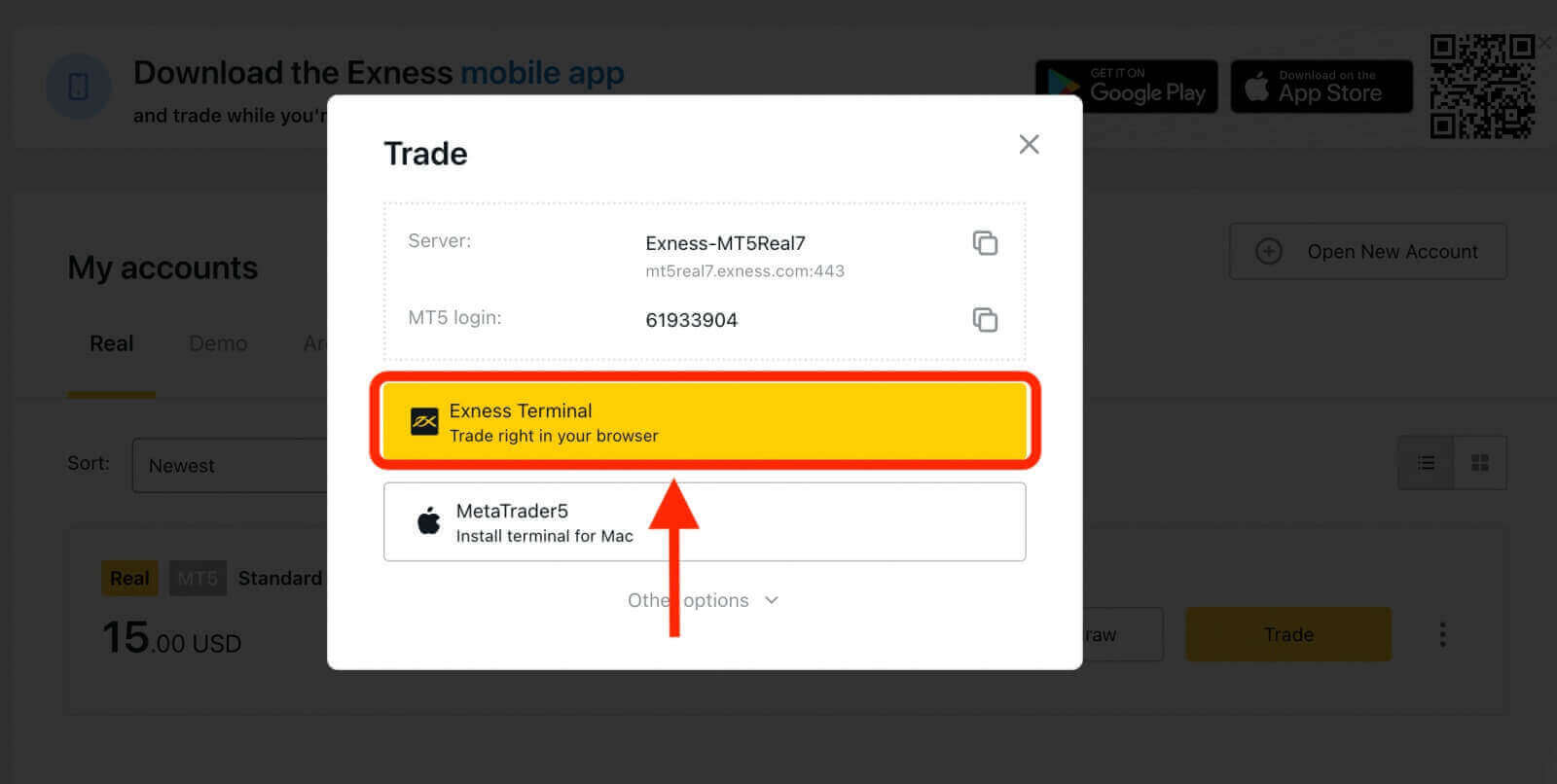

1. Click the "Trade" button.

2. Click "Exness Terminal" to Trade right in your browser.

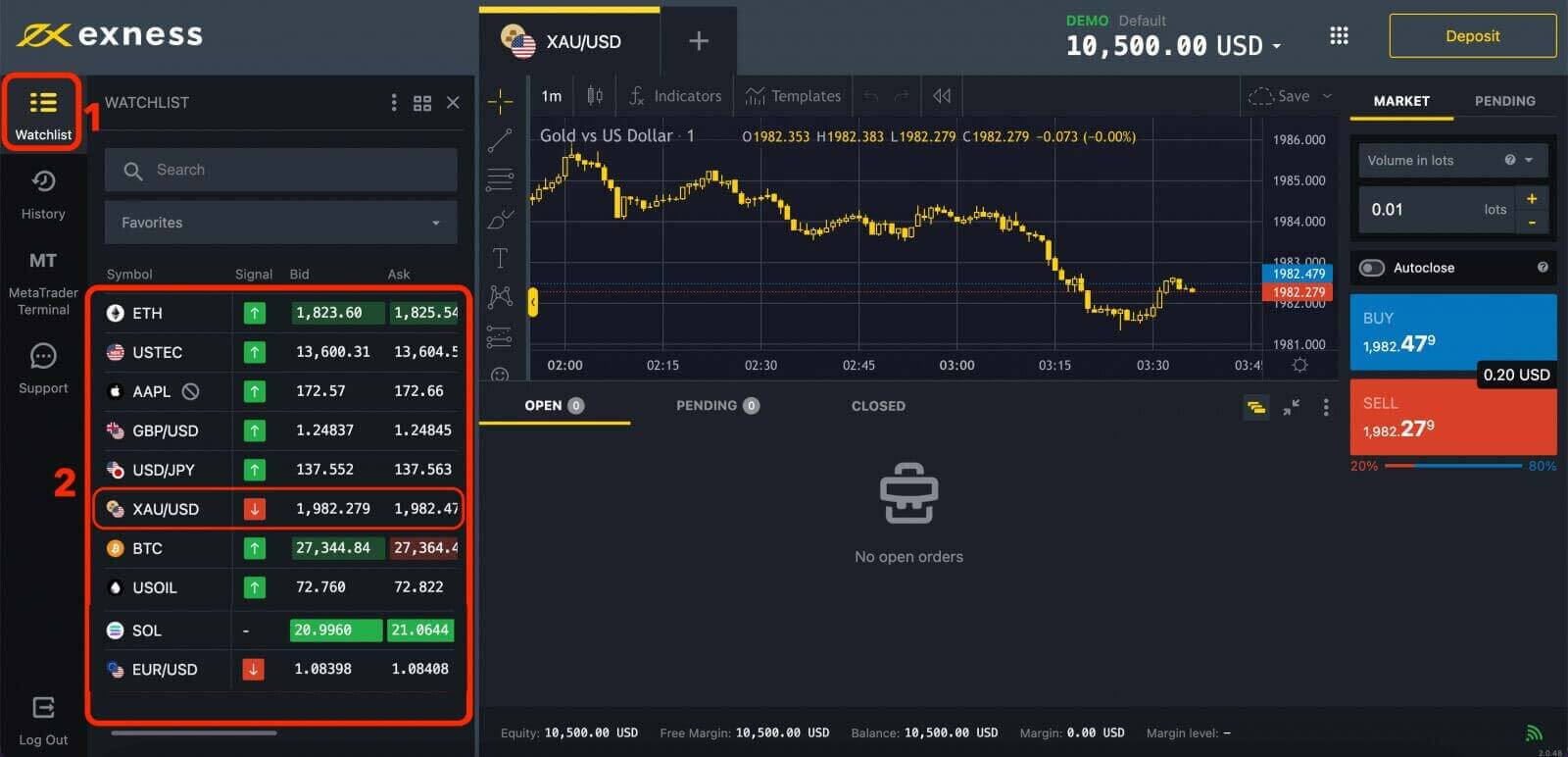

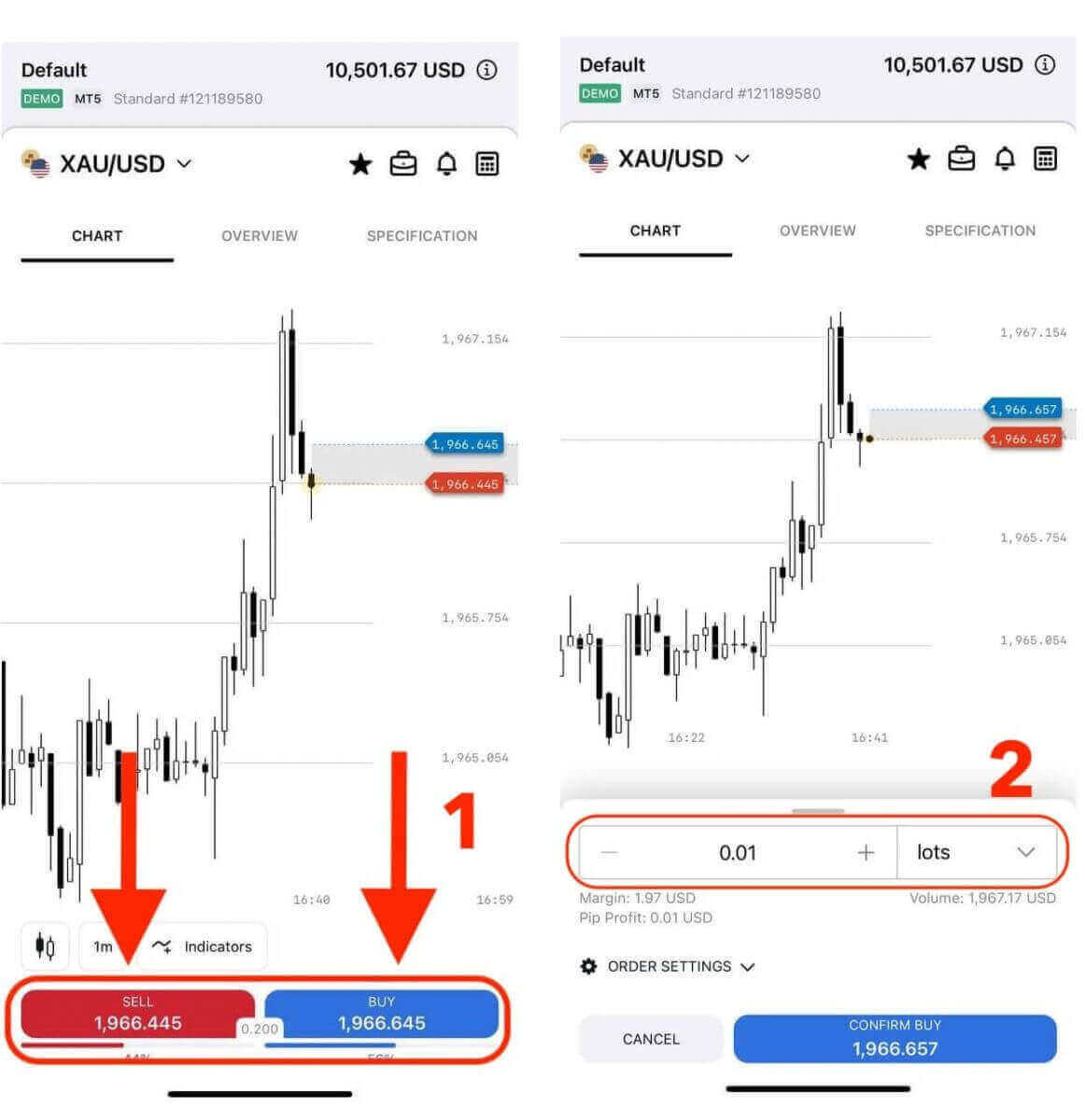

3. Select a currency pair that you want to trade. For example, XAU/USD.

Or click "+" at the top to add instrument(s).

4. Enter the amount of money that you want to trade. This is also known as the lot size or volume. The lot size determines how much profit or loss you will make for every pip movement in the exchange rate. A pip is the smallest unit of change in a currency pair. The minimum trading volume on our platform is 0.01 contracts.

To calculate pips for XAU/USD (gold), you need to know that 1 pip gain represents a 0.01 move in XAU/SUD (gold). So, for example, when XAU/SUD price changes from 1954.00 to 1954.01. it is 1 pip movement. However, if the price moves from 1954.00 to 1955.00, it is 100 pips movement.

5. Decide whether you want to buy or sell the currency pair. Buying means that you expect the base currency (XAU) to rise in value against the quote currency (USD), while selling means that you expect the opposite.

After setting up your trade, you can click on the "Sell" or "Buy" button to execute it. You will see a confirmation message on the screen and your trade will appear in the "OPEN" session.

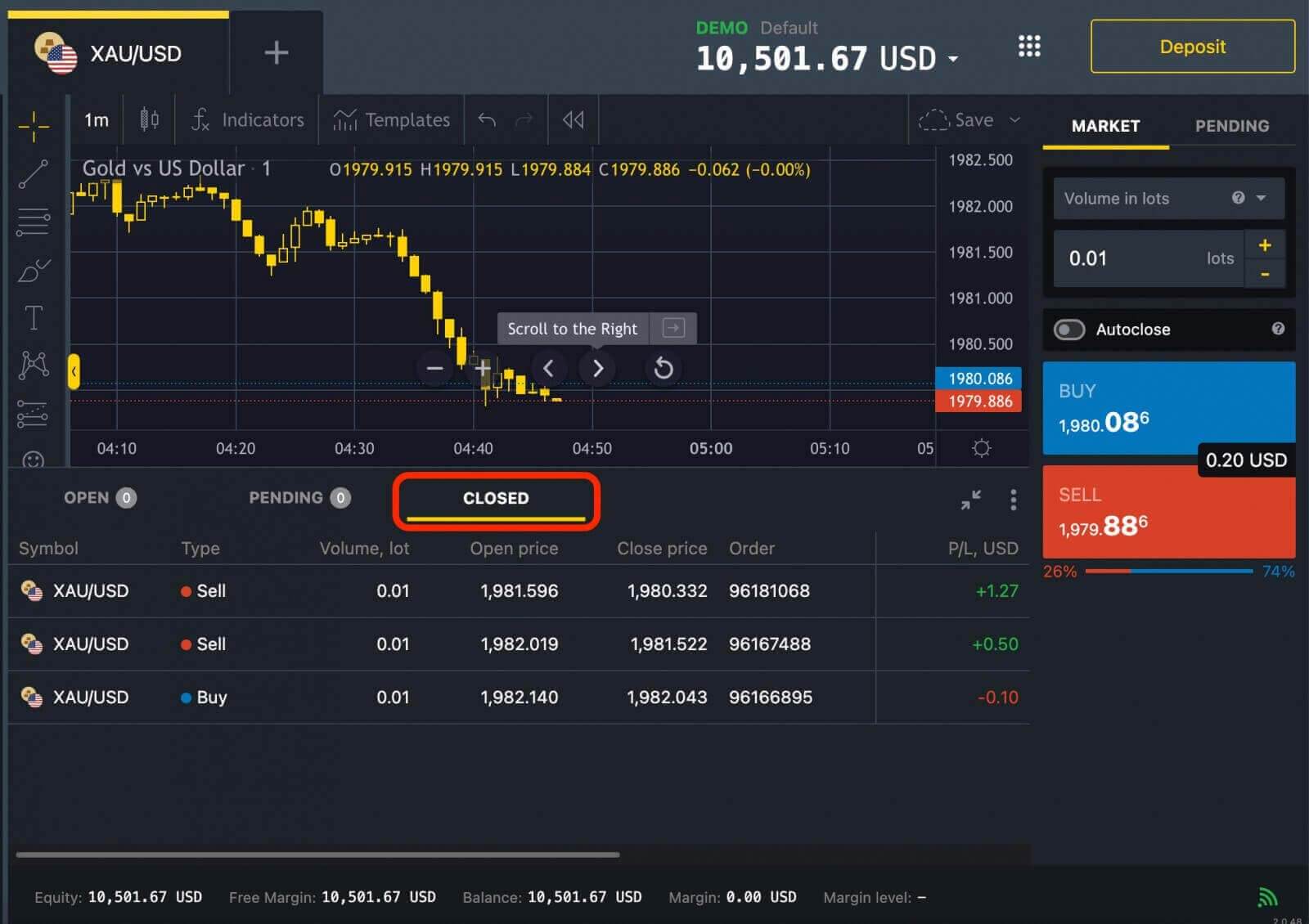

6. Confirm your trade and monitor it until it is closed. You can close your trade manually at any time by clicking on the close button or wait until it hits your stop loss or take profit order.

Your trade will appear in the "CLOSED" section.

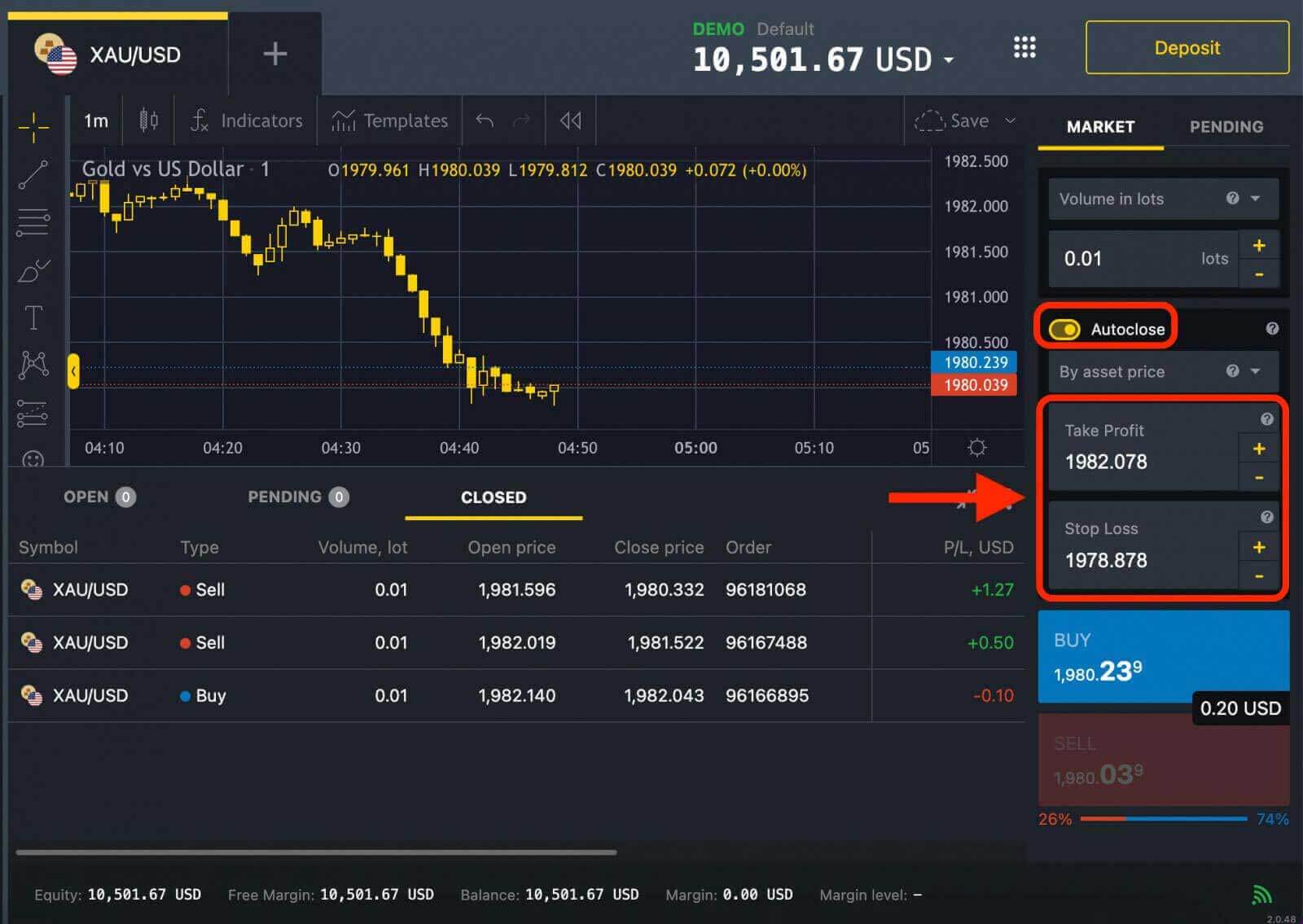

Set a stop loss and take profit order. A stop loss order is an instruction to close your trade automatically if the market moves against you by a certain amount. This helps you limit your risk and protect your capital. A take profit order is an instruction to close your trade automatically if the market moves in your favor by a certain amount. This helps you lock in your profit and avoid missing out on potential gains.

That’s it! You have just placed a forex trade on Exness. You can start your own forex trading journey.

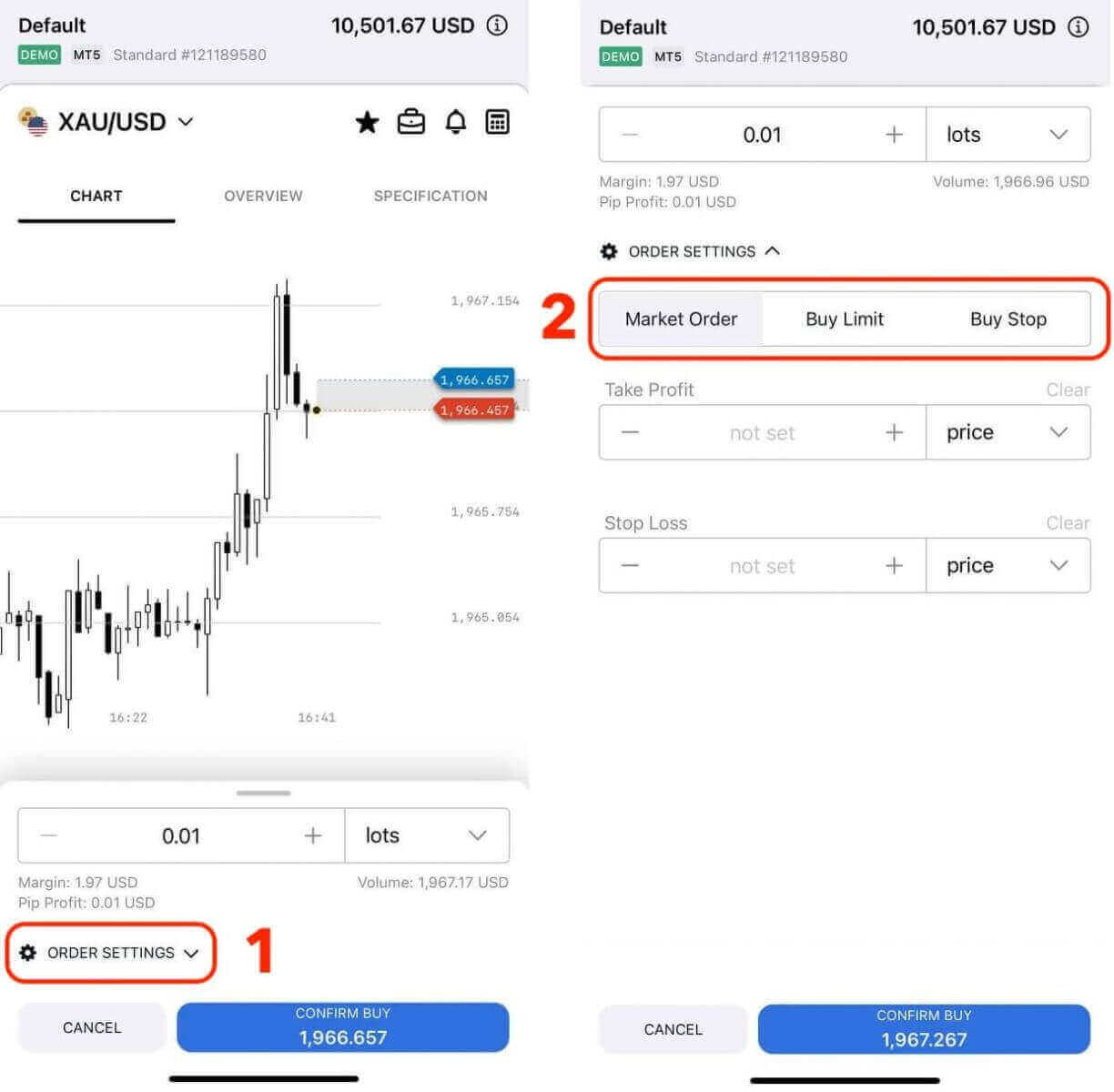

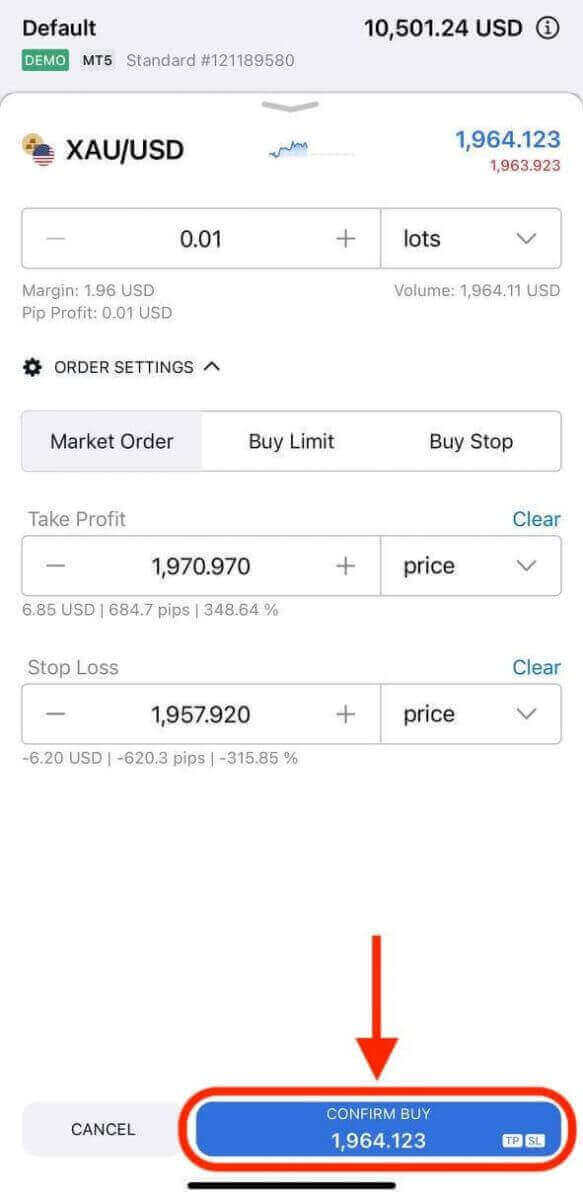

How to Open an Order: Buy and Sell on the Exness app

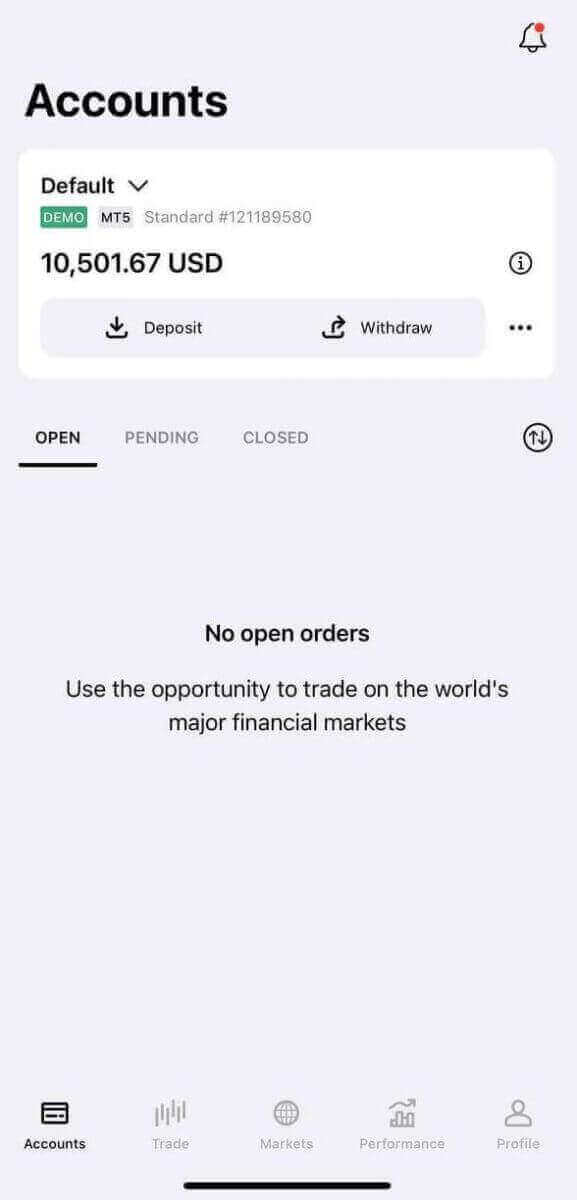

1. Open the Exness Trade app on your mobile device and log in using your account credentials.

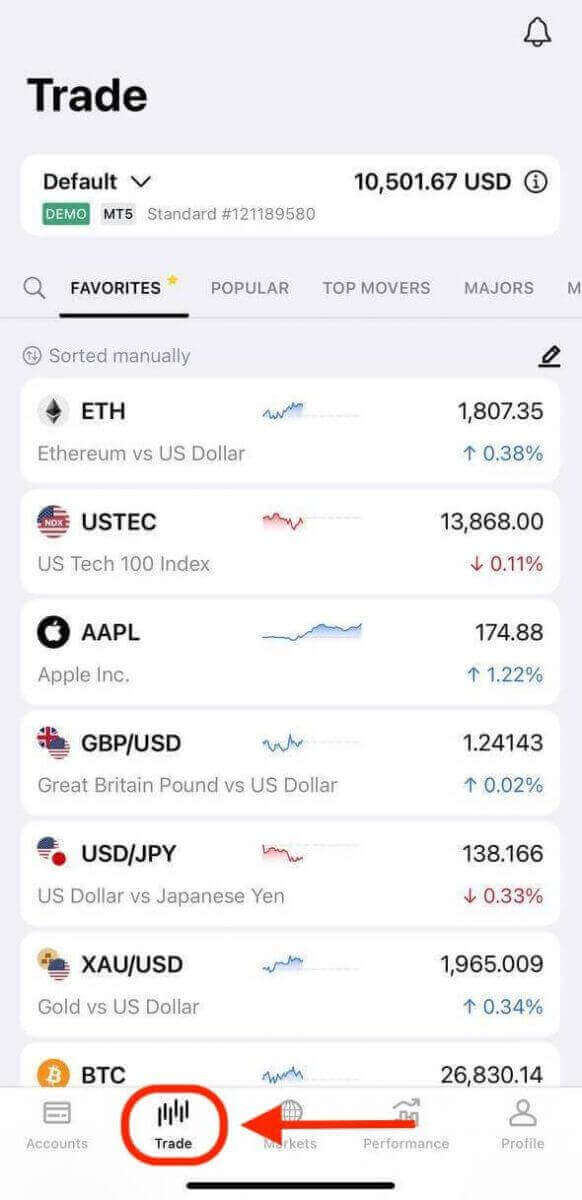

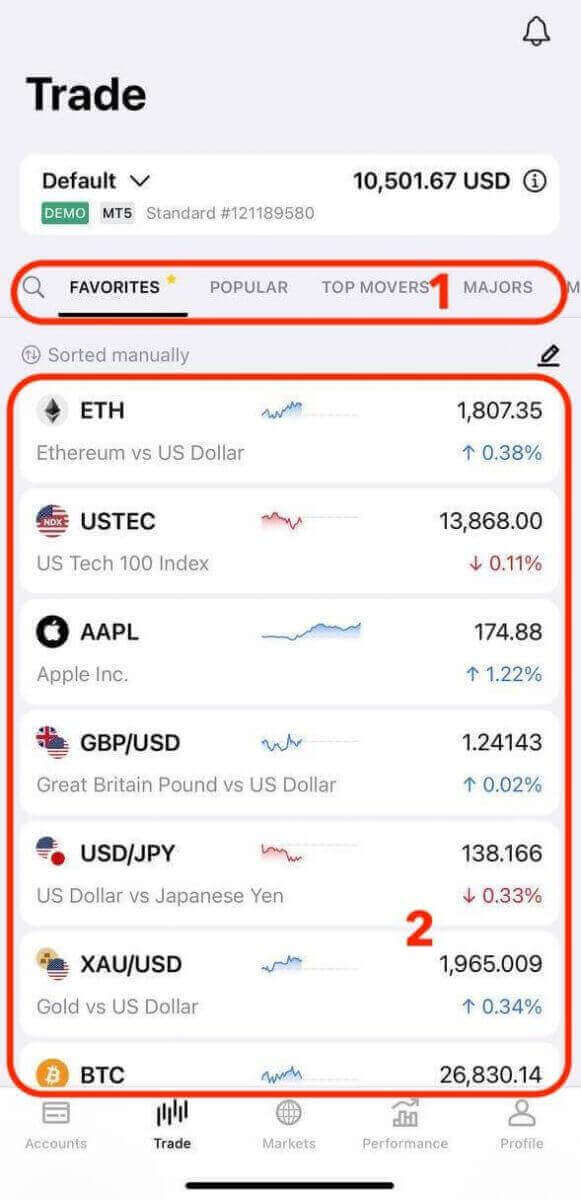

2. Tap on the Trade tab.

3. Explore the available trading instruments and tap on any instrument to expand its chart and access the trading terminal.

4. Tap Sell or Buy to expand its basic order settings, such as lot size.

You can tap Order settings to bring up more advanced options including. These parameters define your risk management and profit targets:

- The choice of 3 order types; market order, limit order and stop order types.

- Take profit and stop loss options for each order type.

When any options are entered, real-time data will display below that option.

5. Once you are satisfied with the trade details, tap the appropriate Confirm button to open the order. The Exness app will process the order and execute it at the prevailing market price or the specified price, depending on the order type.

6. A notification confirms that the order has been opened.

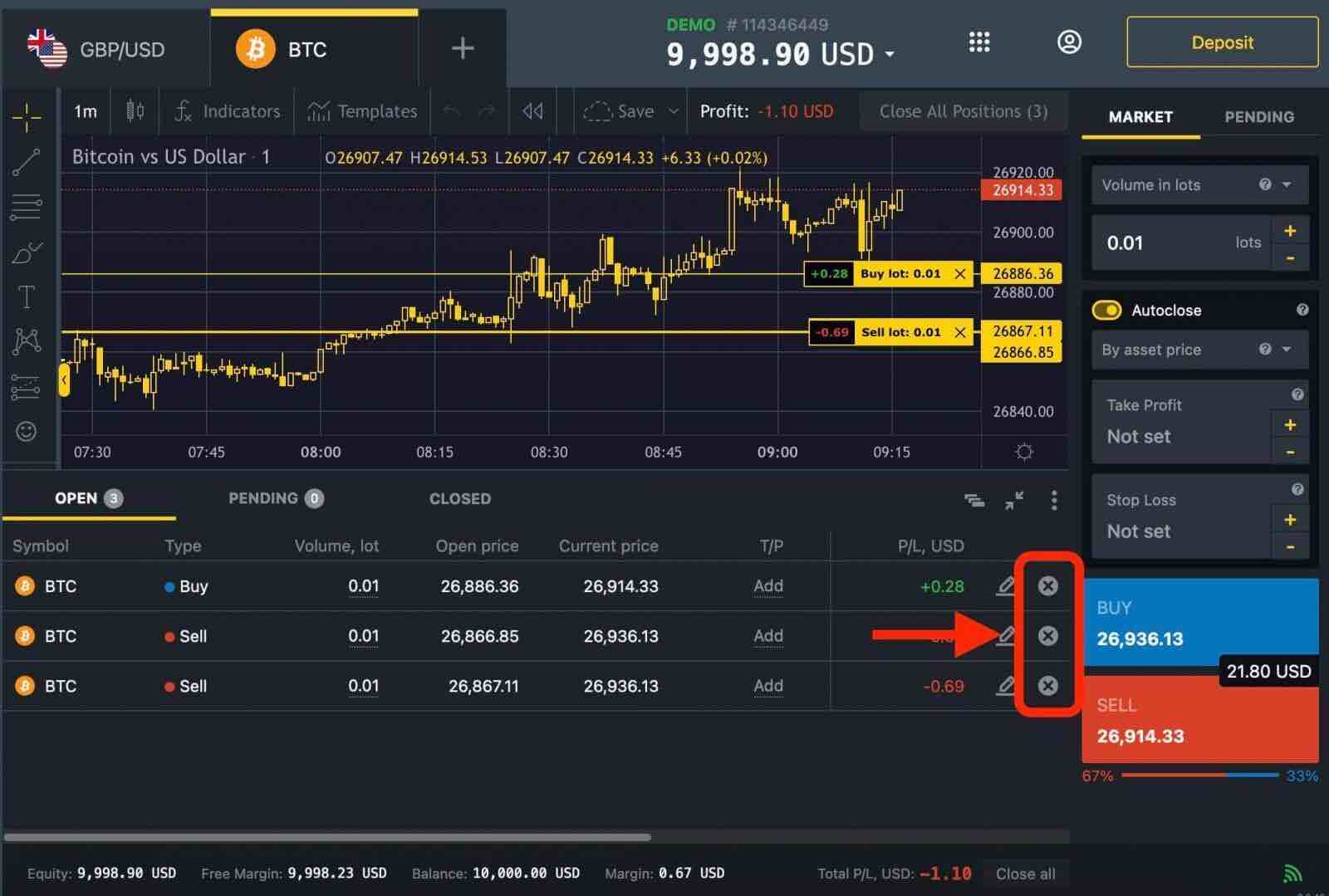

How to Close an Order on Exness

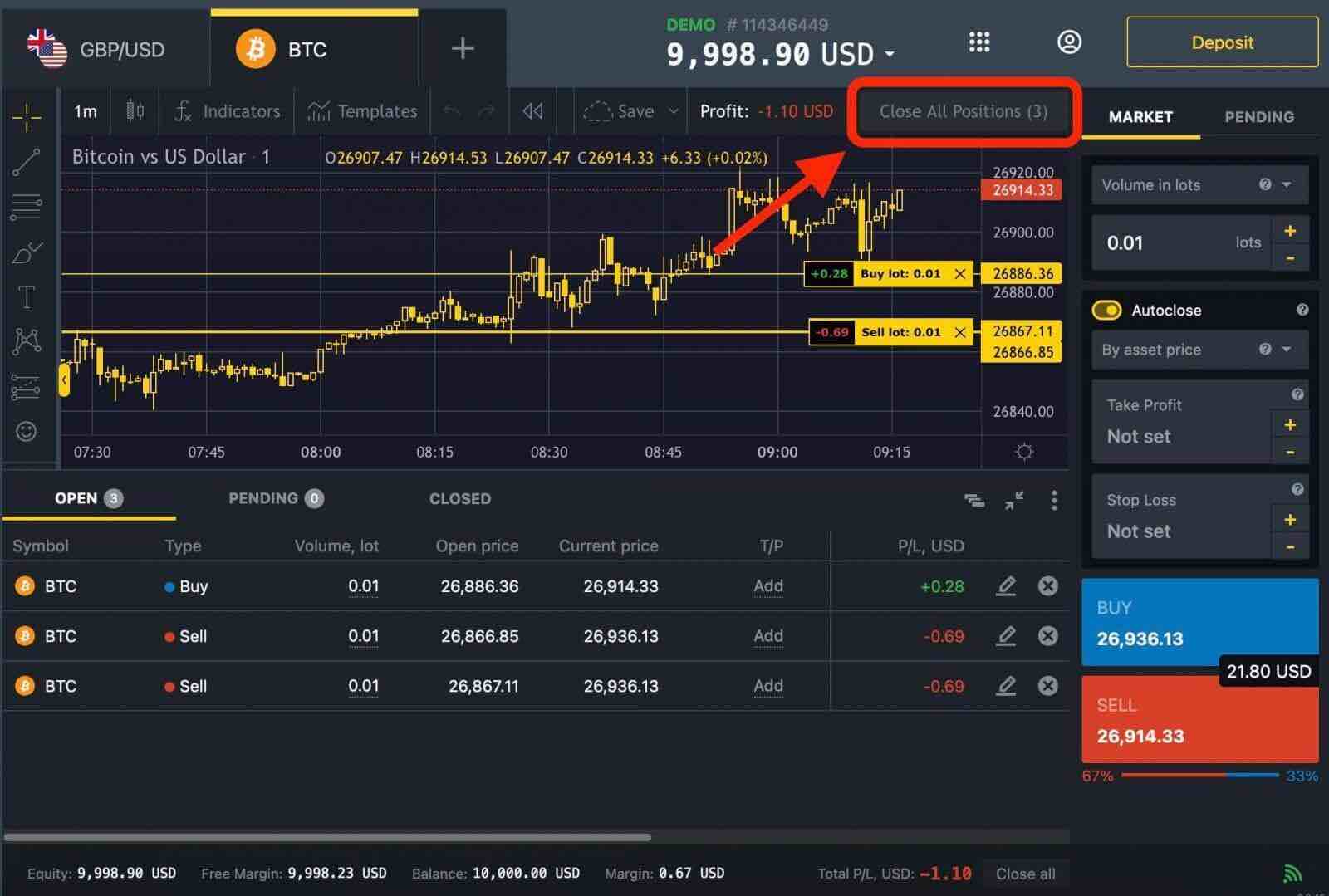

Close an Order on the Exness Website

1. Close an order from that trading instrument’s chart by clicking the x icon for the order, or from the portfolio tab with the x icon.

2. To close all active orders for a particular instrument, click on the "Close All Positions" button located at the top-right of the chart (next to the Profit displayed).

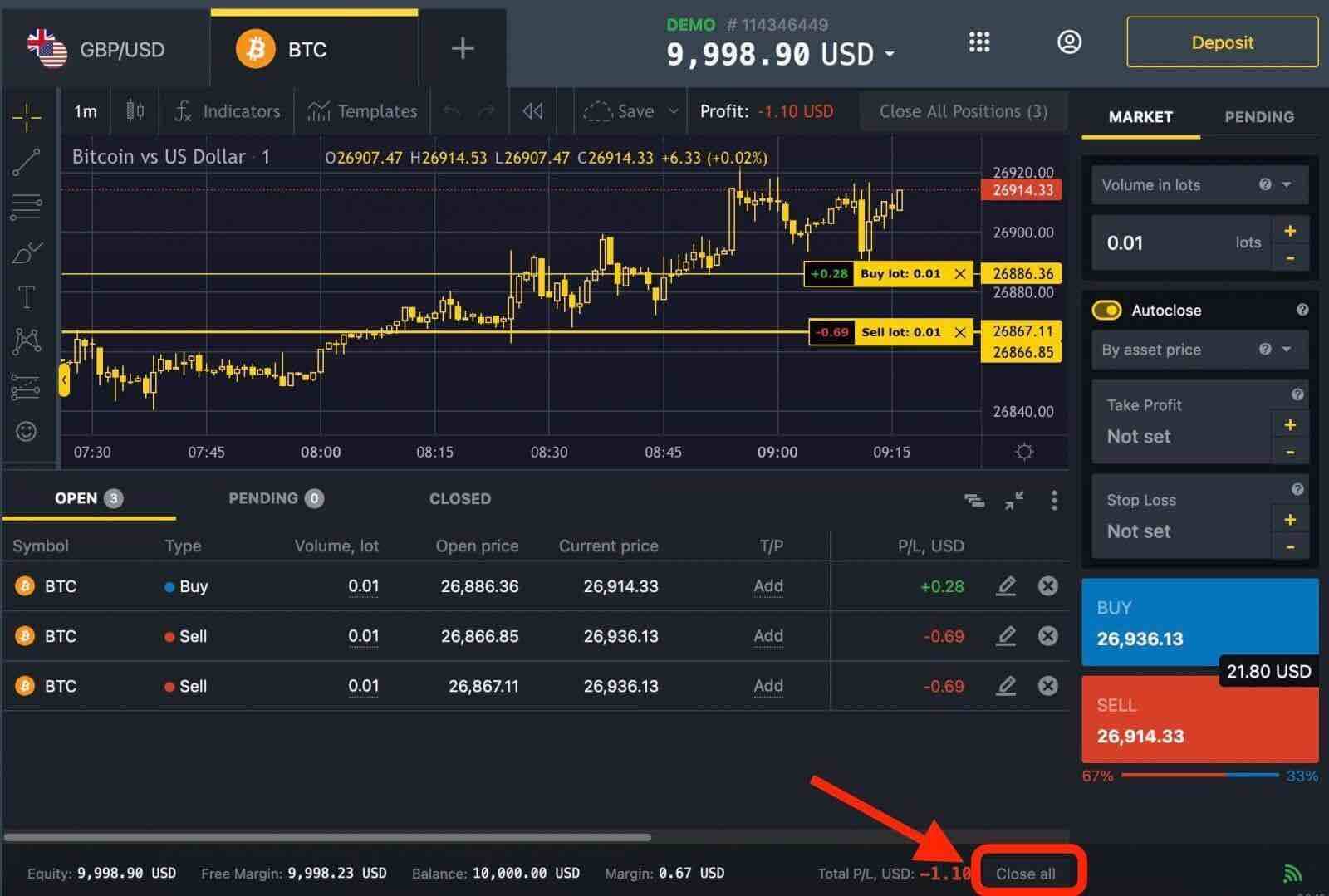

3. Close all open positions for every traded instrument by clicking on the "Close All" button at the bottom-right of the portfolio area.

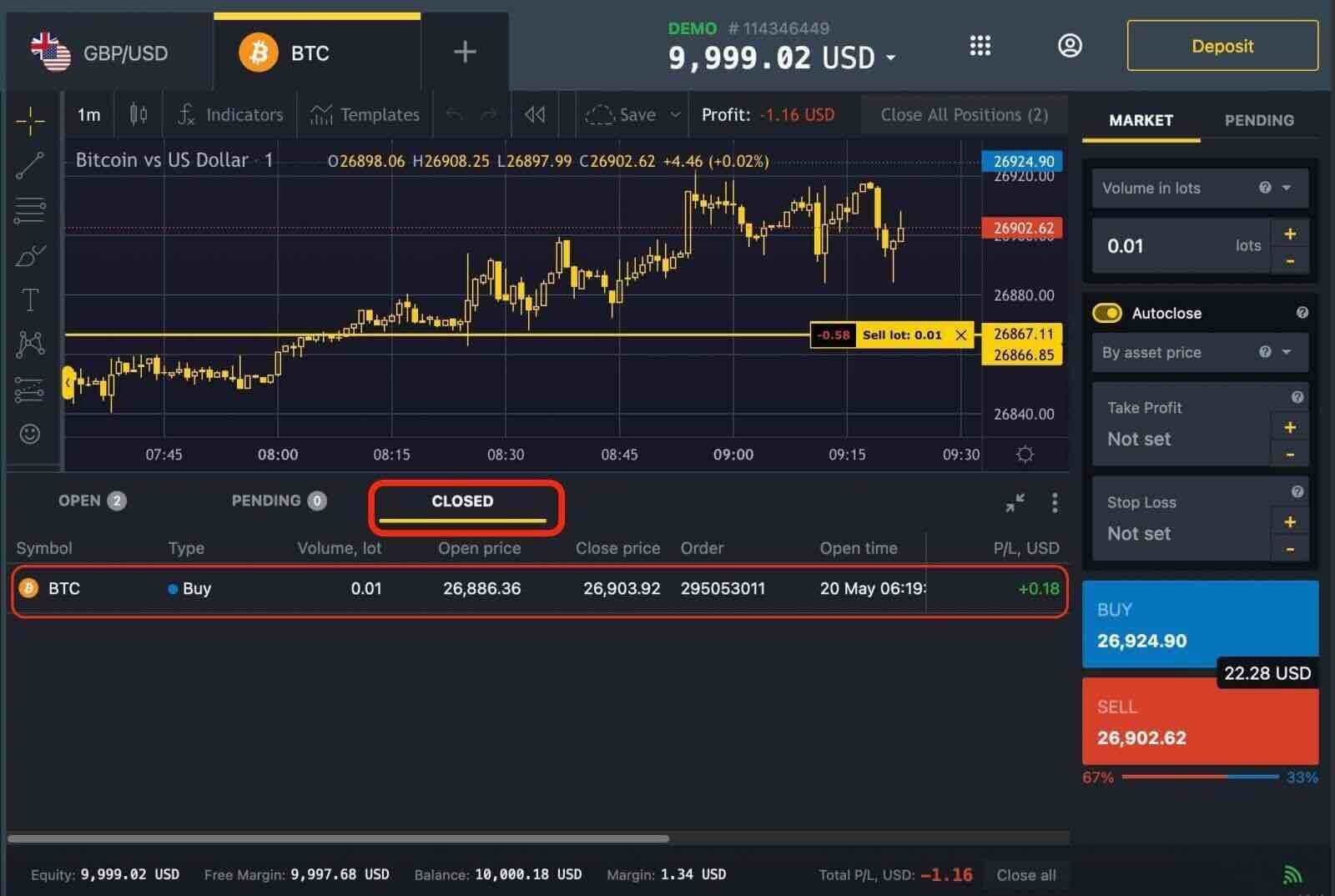

Your trade will appear in the "CLOSED" section.

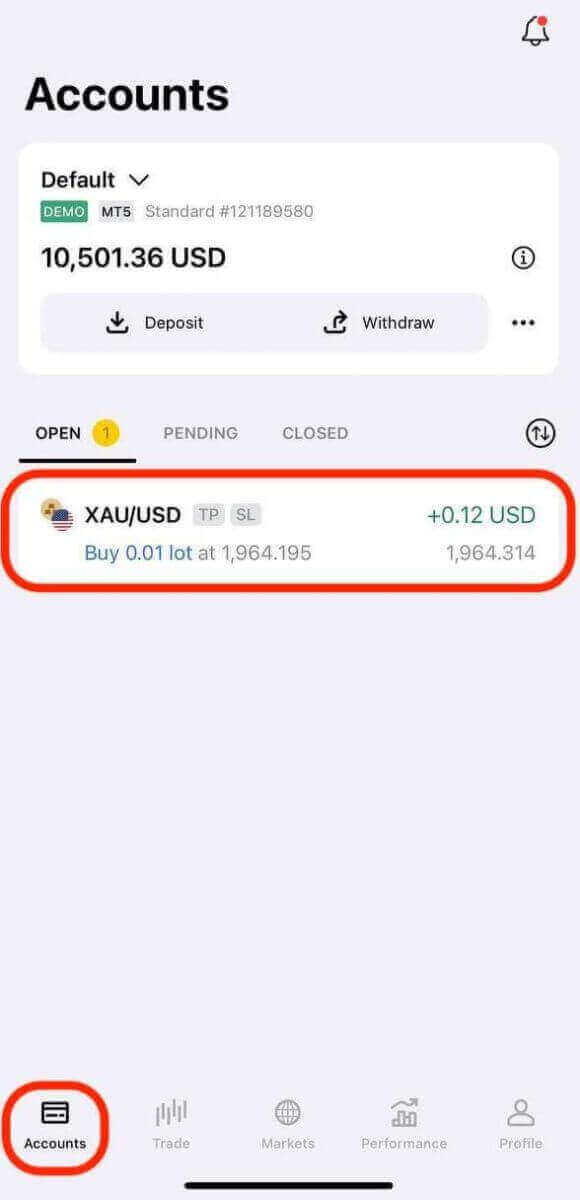

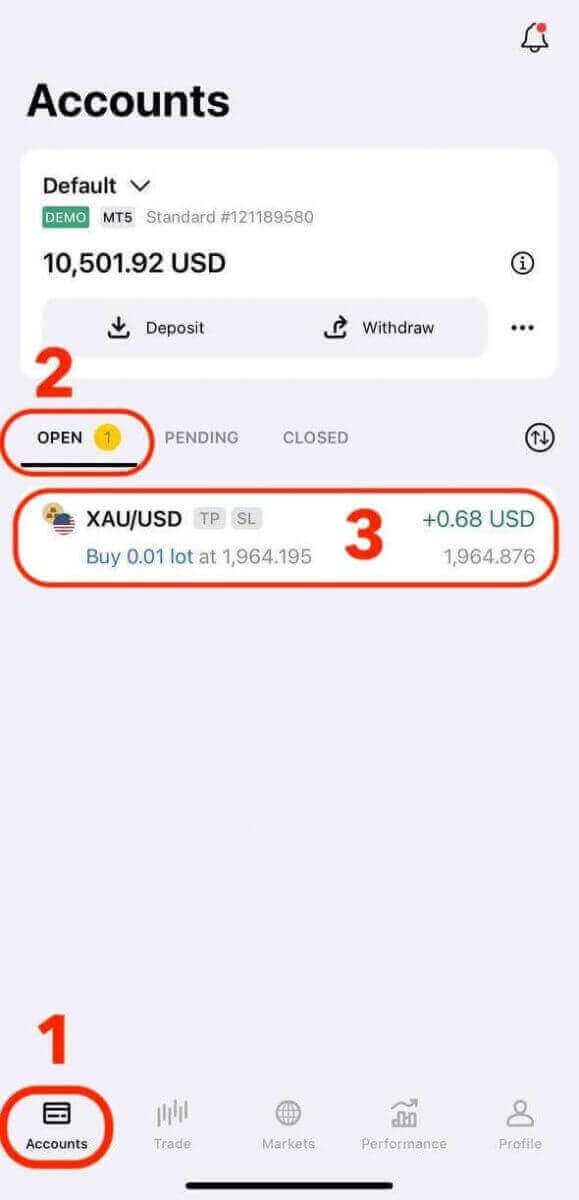

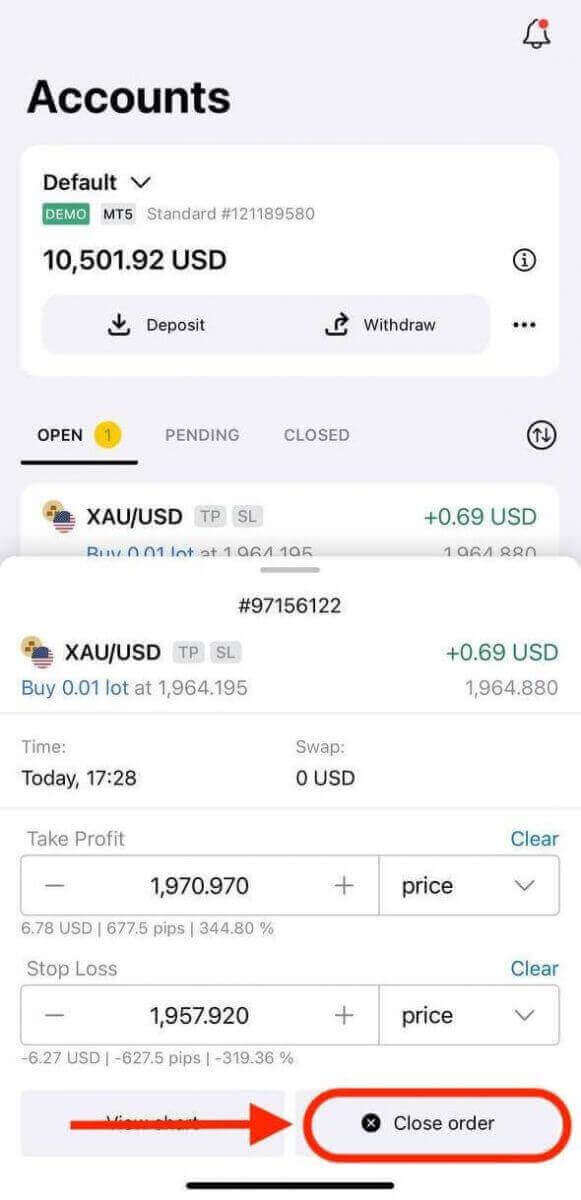

Close an Order on the Exness App

1. Open the Exness Trade app.

2. From the Accounts tab, locate the order you wish to close under the "OPEN" tab.

3. Tap the order you wish to close, and then tap Close order.

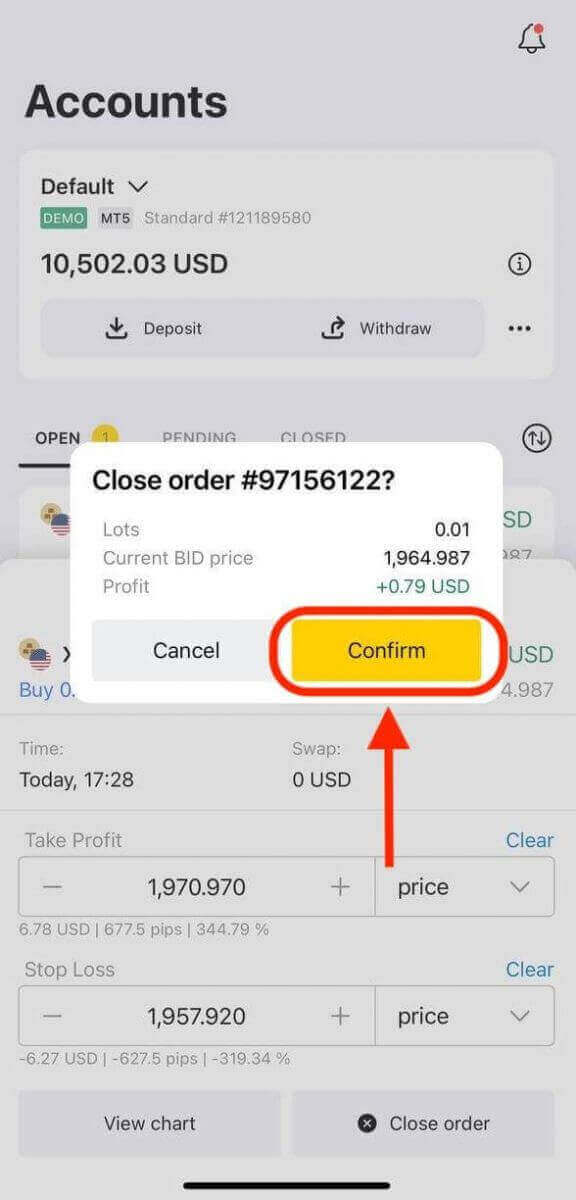

4. A confirmation pop-up will display the order’s information. Review the details once again to ensure accuracy. If you are certain, tap on "Confirm" to close the order.

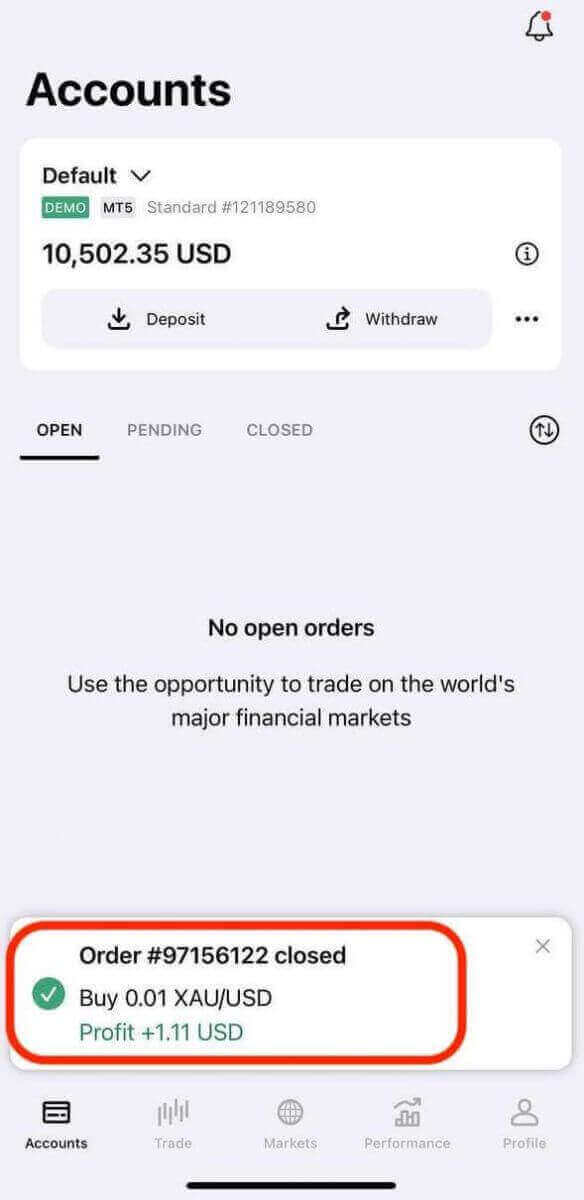

5. You will receive a confirmation message indicating that the order has been closed successfully. The order will be removed from your list of open positions.

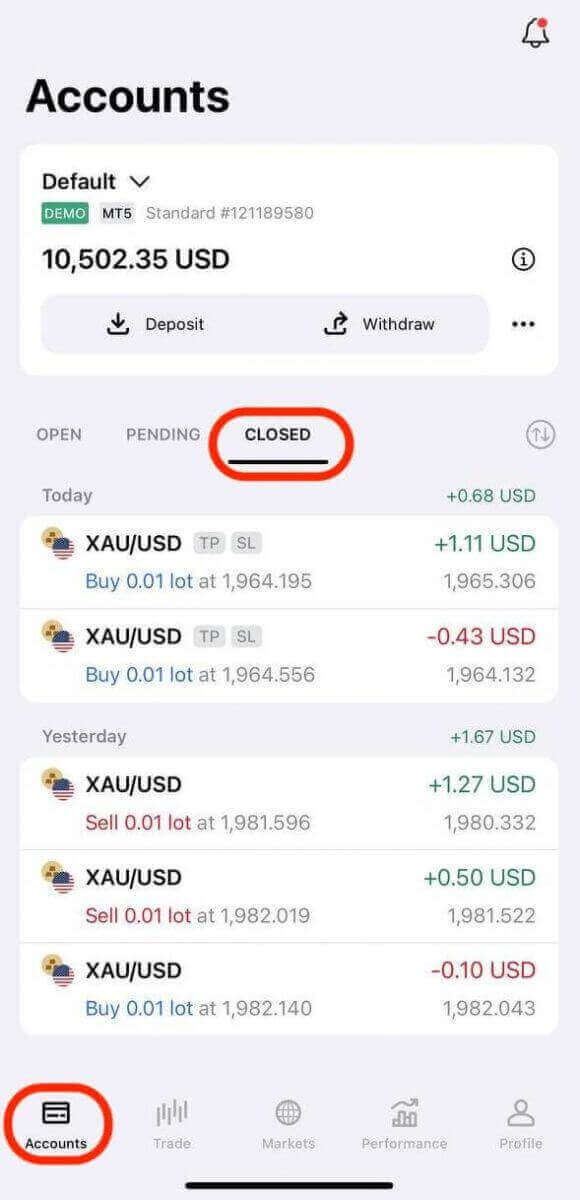

Review Closed Orders: You can access your closed orders under the "CLOSED" tab. This allows you to track your trading activity and analyze your performance.

How do Traders make Profits on Exness

A trade is said to be in profit when the price is moving in your favor. To understand this, you will need to know what is the favorable price direction for Buy and Sell orders.- Buy orders make a profit when the price rises. In other words, if the closing Bid price is higher than the opening Ask price when the order is closed, the Buy order is said to have made a profit.

- Sell orders make a profit when the price falls. In other words, if the closing Ask price is lower than the opening Bid price when the order is closed, the Sell order is said to have made a profit.

Tips for Successful Trading on the Exness

These are some of the tips that can help you trade successfully on the Exness app:

Educate Yourself: Continuously improve your trading knowledge by learning about market analysis techniques, trading strategies, and risk management principles. The Exness app offers a variety of educational resources and expert insights to help you improve your trading skills and knowledge, such as webinars, tutorials, and market analysis articles, to help you stay informed.

Develop a Trading Plan: Set clear trading goals and establish a well-defined trading plan. Define your risk tolerance, entry and exit points, and money management rules to guide your trading decisions and minimize emotional trading.

Utilize Demo Accounts: Take advantage of the Exness app’s demo accounts to practice your trading strategies without risking real money. Demo accounts allow you to familiarize yourself with the platform and test different approaches before transitioning to live trading.

Stay Updated with Market News: Keep track of economic news, geopolitical events, and market trends that can influence your trading positions. Exness provides access to real-time market news and analysis, helping you make well-informed trading decisions.

Use technical analysis tools and indicators: The Exness app provides a range of technical analysis tools and indicators to help you identify trends, patterns, support and resistance levels, and potential entry and exit points. You can use different chart types, time frames, drawing tools, and indicators to analyze market movements and signals. You can also customize your charts and indicators according to your preferences and save them as templates for future use.

Set your risk management parameters: The Exness app allows you to set various risk management parameters to protect your capital and limit your losses. You can use stop loss and take profit orders to close your positions automatically at predefined levels. You can also use trailing stop orders to lock in your profits as the market moves in your favor. Additionally, you can use margin alerts and notifications to keep track of your account balance and margin level.

Keep Emotions in Check: Emotional decisions can lead to poor trading outcomes. Emotions such as fear, greed, and excitement can cloud judgment. Maintain a rational mindset and make decisions based on logical analysis rather than impulsive reactions to market fluctuations.