How to Open Account and Deposit into Exness

This comprehensive guide aims to walk you through the essential steps required to open an account on Exness and deposit funds into it. Whether you're a beginner eager to initiate your trading journey or an experienced trader transitioning to Exness, this guide will provide a clear roadmap for a hassle-free account setup and deposit process.

How to Open an Exness Account

How to Open an Account on Exness

Open an Account on Exness

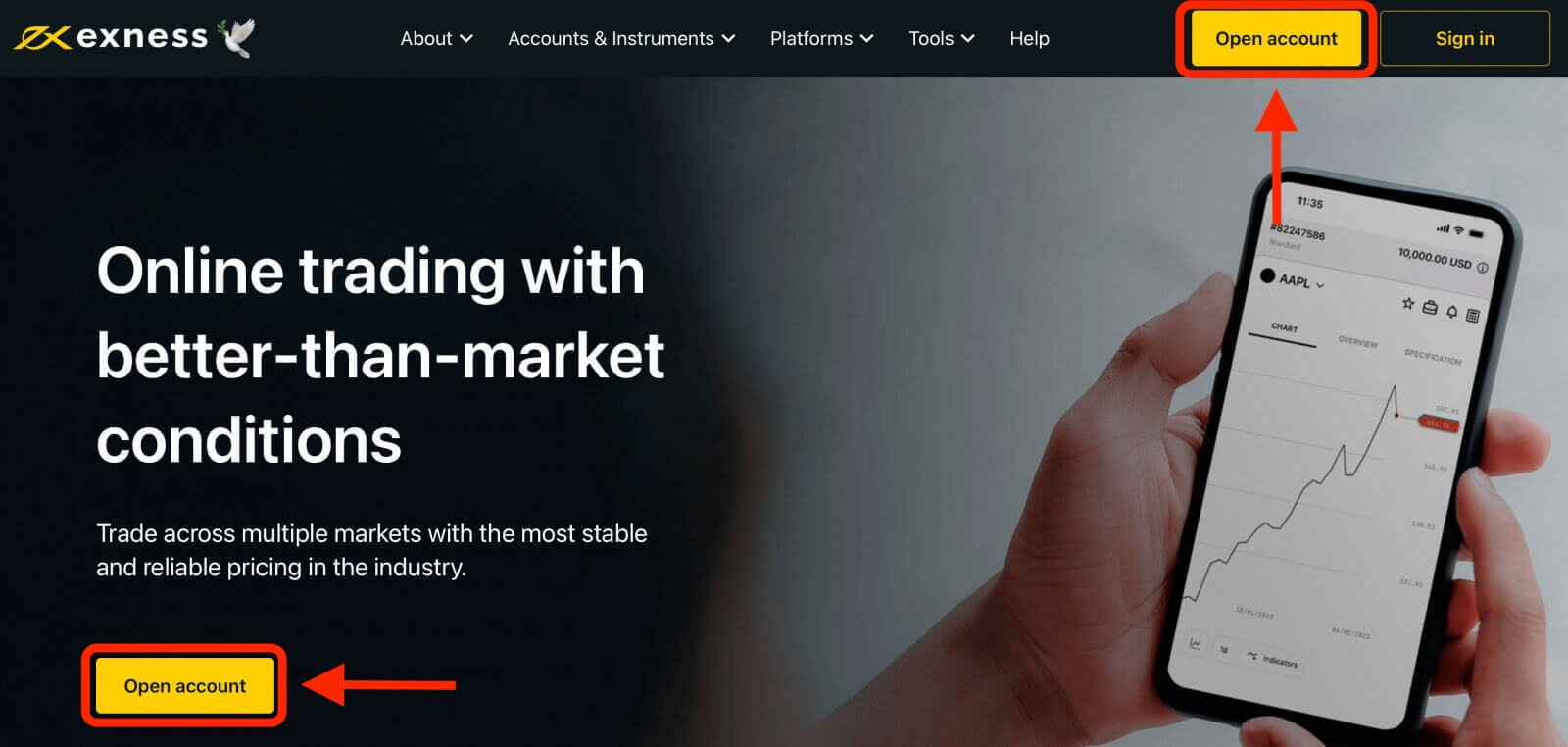

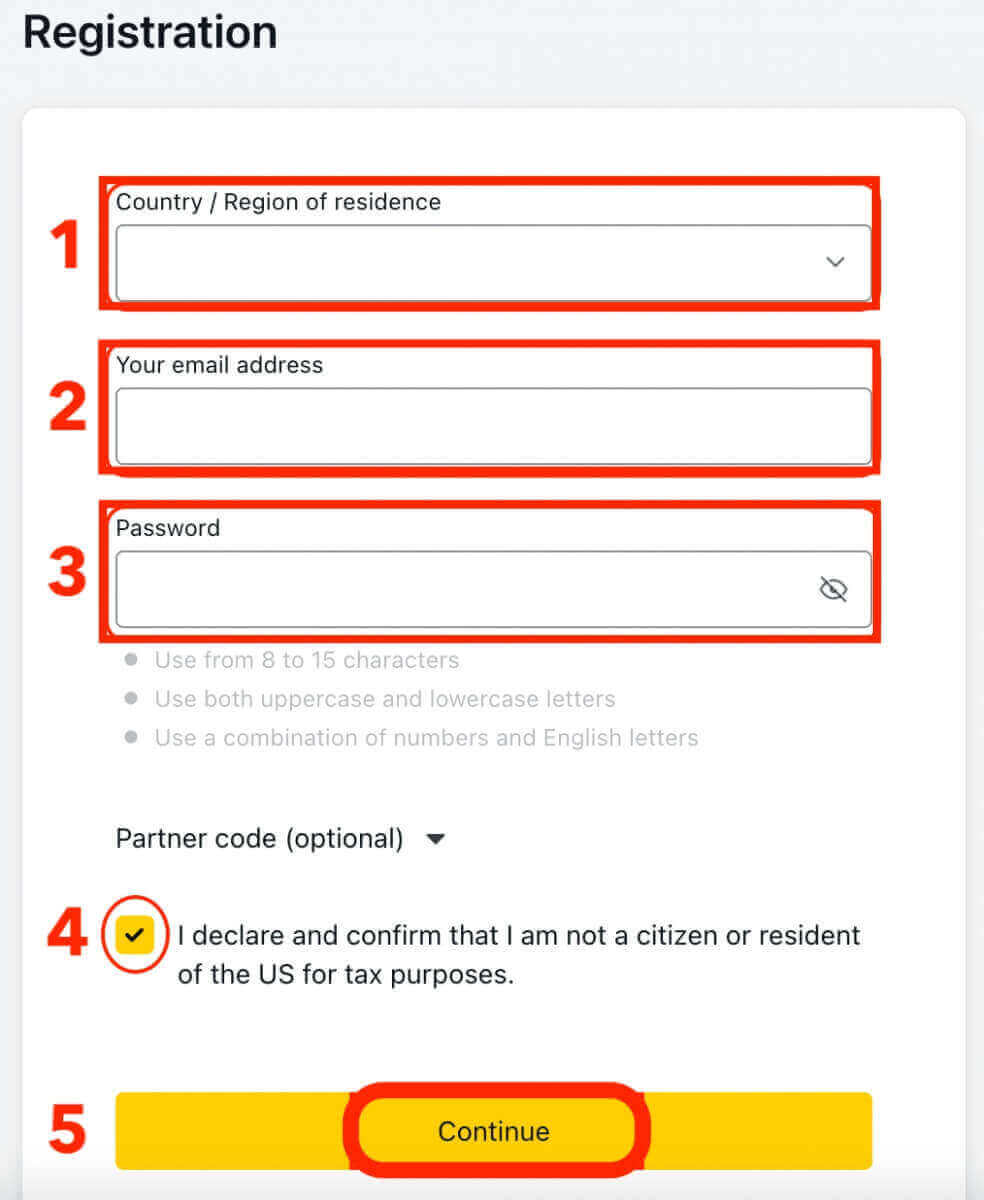

Step 1: Visit the Exness websiteTo start the registration process, you will need to visit the Exness website. On the homepage, click on the "Open account" button at the top right corner of the page.

Step 2: Fill in your personal details

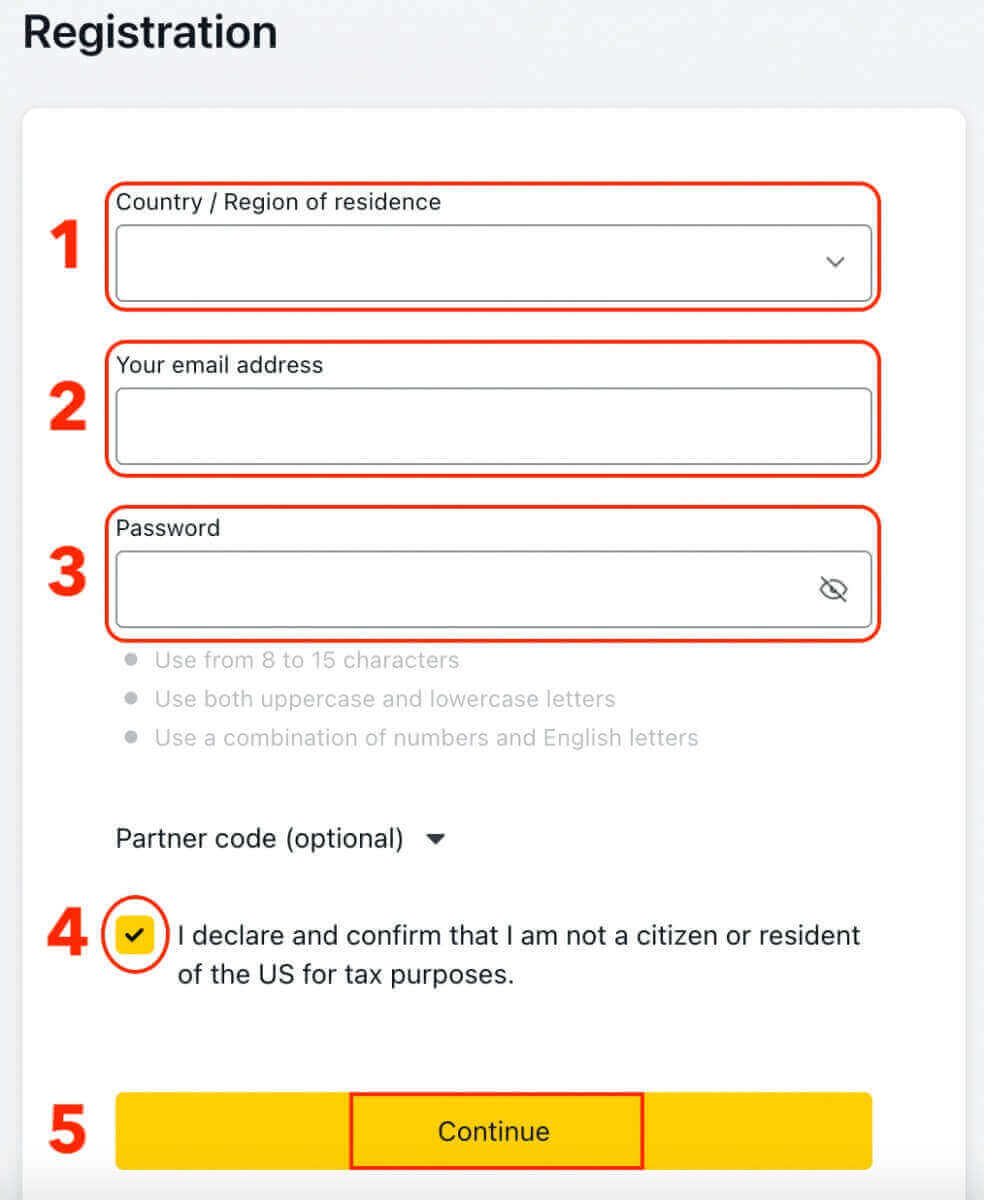

After clicking on the Open account button, you will be directed to a registration form where you will need to provide your personal information:

- Select your country of residence.

- Enter your email address.

- Create a password for your Exness account following the guidelines shown.

- Tick the box declaring you are not a citizen or resident of the US.

- Click Continue once you have provided all the required information. Make sure you enter valid and accurate information, as you will need to verify your identity later.

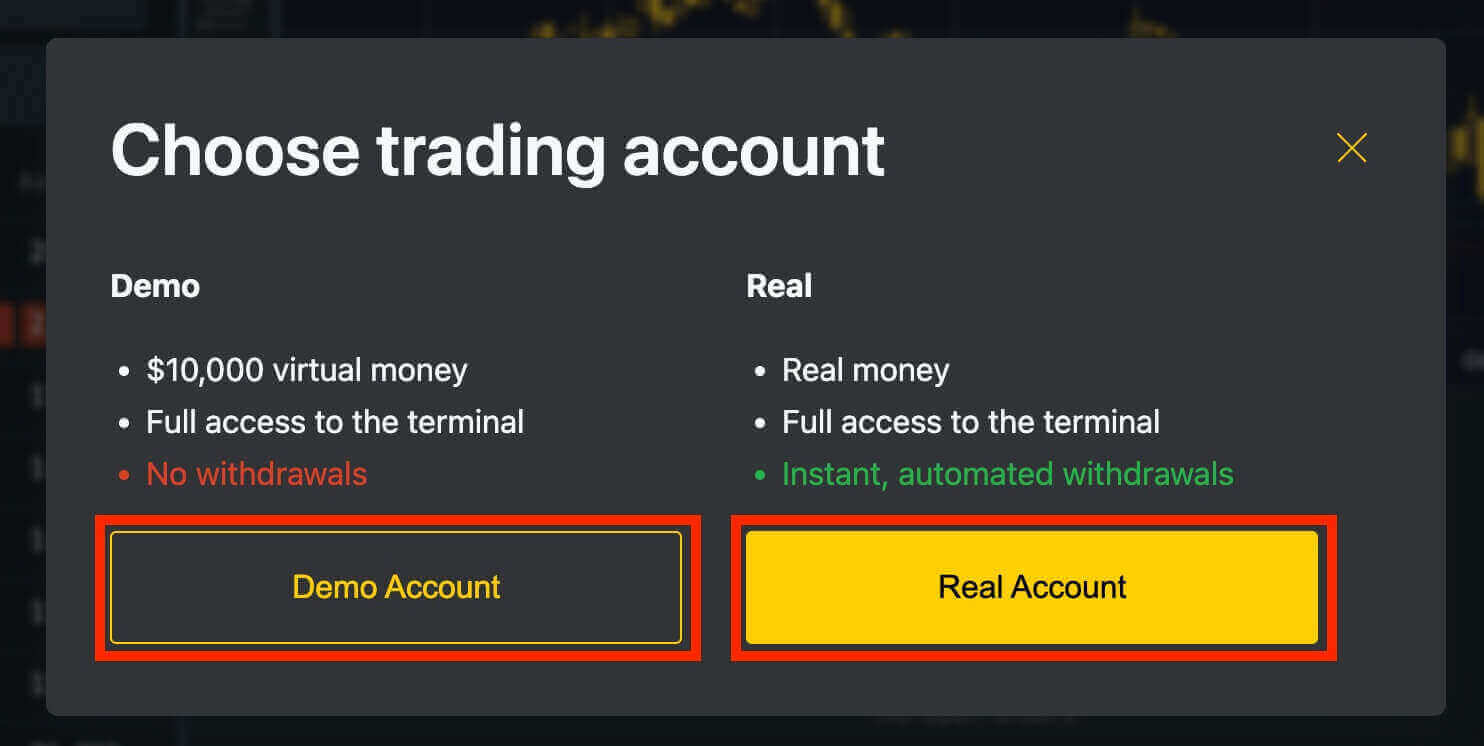

Step 3: Choose your account type

Choose the type of account you want to open. Exness offers various account types, including demo accounts and real trading accounts with different features and trading conditions. Choose the account type that suits your trading needs and experience level.

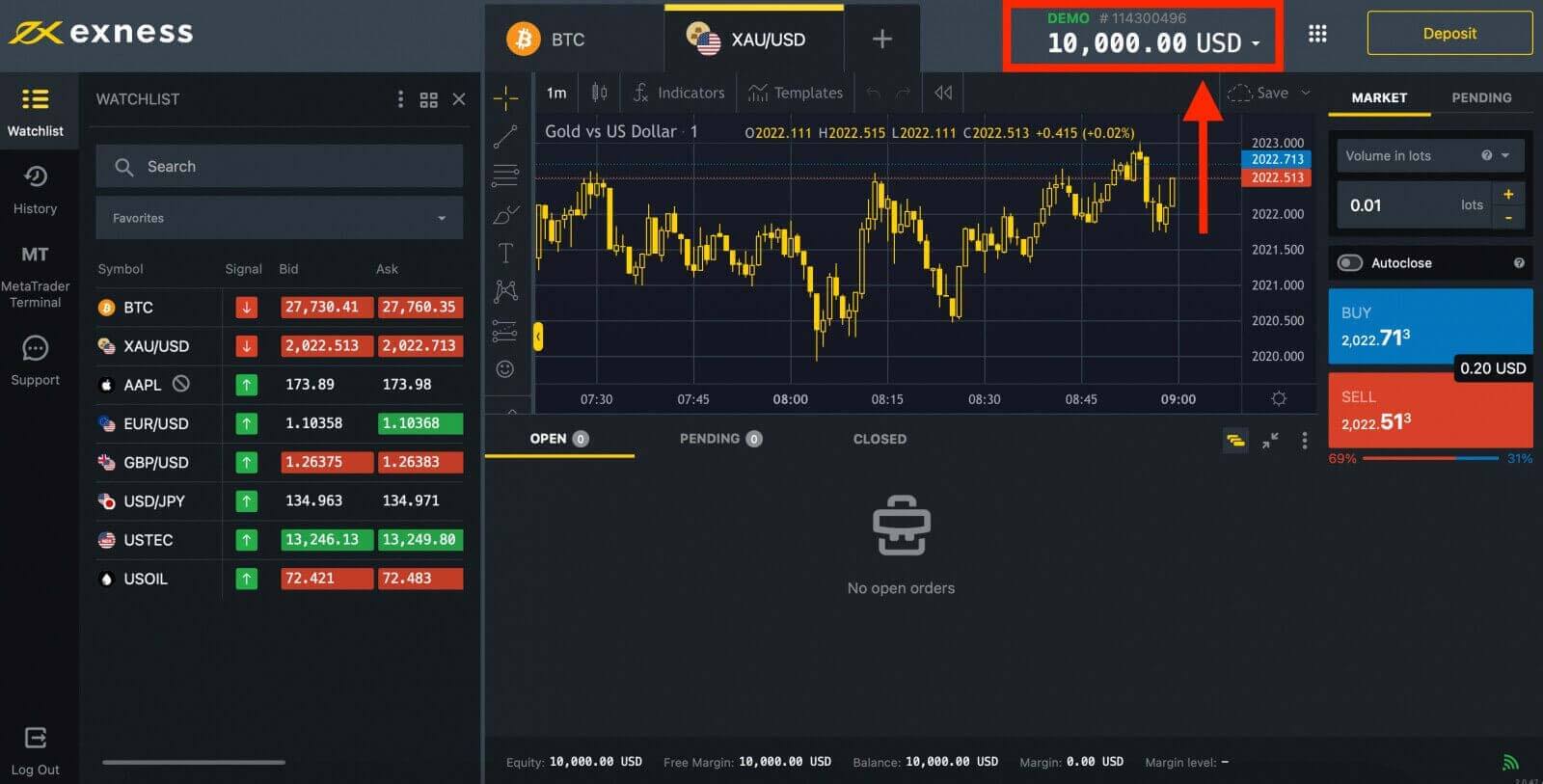

A demo account is a practice account that allows you to trade in a simulated environment using virtual funds ($10,000). Exness offers a demo account to its users to help them practice trading and get familiar with the platform’s features without risking real money. They are an excellent tool for beginners and experienced traders alike and can help you improve your trading skills before moving on to trading with real money.

Once you’re ready to start trading with real funds, you can switch to a real account and deposit your money.

Once you have registered, it is advised that you fully verify your Exness account to gain access to every feature available only to fully verified Personal Areas.

Once your account is verified, you can fund it using various payment methods, such as bank transfer, credit card, e-wallet or cryptocurrency.

Create a Trading Account on Exness

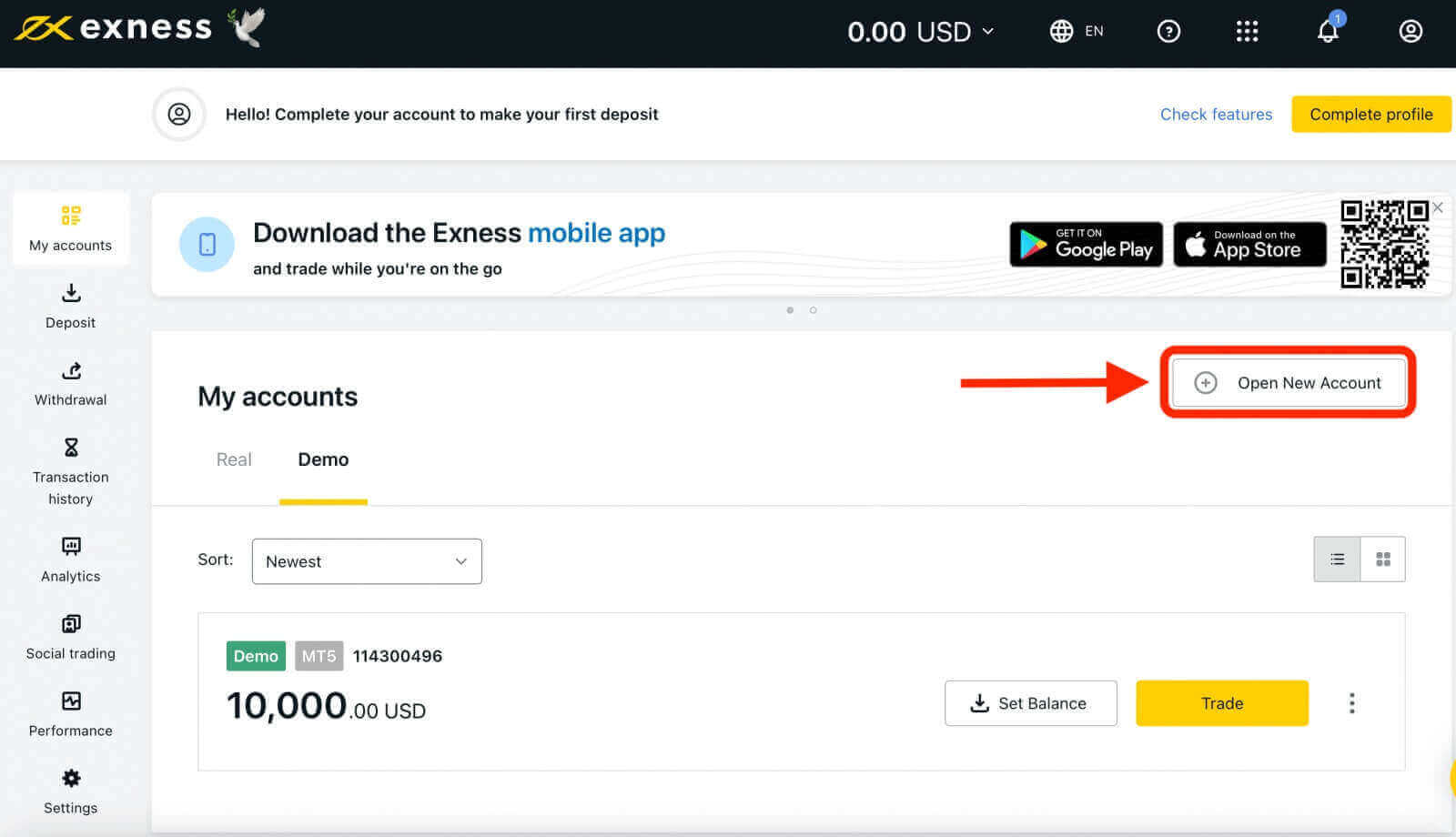

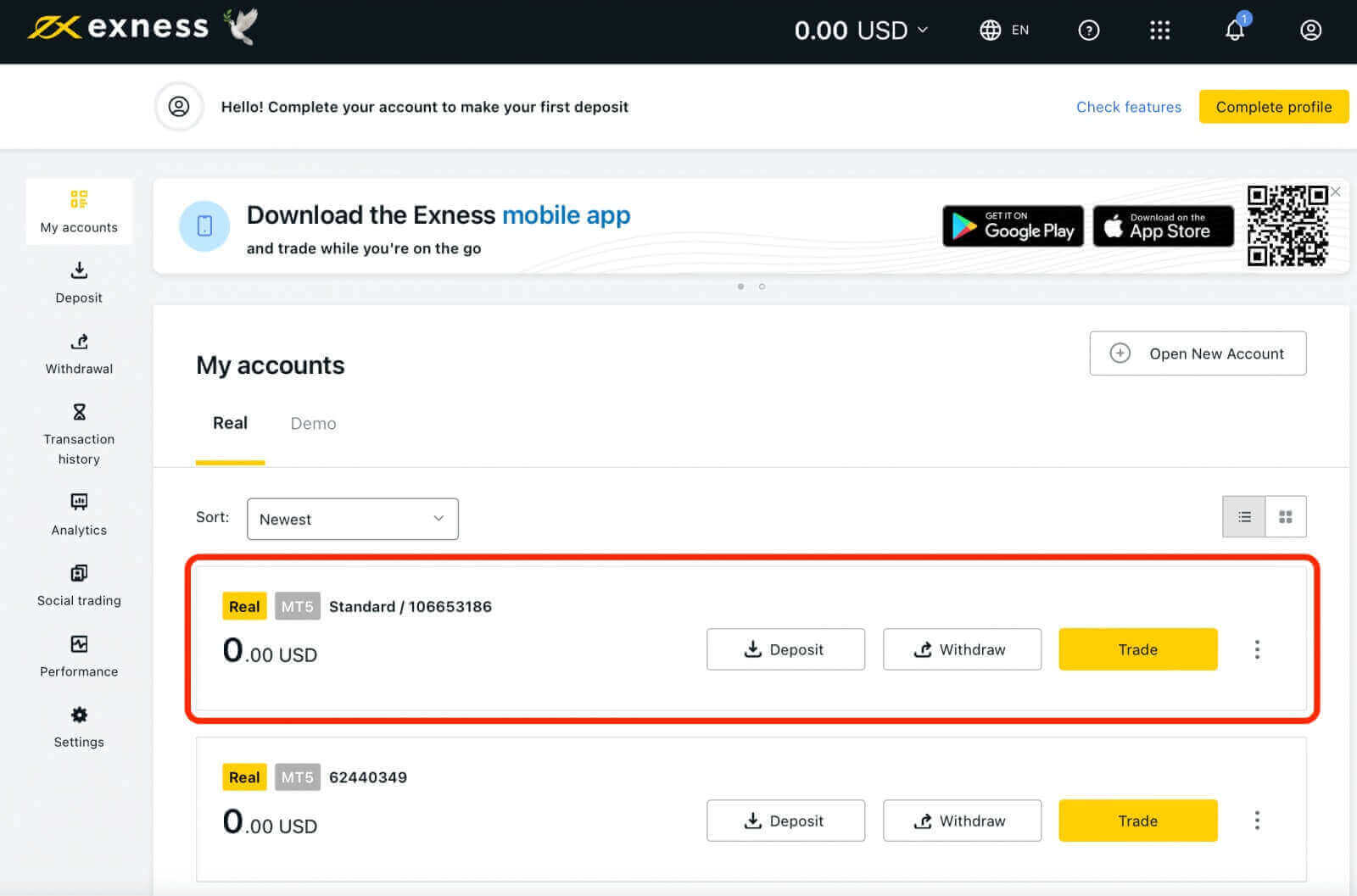

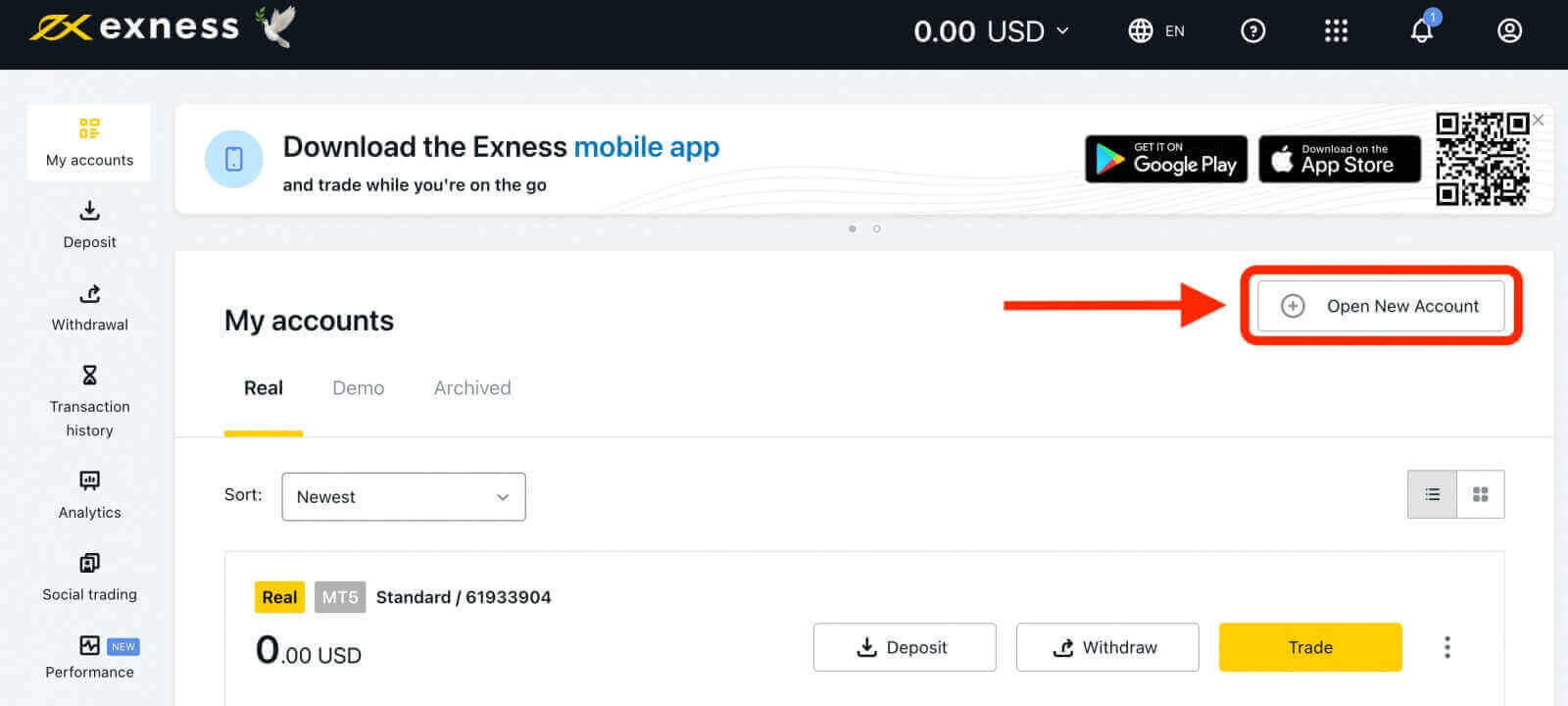

When you create a new Personal Area on Exness, a real trading account and a demo trading account (both for MT5) are automatically created, but you also have the option to create additional trading accounts if needed1. Go to Personal Area to open more trading accounts.

2. From your new Personal Area, click the "Open New Account" button in the ‘My Accounts’ area.

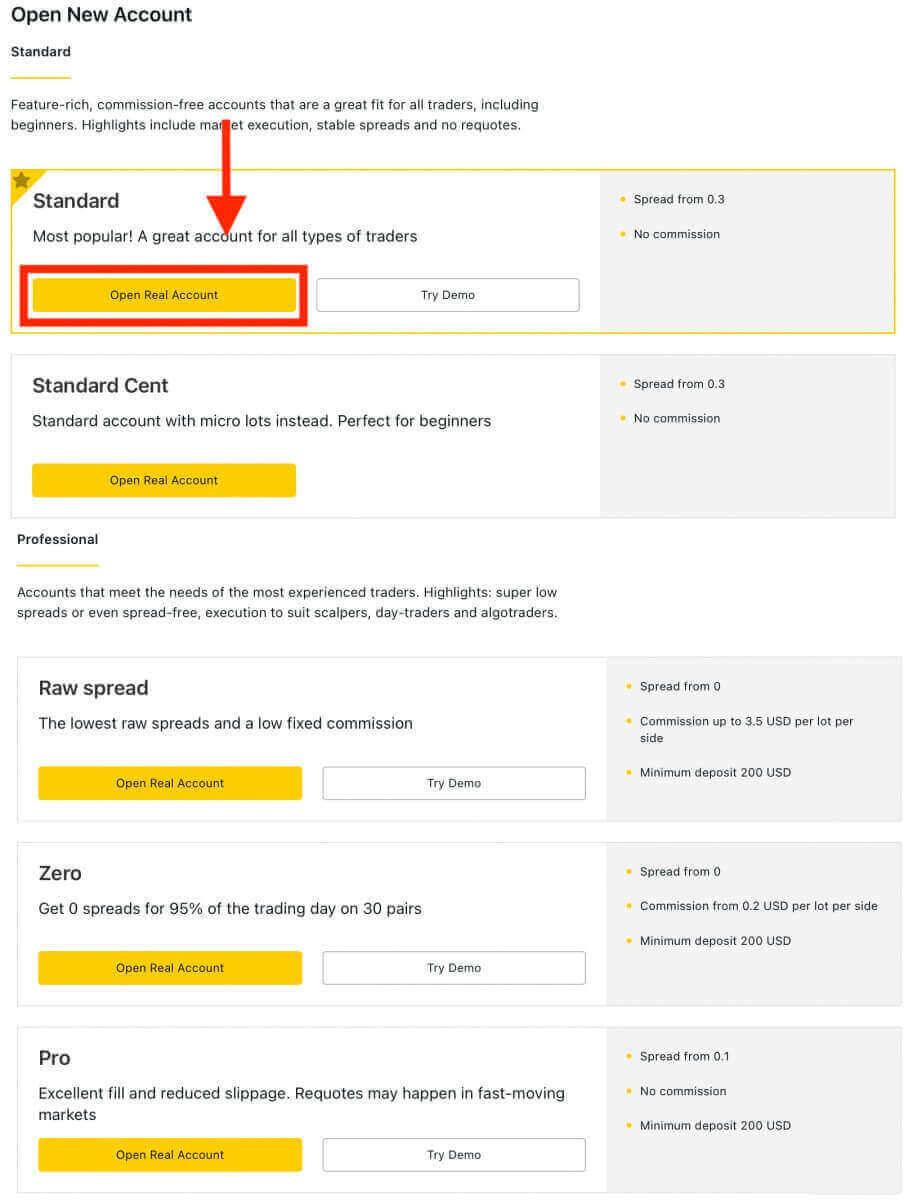

3. Choose from the available trading account types, and whether you prefer a real or demo account.

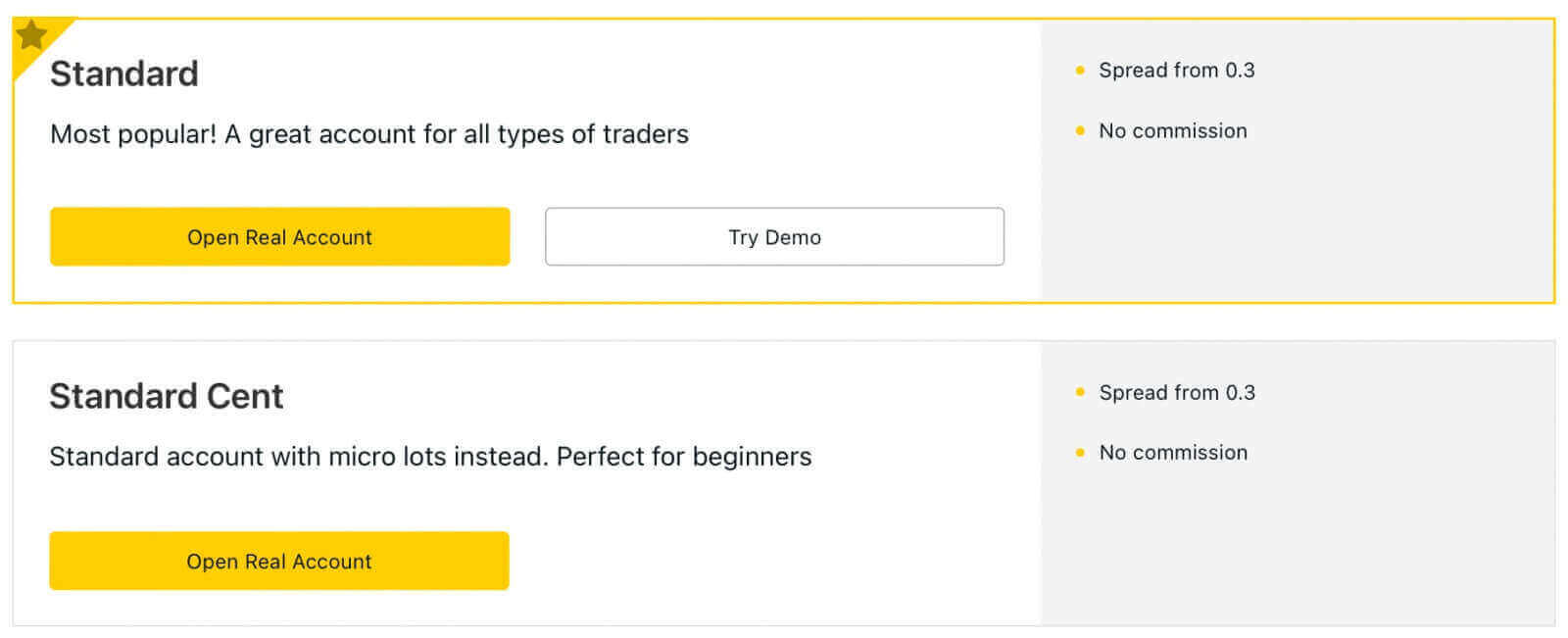

Exness provides a variety of account types to accommodate different trading styles. These accounts are categorized into two primary types: Standard and Professional. Each account type has different features and specifications, such as minimum deposit, leverage, spreads and commissions.

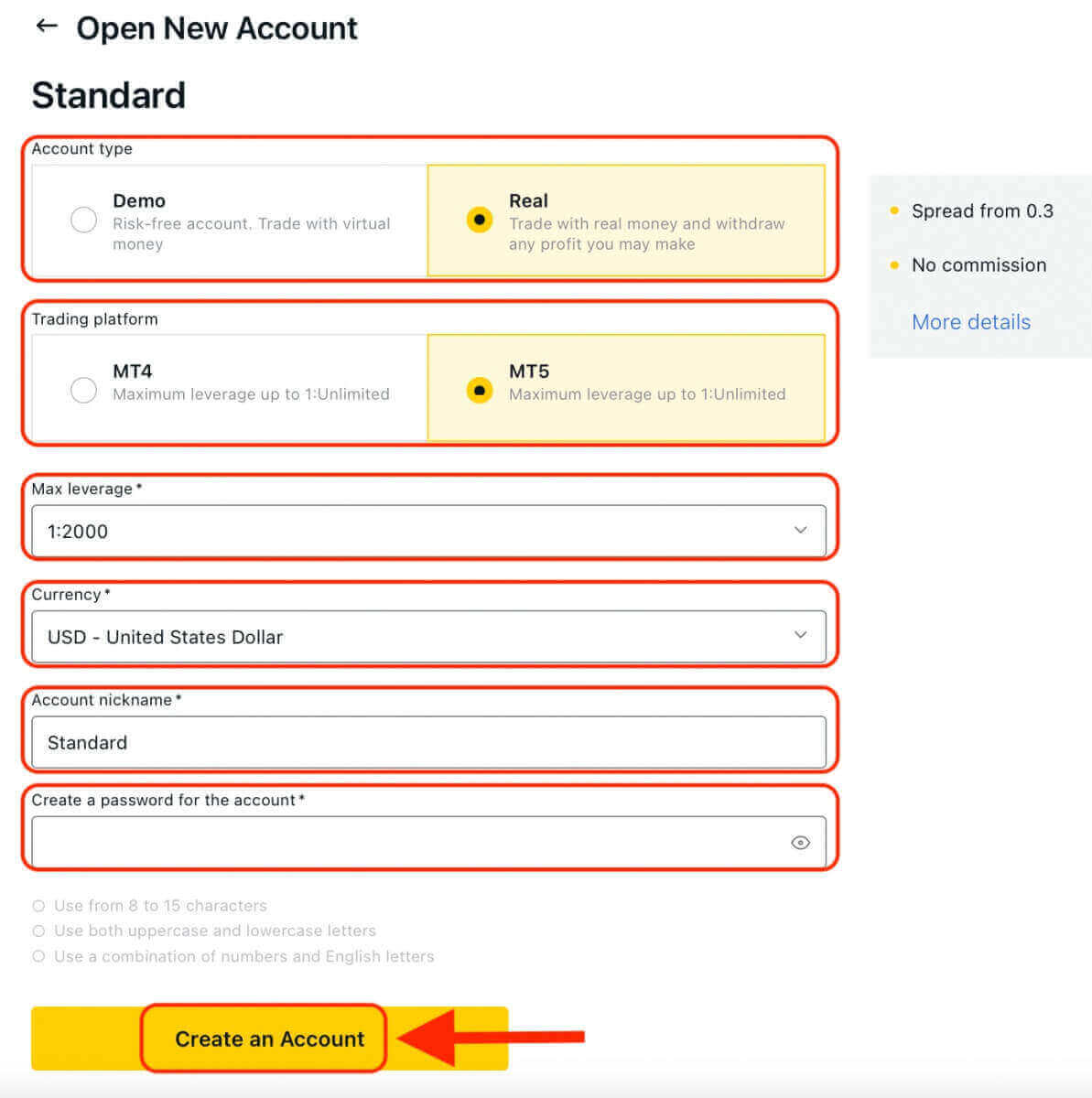

4. On the next screen, you will be presented with several settings:

- Choose between a Real or Demo account, as well as select between MT4 and MT5 trading platform.

- Set your Maximum Leverage.

- You can choose the currency for your account (note that this cannot be changed once set).

- Create a nickname for this trading account.

- Set a trading account password.

- Once you have reviewed and are satisfied with your settings, you can click the "Create an Account" button.

5. Congratulations, you’ve opened a new trading account. Your new trading account will show up in the ‘My Accounts’ tab.

Exness Account Types

Exness offers a range of account types to suit different trading needs. These account types can be broadly classified into two categories: Standard and Professional. You can compare the account types and choose the one that suits your trading style and preferences.Standard Accounts

- Standard

- Standard Cent

- Pro

- Zero

- Raw Spread

Note: Trading accounts created by clients registered with our Kenyan entity have fewer account currency options, with a maximum available leverage of 1:400, and trading on cryptocurrencies is unavailable.

Standard Accounts

Feature-rich, commission-free accounts are a great fit for all traders, including beginners as it is the simplest and most accessible account offered. Highlights include market execution, stable spreads and no requotes.

Please note: Demo Accounts are not available for the Standard Cent account type.

Includes the Standard Account and Standard Cent Account.

| Standard | Standard Cent | |

|---|---|---|

| Minimum deposit | Depends on the payment system | Depends on the payment system |

| Leverage |

MT4: 1:Unlimited (subject to conditions) MT5: 1:Unlimited |

MT4: 1:Unlimited (subject to conditions) |

| Commission | None | None |

| Spread | From 0.3 pips | From 0.3 pips |

| Maximum number of accounts per PA: |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 10 |

| Minimum and maximum volume per order* |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) |

Min: 0.01 cent lots (1K cents) Max: 200 cent lots 24 hours a day |

| Maximum volume of concurrent orders |

MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 024 MT5 Real: Unlimited |

Pending orders: 50 Market orders: 1 000 This amount combines both pending and market orders open concurrently. |

|

Maximum volume of a position |

Day time: 200 lots Night time: 20 lots |

Day time: 200 cent lots Night time: 200 cent lots |

| Margin call | 60% | 60% |

| Stop out | 0%** | 0% |

| Order execution | Market Execution | Market Execution |

*The maximum lot size specified is only to be observed while opening positions. Clients can choose any lot size while closing positions.

**Stop out level for Standard accounts is changed to 100% during the daily break hours of stock trading.

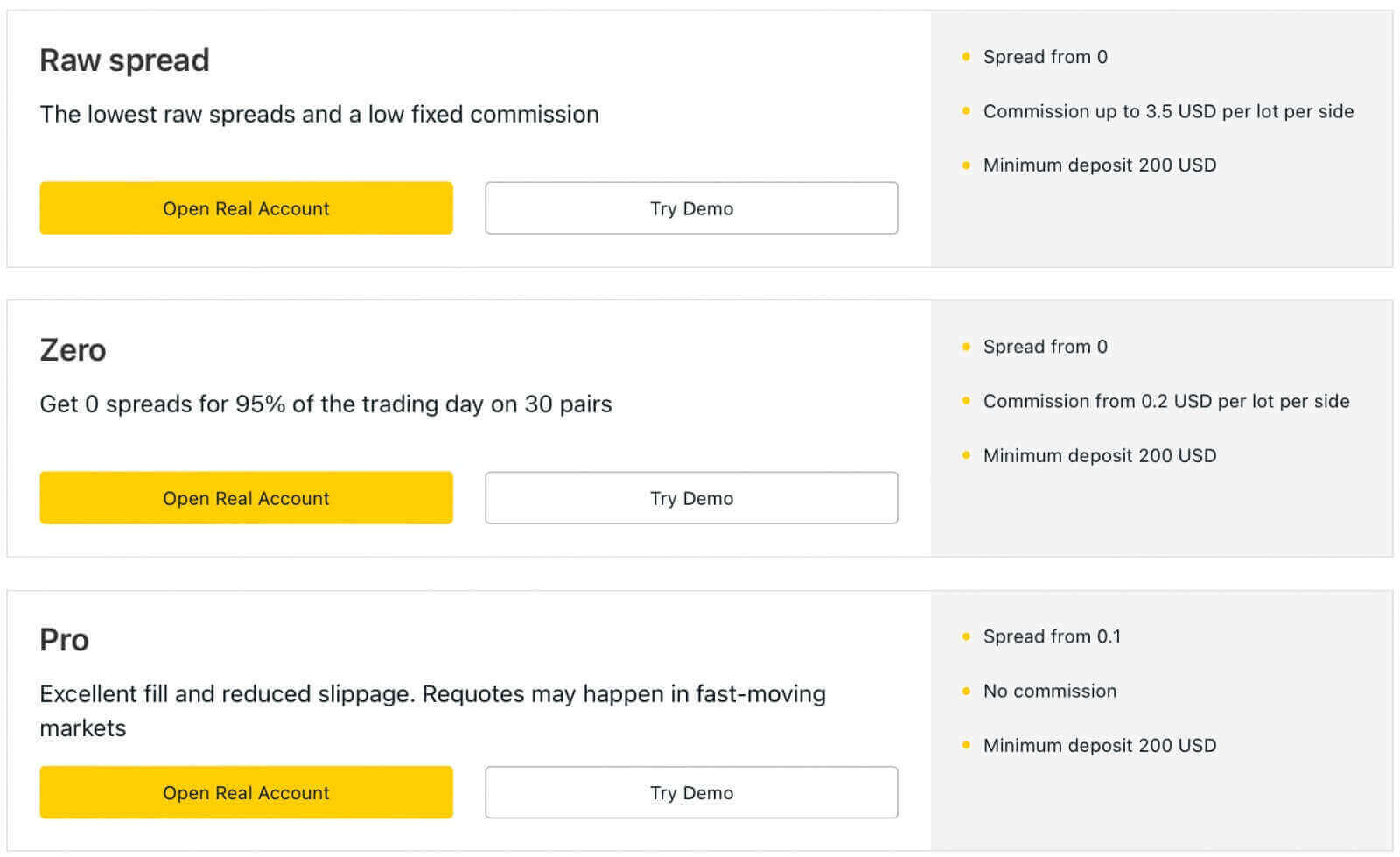

Professional Accounts

Accounts that meet the needs of the most experienced traders as it offers unique features such as instant order executions. Highlights: super low spreads or even spread-free, execution to suit scalpers, day-traders and algotraders.

Note: The minimum initial deposit for Professional accounts is only required for the first deposit; you may deposit any amount more than the minimum requirements of your chosen payment system from then on.

Includes the Pro Account, Zero Account, and Raw Spread Account.

| Pro | Zero | Raw Spread | |

|---|---|---|---|

| Minimum initial deposit* | Starts from USD 200 (depends on your country of residence) | Starts from USD 200 (depends on your country of residence) | Starts from USD 200 (depends on your country of residence) |

| Leverage |

MT4: 1:Unlimited |

MT4: 1:Unlimited |

MT4: 1:Unlimited |

| Commission | None |

From USD 0.2/lot in one direction. Based on the trading instrument |

Up to USD 3.5/lot in one direction. Based on the trading instrument |

| Spread | From 0.1 pips | From 0.0 pips** |

From 0.0 pips Floating (low spread) |

| Maximum number of accounts per PA |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

Real MT4 - 100 Real MT5 - 100 Demo MT4 - 100 Demo MT5 - 100 |

| Minimum and maximum volume per order |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

Min: 0.01 lots (1K) Max: 07:00 – 20:59 (GMT+0) = 200 lots 21:00 – 6:59 (GMT+0) = 20 lots (Limits are subject to instruments traded) |

| Maximum volume of concurrent orders | MT4 Demo: 1 000 MT4 Real: 1 000 MT4 combines both pending and market orders open concurrently. MT5 Demo: 1 024 MT5 Real: Unlimited |

||

|

Maximum volume of a position |

MT4 Demo: 1000 MT4 Real: 1000 |

MT4 Demo: 1000 MT4 Real: 1000 |

MT4 Demo: 1000 MT4 Real: 1000 |

| Margin call | 30% | 30% | 30% |

| Stop out | 0%*** | 0%*** | 0%*** |

| Order execution |

Instant****: Forex, Metals, Indices, Energies, Stocks Market: Cryptocurrency |

Market Execution | Market Execution |

The minimum deposit requirements vary by country of residence and must be met in a single deposit.

For example, if the minimum deposit for a Pro account in your country is USD 200, you need to make a deposit of USD 200 or more in a single transaction to start using the trading account. After this initial deposit, you can deposit any amount without further requirements.

The maximum lot size specified is only applied while opening orders, and any lot size is available while closing orders.

*The minimum initial deposit for Professional accounts is only required for the first deposit; you may deposit any amount more than the minimum requirements of your chosen payment system from then on.

**Zero spread for top 30 instruments 95% of the day but can also be zero spread for other trading instruments 50% of the day depending on market volatility, with floating spread during key periods such as economic news and rollovers.

***Stop out level for Pro, Zero, and Raw Spread accounts is changed to 100% during the daily break hours of stock trading.

****Requotes for these instruments on a Pro account may occur. Requotes occur when there is a price change while a trader is trying to execute an order using instant execution.

Why Traders are Choosing Exness for Their Trading Needs

I will explain why you should open an account on Exness and what benefits you can enjoy as a trader.

- Regulated Broker: Exness is a regulated broker that operates under the supervision of reputable financial authorities, including the Seychelles Financial Services Authority (FSA), the Cyprus Securities and Exchange Commission (CySEC), and the Financial Conduct Authority (FCA), FSCA, CBCS, FSC, CMA. This ensures that the broker operates in a fair and transparent manner, providing a level of protection for traders’ funds. Exness segregates client funds from its own funds and provides negative balance protection to its clients.

- Range of Account Types: Exness offers a variety of account types to suit different trading styles and needs. Whether you are a beginner or an experienced trader, there is an account type that can cater to your trading preferences.

- Range of trading instruments: Exness offers a wide range of trading instruments, including forex, metals, cryptocurrencies, indices, stocks, energies and more.

- Various platforms: You can trade on various platforms, such as MetaTrader 4, MetaTrader 5, WebTerminal and mobile apps.

- Low Spreads: Exness is known for offering some of the tightest spreads in the industry. This can help traders reduce their trading costs and potentially increase their profitability.

- High Leverage: Exness provides high leverage on its accounts, which can enable traders to open larger positions with a smaller amount of capital. However, it’s important to note that leverage can also increase the risk of losses and should be used with caution.

- Trading Tools and Resources: Exness offers a range of advanced trading tools, resources, and features, including analytical tools, economic calendars, educational materials, and more, which can help traders make more informed trading decisions.

- Multiple Payment Options: Exness offers multiple payment options for deposits and withdrawals, including credit/debit cards, bank transfers, and e-wallets, and local payment systems, making it easy for traders to manage their funds.

- No commission on deposits and withdrawals: Traders can enjoy the convenience of depositing and withdrawing funds without incurring any additional fees, ultimately optimizing their trading experience.

- Multilingual Customer Support: Exness offers multilingual customer support, which can be especially helpful for traders who are not fluent in English. You can contact the support team 24/7 via live chat, phone or email in various languages.

How to Deposit Money into Exness

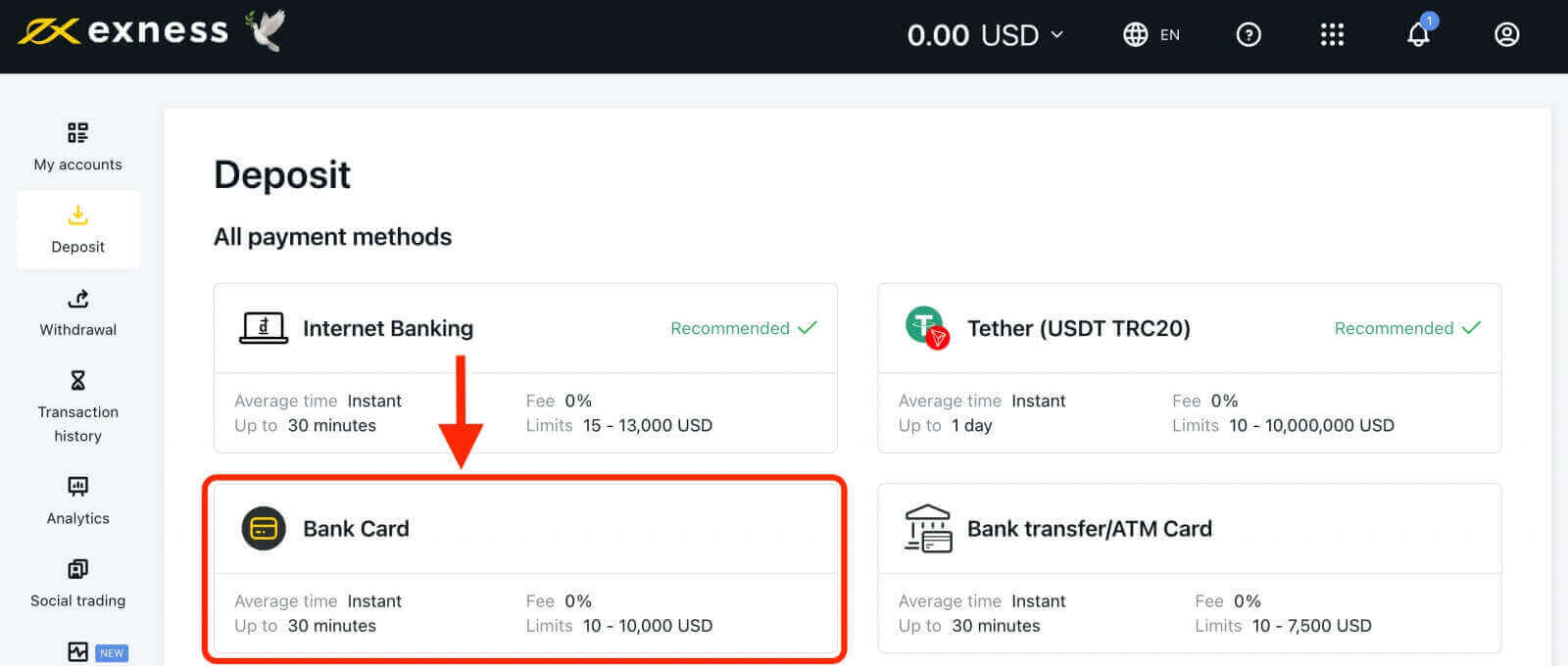

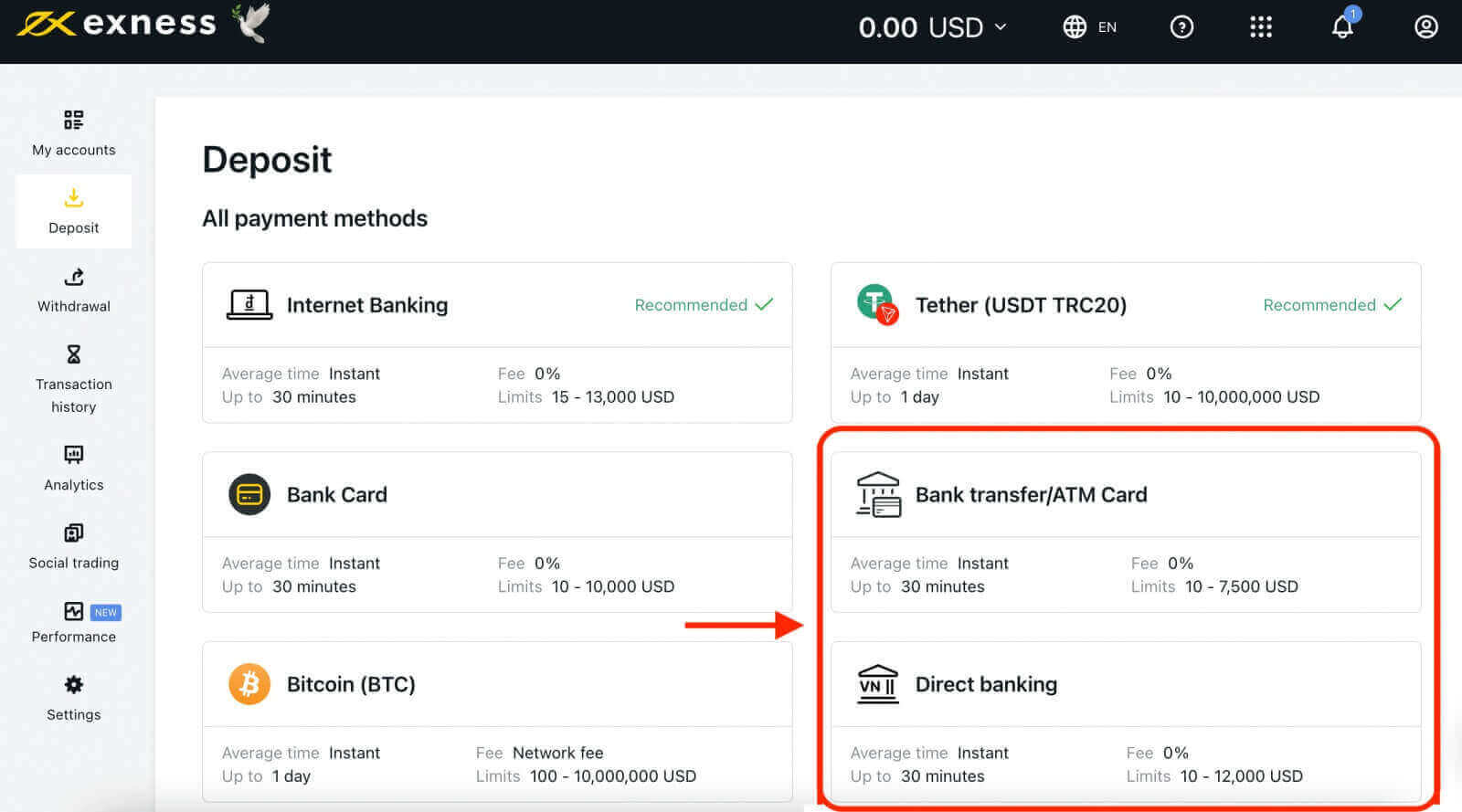

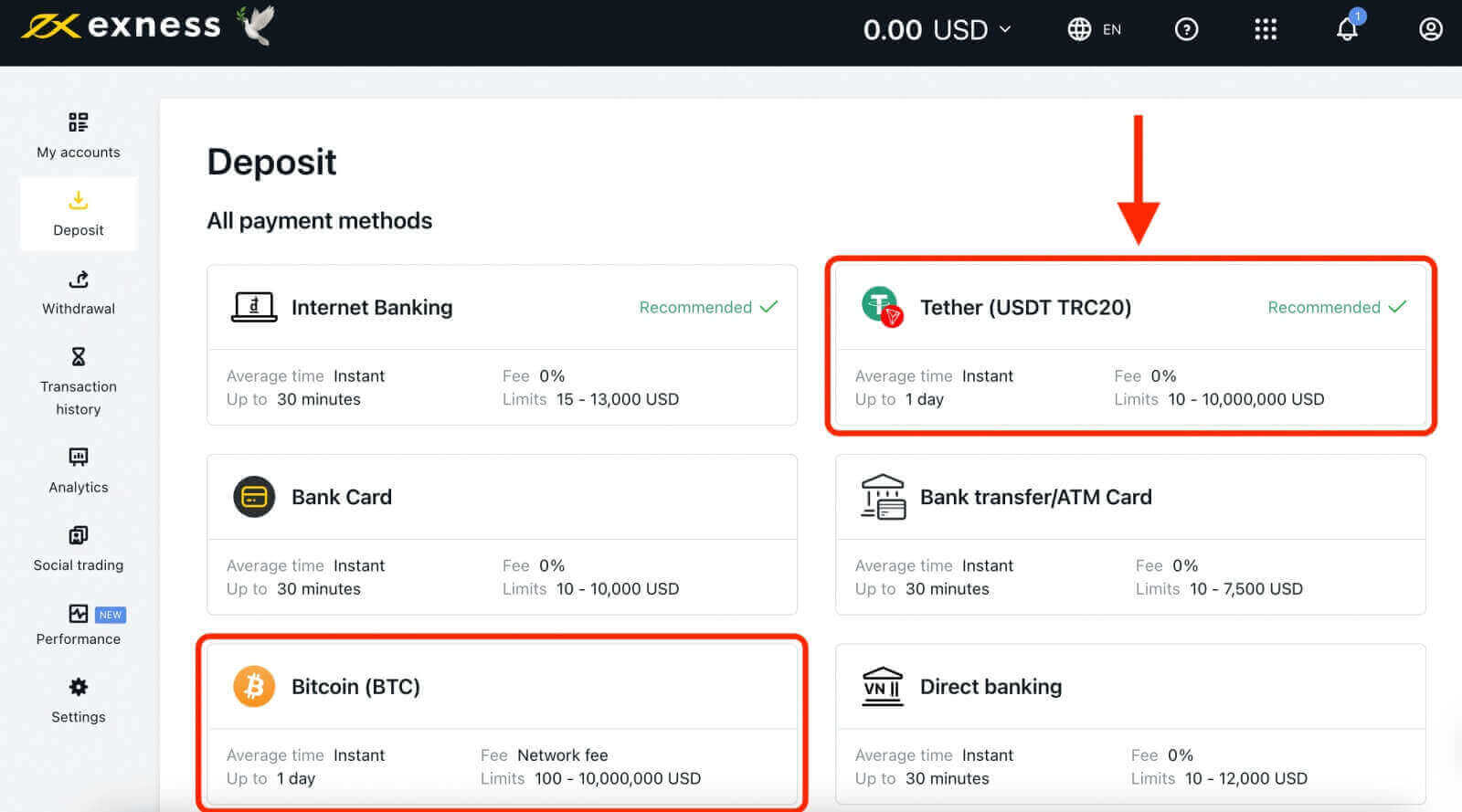

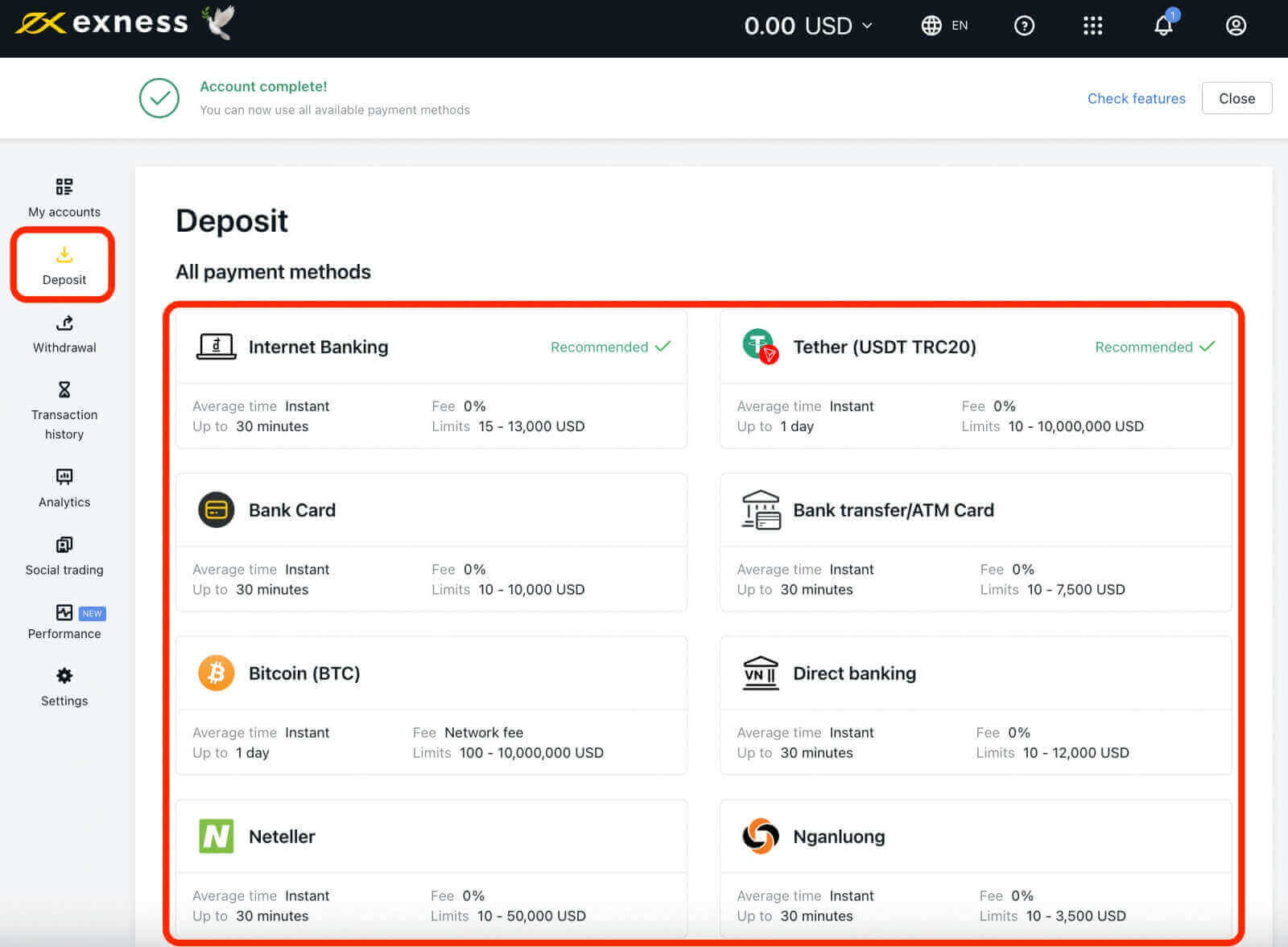

Deposit Payment methods on Exness

If you are looking for a reliable and convenient way to fund your trading account, Exness offers a variety of deposit payment methods for you to choose from. Whether you prefer to use a credit card, a bank transfer, an e-wallet, or a cryptocurrency, Exness has you covered. We will explain the different deposit payment methods available on Exness and how to use them.

Bank Cards

Exness supports various credit and debit cards, including Visa, Mastercard, and Japan Credit Bureau (JCB). This is one of the most convenient and fast deposit payment methods on Exness. To use a bank card, you need to provide your card details and the amount you want to deposit on the Exness website. Then, you need to confirm the payment with your card provider. The processing time for a Bank Card deposit is usually instant or within a few minutes, allowing clients to start trading immediately.

Bank Transfer

A bank transfer is a method of sending money from your bank account to an Exness trading account. This is one of the most secure and widely accepted deposit payment methods on Exness. To use a bank transfer, you need to provide your bank details and the amount you want to deposit on the Exness website. Then, you need to follow the instructions given by your bank to complete the transfer. The processing time for a bank transfer may vary depending on your bank and the country you are in. Usually, it takes a few minutes for the funds to appear in your trading account.

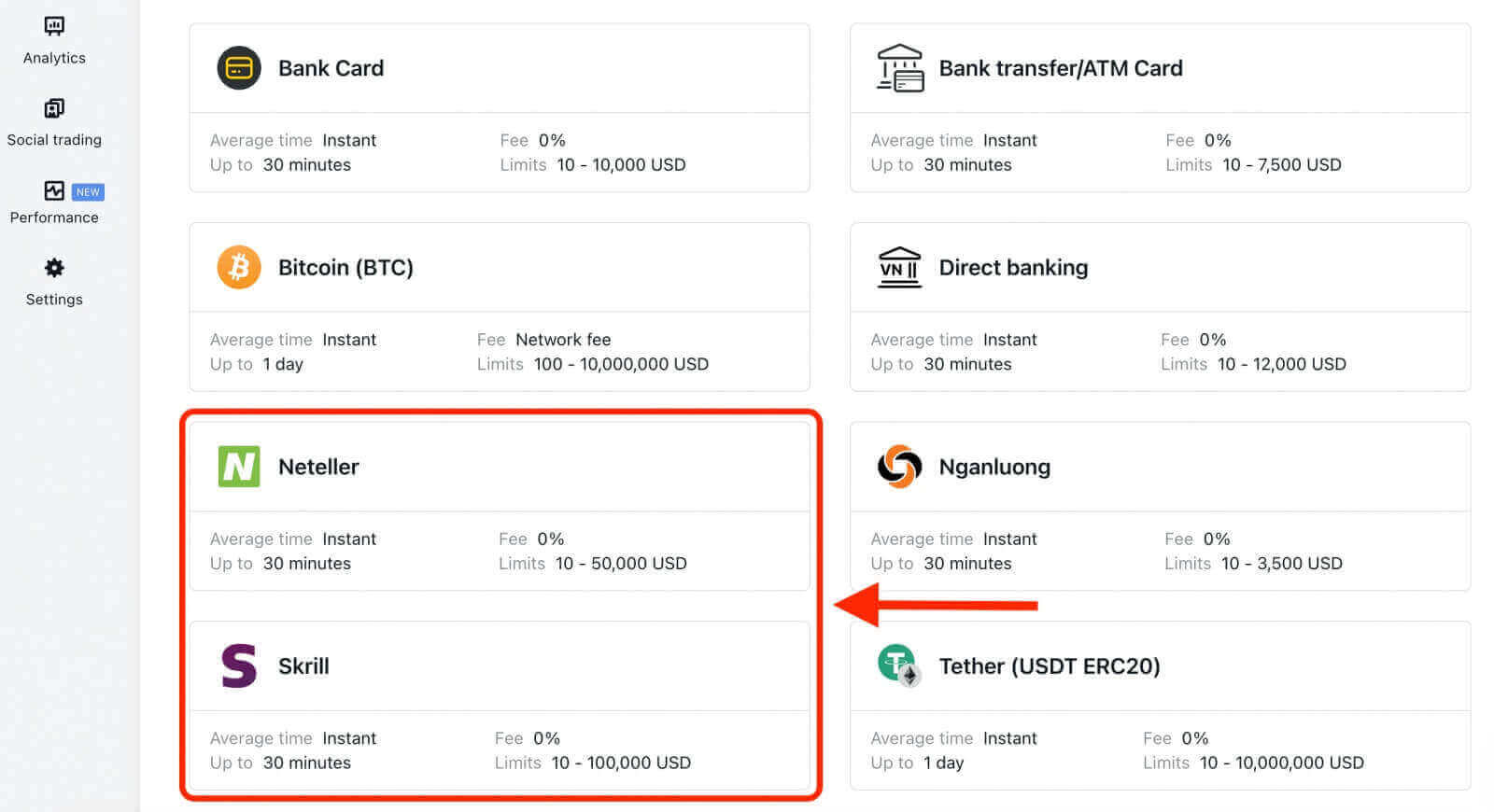

Digital wallets (E-wallets)

Exness partners with various electronic payment systems such as Neteller, Skrill, and more, to offer a swift and efficient deposit option for its clients. This is one of the most popular and flexible deposit payment methods on Exness. To use an e-wallet, you need to provide your e-wallet details and the amount you want to deposit on the Exness website. Then, you need to confirm the payment with your e-wallet provider. The processing time for an e-wallet deposit is usually instant or within a few minutes.

Cryptocurrencies

Exness allows deposits to be made using a variety of cryptocurrencies, including Bitcoin, USDT, USDC, and more. Cryptocurrency is an innovative and dynamic deposit payment method offered by Exness. It involves creating and exchanging digital tokens that are secured by cryptography. To use cryptocurrency for deposits on Exness, you will require a cryptocurrency wallet that supports online transactions and has sufficient balance to cover the deposit amount. Once you have provided your cryptocurrency address and the deposit amount on the Exness website, you can initiate the payment by scanning the QR code or copying the address provided. The processing time for cryptocurrency deposits may vary depending on the network speed and confirmation time of the cryptocurrency used. Typically, it takes between 5 minutes to 1 hour for the funds to reflect in your trading account.

How to Deposit Money on Exness: Step-by-Step Guide

Before you can deposit money on Exness, you need to create an account and verify your identity. To create an account, you need to visit the Exness website and click on the "Open account" button. You will be asked to provide some basic information, such as country of residence, email address, and password. You will also need to agree to the terms and conditions.

After you create your account, you will receive a confirmation email with a link to activate your account. You need to click on the link and log in to your account. You will then be directed to the verification page, where you need to upload a copy of your identity document (such as passport or driver’s license) and a proof of address document (such as utility bill or bank statement). The verification process may take up to 24 hours.

Once your account is verified, you can proceed to deposit money on Exness. To do so, you need to follow these steps:

1. Click on the "Deposit" button on the top right corner of the screen.

2. Choose the payment method that you prefer from the list of available options. Some of the most popular payment methods are Visa/Mastercard, Skrill, Neteller, Bitcoin, and local bank transfer.

3. Fill out the deposit form: Once you’ve chosen your deposit method, you’ll need to fill out the deposit form with the required information, such as your name, account number, and the amount you wish to deposit.

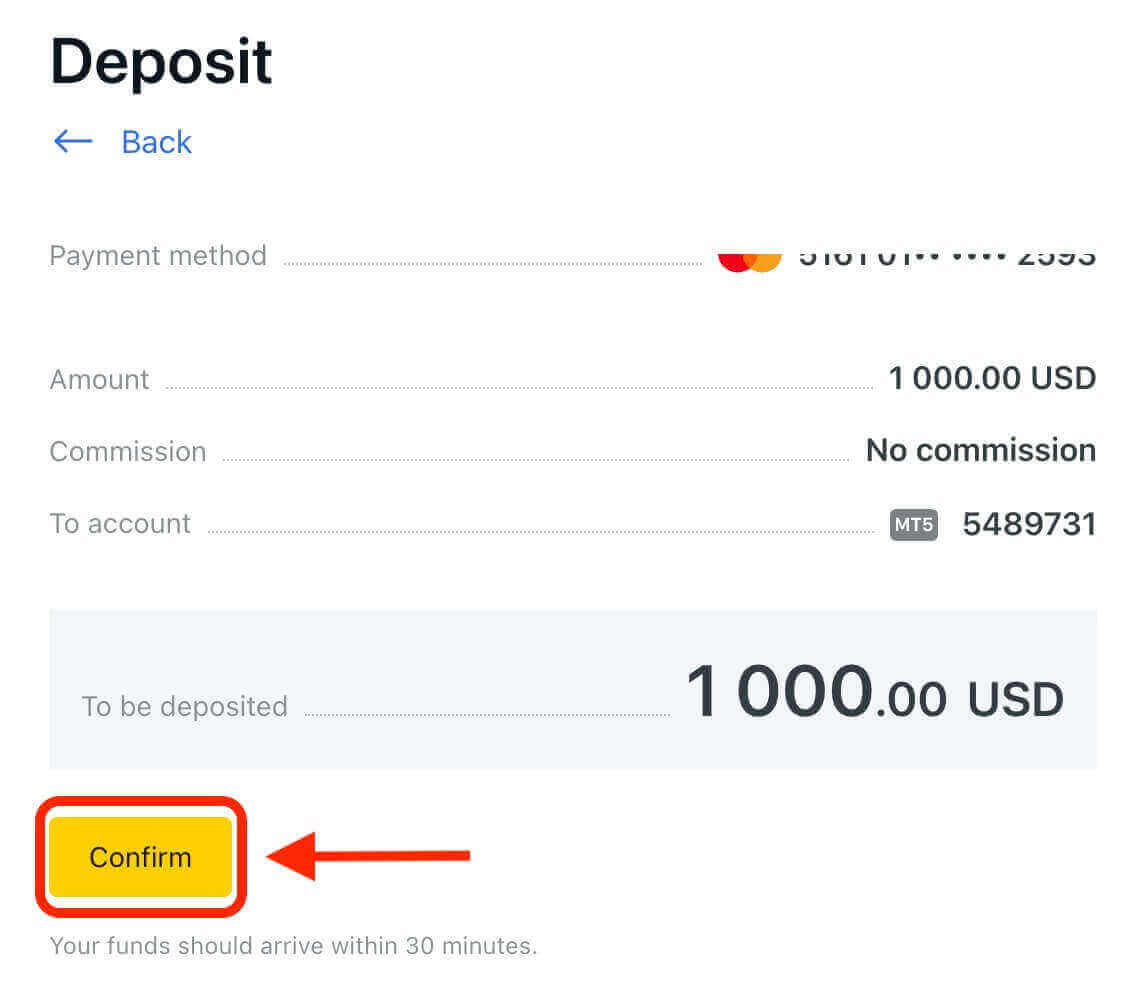

4. Confirm your deposit: Once you’ve filled out the deposit form, you’ll be prompted to confirm your deposit. Double-check all of the information you’ve entered to ensure that it is correct, then click the "Confirm" button.

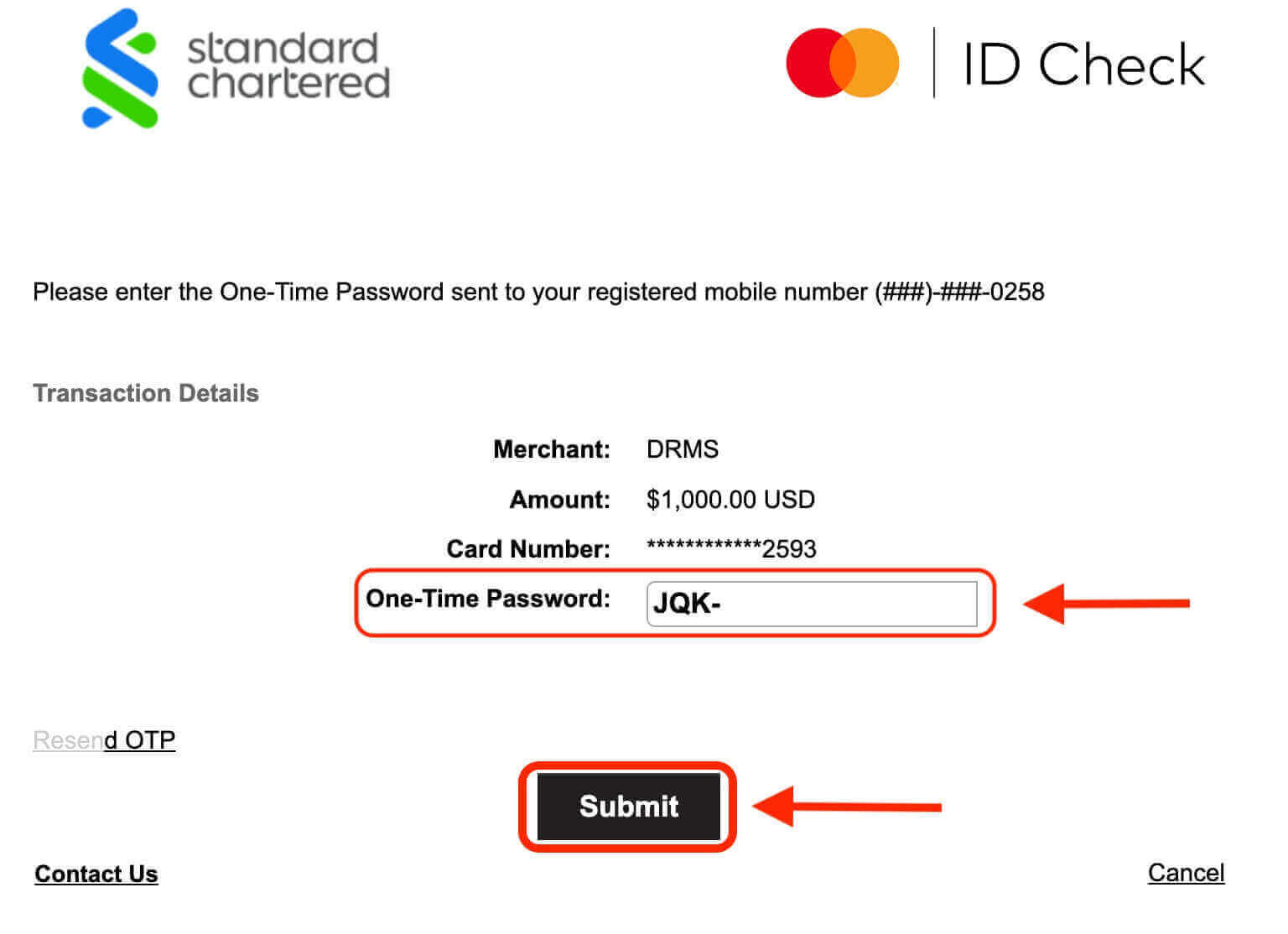

5. Follow the instructions on the screen to complete your payment. Depending on the payment method that you choose, you may need to enter some additional information or confirm your payment via SMS or email.

6. Wait for your payment to be processed and credited to your account. The processing time may vary depending on the payment method that you choose. Some payment methods are instant, while others may take up to several hours.

That’s it! You have successfully deposited money on Exness and you are ready to start trading.

What is the minimum deposit amount on Exness?

The minimum deposit amount on Exness depends on the account type that you choose and the currency that you use. For instance, if you choose a Standard account and use USD as your currency, the minimum deposit amount is $10. However, If you choose a Raw Spread account and use EUR as your currency, the minimum deposit amount is €200. To view the minimum deposit amount for each account type and currency, please refer to this article.

What are the fees for depositing money on Exness?

Exness does not charge any fees for depositing money on its platform. However, some payment methods may charge fees for their services. For example, if you use an e-wallet, you may incur fees from e-wallet provider.

How can I change my currency on Exness?

You can switch to a different currency on Exness by opening a new trading account in that currency. Simply log in to your account and click on the "Open New Account" button located at the top right corner of the screen. From there, you can select the desired currency from the various options available, such as USD, EUR, GBP, AUD, and more.

Benefits of Using Exness

There are several benefits to using Exness as your trading platform, including:

- Security: Exness prioritizes the security of its users by employing advanced encryption technologies to safeguard personal and financial information. Additionally, the platform also ensures that all client funds are kept in segregated accounts, separate from company funds, to further enhance security.

- Flexible Account Types: Exness offers two main account types: Standard and Professional.

- The Standard account is a feature-rich, commission-free account that suits the needs of most traders. It has low spreads from 0.3 pips, and high leverage up to 1:Unlimited.

- The Professional account is a flexible account that allows you to choose between raw spread model, zero spread model, and zero commission model. It is designed for experienced traders, scalpers, and algotraders who want to optimize their trading costs and performance.

- Low fees: Exness offers competitive spreads and low trading fees. Moreover, the platform has a reputation for being transparent and fair in its pricing, with no hidden fees or commissions, making it an attractive choice for traders of all levels.

- Wide range of financial instruments: Exness offers a wide range of financial instruments, including more than 200 instruments, which include trading forex currency pairs, metals, cryptocurrencies, stocks, indices and energies.

- Easy-to-use platform: Exness provides a user-friendly platform that is easy to navigate, even for beginners.

- Multiple deposit and withdrawal options: Exness provides traders with numerous options to deposit and withdraw funds, such as bank transfers, credit/debit cards, electronic payment systems, and cryptocurrencies. This makes it easy for traders to deposit and withdraw funds quickly and efficiently.

- Excellent Customer Support: Exness provides 24/7 customer support via live chat, phone, email, and social media. You can reach out to their friendly and professional team anytime you have a question or issue regarding your account or trading platform. You can also find helpful information and resources on their website, such as FAQs, tutorials, webinars, market analysis, and trading education.

Seamless Account Setup and Deposits: Exness’ Effortless Process

Exness offers a seamless experience for opening accounts and depositing funds. The user-friendly account setup simplifies the initial process, while the array of deposit options, coupled with secure transactions, ensures swift and hassle-free funding. Exness’ commitment to simplicity and security fosters a smooth journey for users, making account setup and depositing funds an effortless task within their platform